The world’s largest cryptocurrency by market cap, Bitcoin, is experiencing an enormous selloff from none apart from its miners.

🚨 #Bitcoin Miners in Promoting Mode: Latest on-chain knowledge from @cryptoquant_com signifies a considerable improve in promoting exercise by #BTC miners. In simply the final 24 hours, they’ve offloaded practically 10,600 $BTC, valued at roughly $455.8 million! pic.twitter.com/JEtasWfR6N

— Ali (@ali_charts) January 17, 2024

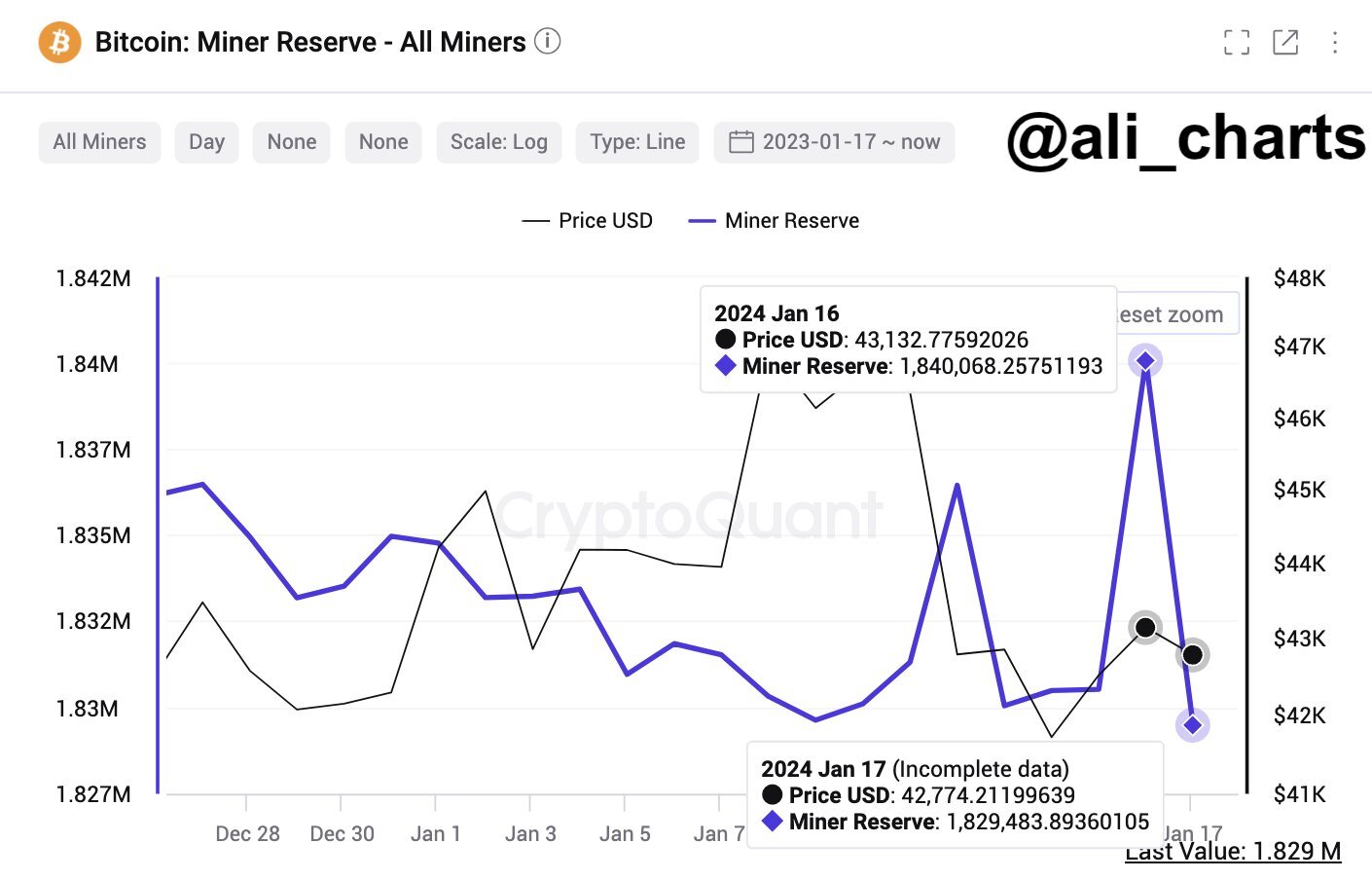

Capturing the information on his official X (previously Twitter) deal with, crypto market professional Ali Martinez revealed that Bitcoin miners have offloaded a whopping 10,600 BTC – equal to over $455.8 million at present market costs – within the final 24 hours.

Corroborating this data, common on-chain analytics agency CryptoQuant revealed that Bitcoin miners are actively promoting their BTC hoards. In response to the platform, crypto trade netflow whole has surged by 130.45% within the final seven-day common.

Nevertheless, CryptoQuant additionally notes a decline in trade Bitcoin reserves, suggesting a slowdown in promoting strain throughout the crypto panorama. Extra traders are apparently shifting their digital belongings off exchanges and storing them individually.

