Moody’s Investor Providers, a credit score rankings and analysis supplier, on Monday, highlighted the inherent tech dangers related to rising tokenized funds.

Moody’s DeFi and Digital Belongings skilled staff flagged the need for additional expertise in managing tokenized funds. Tokenized funding funds tech suppliers usually have “restricted observe file,” contributing to the elevated threat.

“The entities concerned on the know-how facet usually have restricted observe information, rising the danger that within the case of chapter or technological failure, funds could also be disrupted.”

Additional, there may be additionally potential for publicity of the fund collateral to the volatility of different digital property like stablecoins.

The staff emphasised that public blockchains, utilized by some tokenized funds, are “uncovered to technological dangers, cyberattacks and governance points.”

The report proposed that “a sturdy contract audit course of is helpful” to beat potential tech and cyberattack points.

Moreover, Moody’s analysis pressured the necessity for experience in fields equivalent to token issuance and redemption, sustaining on-chain buyers’ registers and whitelisting wallets in compliance with KYC and AML checks.

Analysts on the credit-rating company have noticed the quickly rising adoption of tokenized funds, signaling “untapped market potential.”

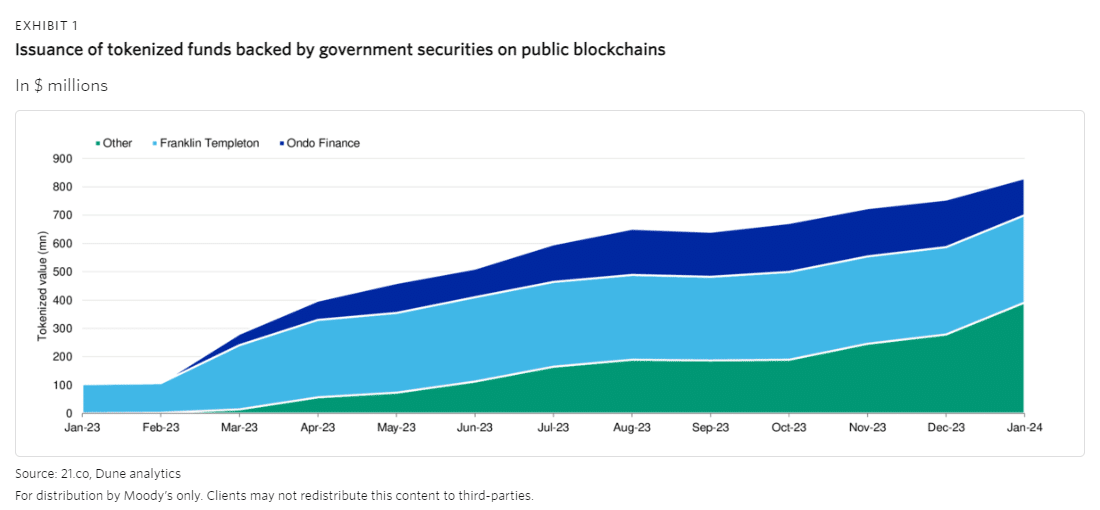

The report attributed the expansion fueled by funds that put money into authorities securities. Moreover, per Dune Analytics Tokenization Report 2023, the entire worth of tokenized funds invested in authorities securities and issued on public blockchains, exceeded $800 million, triple the expansion in 2023.

“Tokenized funds’ potential purposes lengthen past merely enhancing asset liquidity,” the consultants wrote. “These funds have a wide range of different doable features, together with serving as collateral.”

In November 2023, JPMorgan and Apollo partnered with a number of blockchain corporations to discover fund tokenization for managing intensive shopper portfolios. In October, main Swiss asset administration financial institution UBS debuted its first reside pilot of a tokenized cash market fund on the Ethereum blockchain in Singapore.