Bitcoin has undergone numerous cycles in latest months. Following reviews of a US Securities and Trade Fee (SEC) spot Bitcoin exchange-traded fund (ETF) in early 2024, the leading cryptocurrency surpassed the $30,000 worth mark, finally reaching $45,000 earlier than encountering a pattern reversal.

At press time, Bitcoin is seeing support throughout the $41,000 and $43,000 vary, though the opportunity of a downtrend can’t be dominated out. Nonetheless, the crypto bellwether nonetheless maintains optimistic momentum, supported by a number of components.

One key issue is the upcoming Bitcoin halving scheduled for April 2024. This occasion will considerably scale back the block rewards miners obtain by 50%, slicing it from 6.25 to three.125 BTC.

With low provide and growing demand, Bitcoin is anticipated to surpass the $45,000 worth mark within the close to future.

One other optimistic improvement is the historic approval of a spot Bitcoin ETF by the SEC, announced on January 10, 2024.

Appears like they took the hyperlink down for now

However I took a display recording of the total PDF from SEC’s web site displaying approval for all 11 spot bitcoin ETFs

(Pause to learn) pic.twitter.com/13wQ1Gx3dc

— Jacquelyn Melinek (@jacqmelinek) January 10, 2024

This occasion marks a pivotal second for the crypto space because it mainly ushered the deflationary decentralized asset into the normal monetary panorama. This considerably boosts adoption and amplifies market curiosity in Bitcoin and different comparable belongings.

Selloffs? No Probs

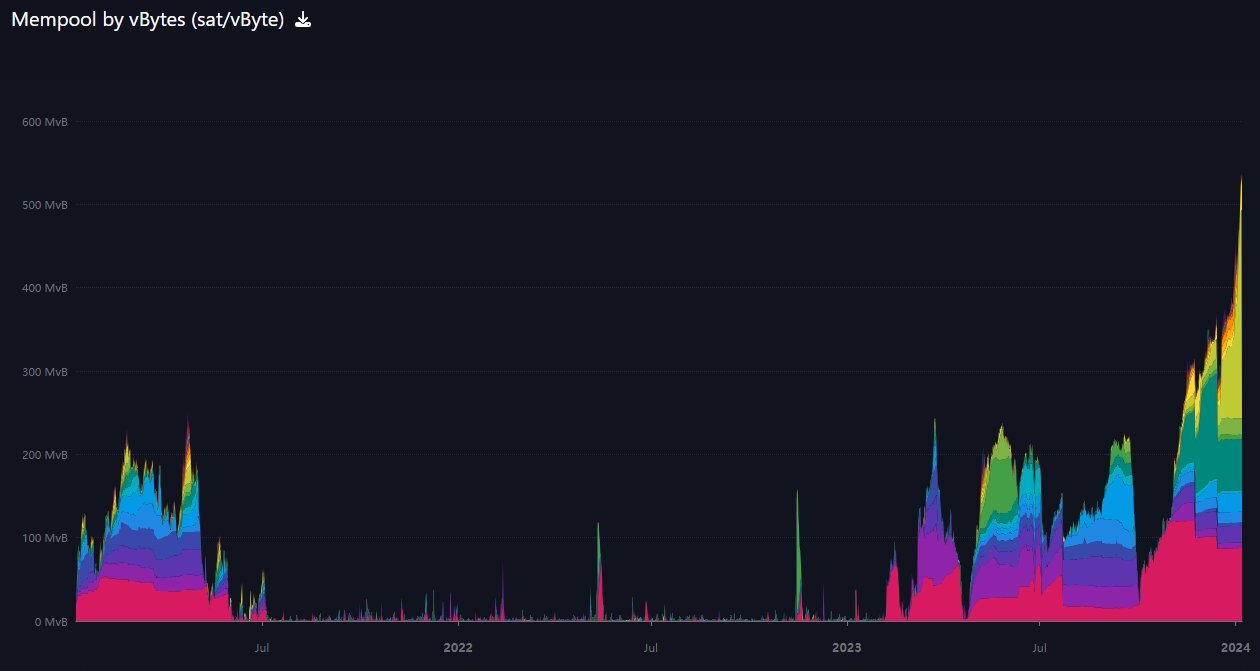

Regardless of what appears to be like like a adverse outlook with miner gross sales, the Bitcoin community remains to be depicting robust demand and an overflooded reminiscence pool.

In response to a submit on X by Mati, CEO of Quantum Economics, the Bitcoin reminiscence pool (mempool) is at present at full capability.

The above chart signifies that the quantity of knowledge awaiting affirmation is at present double the quantity of its earlier all-time excessive (ATH).

Bitcoin is overflooding!!!

The mempool, which is the place transactions wait to be confirmed by miners is totally full. This chart exhibits the quantity of knowledge awaiting affirmation, which is at present greater than double the earlier all time excessive. pic.twitter.com/E8tnRsYi4U

— Mati (@MatiGreenspan) January 8, 2024

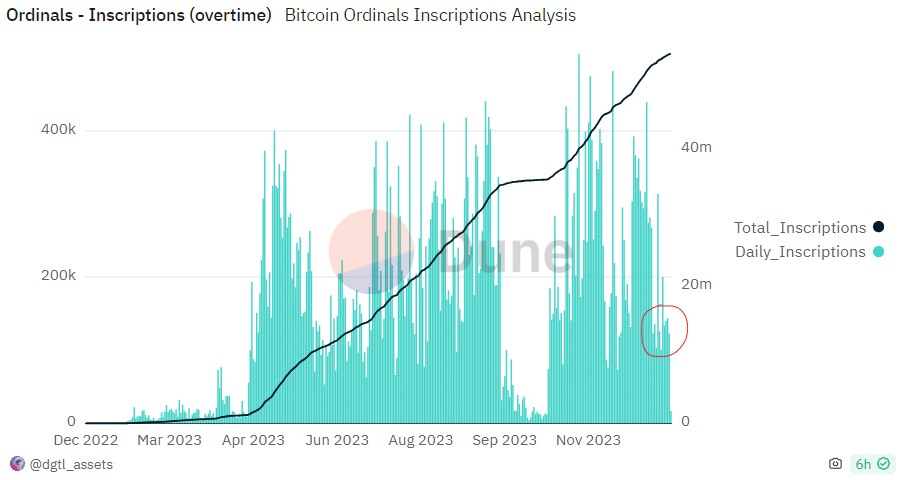

The first issue contributing to this uncommon prevalence is the Bitcoin Ordinals inscriptions service, which permits the recording of metadata on particular person satoshis (the smallest unit of Bitcoin).

Nevertheless, Mati famous that the Bitcoin Ordinals will not be but working at full capability. He revealed that solely 100,000 inscriptions have been recorded for the reason that starting of 2024.

Therefore, the Bitcoin community is having fun with natural development with out exterior forces placing a lot affect on it.