In 2013 an entity affiliated with the Winklevoss twins despatched the primary utility to The USA Securities and Alternate Fee (SEC) to create a spot Bitcoin (BTC) exchange-traded fund (ETF). The SEC officially approved spot Bitcoin ETFs on Jan. 10 this yr.

It has taken over 10 years for spot Bitcoin ETFs to be authorized within the US, leading to a new-found curiosity in ETFs. Many people are actually questioning what an ETF is and the way the monetary product can be utilized to purchase Bitcoin.

What are ETFs?

Yesha Yadav, professor of regulation and affiliate dean at Vanderbilt Legislation Faculty, informed Cryptonews that an ETF has quickly come to signify a well-liked and versatile funding innovation inside securities markets. In response to Yadav, the fundamentals behind ETFs are pretty simple. She stated:

“In an ETF, traders put their cash right into a fund in return for shares on this fund. Returns on these shares are decided by explicit merchandise {that a} fund tracks – akin to basket of shares, bonds, sure commodities, or perhaps a explicit funding technique. For instance, a bond ETF will ship returns to fundholders primarily based on the curiosity revenue being generated by its basket of bonds.”

Yadav added that the main innovation behind an ETF, which distinguishes it from a typical mutual fund, is that an ETF’s shares are traded on a inventory alternate like a traditional inventory. “This helps make ETFs very enticing to traders who can transfer in-and-out of ETF shares easily and usually at comparatively low price,” stated Yadav. She additional remarked that as a result of ETFs are traded like shares, they’re regulated by the SEC.

That is vital to level out, as each retail and institutional US traders for the primary time have entry to regulated Bitcoin. Furthermore, as a result of Bitcoin can now be purchased or bought by way of acquainted brokerages and held by people saving for retirement to hedge funds, spot BTC ETFs will seemingly be a option to enhance mainstream adoption of crypto.

It’s additionally price mentioning that ETFs have an infinite footprint inside US securities markets. In response to State Avenue World Advisors, ETFs had a monumental month within the US in November final yr, with property climbing to a document $7.65 trillion.

The Distinction Between Futures and Spot ETFs

In 2021, the primary Bitcoin Futures ETF was authorized by the SEC within the US. ProShares’ Bitcoin Strategy ETF was listed as the first exchange-traded fund, permitting US traders direct publicity to cryptocurrency futures. Whereas notable, there are key variations between a futures and spot ETF. Yadav stated:

“A spot Bitcoin ETF is one which tracks the worth of Bitcoin. Returns are ruled by the altering worth of the underlying Bitcoin. The spot ETF for Bitcoin will immediately maintain a pool of BTC. Within the case of a Bitcoin Futures ETF, traders take publicity on the efficiency of the Bitcoin derivatives relatively than simply the spot. A spot ETF versus a futures ETF can present various efficiency for traders, particularly within the context of commodities akin to Bitcoin.”

For added context, Bloomberg ETF analyst James Seyffart informed Cryptonews {that a} spot Bitcoin ETF is only a fund that trades on an alternate like a typical inventory, however will maintain spot Bitcoin. “So shopping for a share of those ETFs provides you with publicity to Bitcoin,” he stated. In comparison with a Futures ETF, Seyffart defined that these kinds of merchandise maintain month-to-month Bitcoin Futures contracts. He stated:

“They should promote the present month each single month after, which may result in poor efficiency as a result of nature and friction in continuously rolling these contracts. Significantly when the contract you might be promoting is a cheaper price than the one you might be shopping for. You find yourself promoting low and shopping for excessive again and again.”

In response to Seyyfart, this course of has led the main Bitcoin futures ETF to underperform spot Bitcoin ETFs by 16% in 2023. Nevertheless, he believes that the Bitcoin futures ETF is a superb buying and selling car for brief and even medium time period publicity, however warns that frictions can add up over time.

All issues thought of, the approval of a Bitcoin Futures ETF helped pave the best way for the eleven spot Bitcoin ETFs that started buying and selling on Jan. 11, which embody extremely credible institutional gamers like BlackRock’s iShares Bitcoin Belief (IBIT.O), Grayscale Bitcoin Belief (GBTC), Valkyrie Bitcoin Fund (BRRR.O) and others.

Leah Wald, chief govt officer of Valkyrie, informed Cryptonews that Valkyrie’s spot Bitcoin ETF might be accessible to US traders by way of their brokerage and funding accounts. “Any investor will be capable to buy shares of our ETF which might be accessible for buying and selling on the Nasdaq,” she stated.

Wald added that resulting from heightened demand for entry to Bitcoin, she expects upwards of $400 million in property to circulation into Valkyrie’s ETF in the course of the first few weeks of buying and selling. Wald’s prediction could also be correct, because it’s been reported that Bitcoin spot ETFs have already seen $4.6 billion in quantity in the course of the first day of buying and selling.

Though spectacular, it’s vital to know that investing in a spot Bitcoin ETF introduces counterparty threat. Perianne Boring, founder and chief govt officer of the Chamber of Digital Commerce, informed Cryptonews that traders depend on the ETF issuer to precisely monitor the efficiency of the underlying asset (Bitcoin). “If the issuer encounters monetary difficulties or mismanages the fund, it could possibly impression the ETF’s worth and the investor’s returns,” she stated.

Spot ETF Buying and selling Charges and Why Buyers Might Favor GBTC

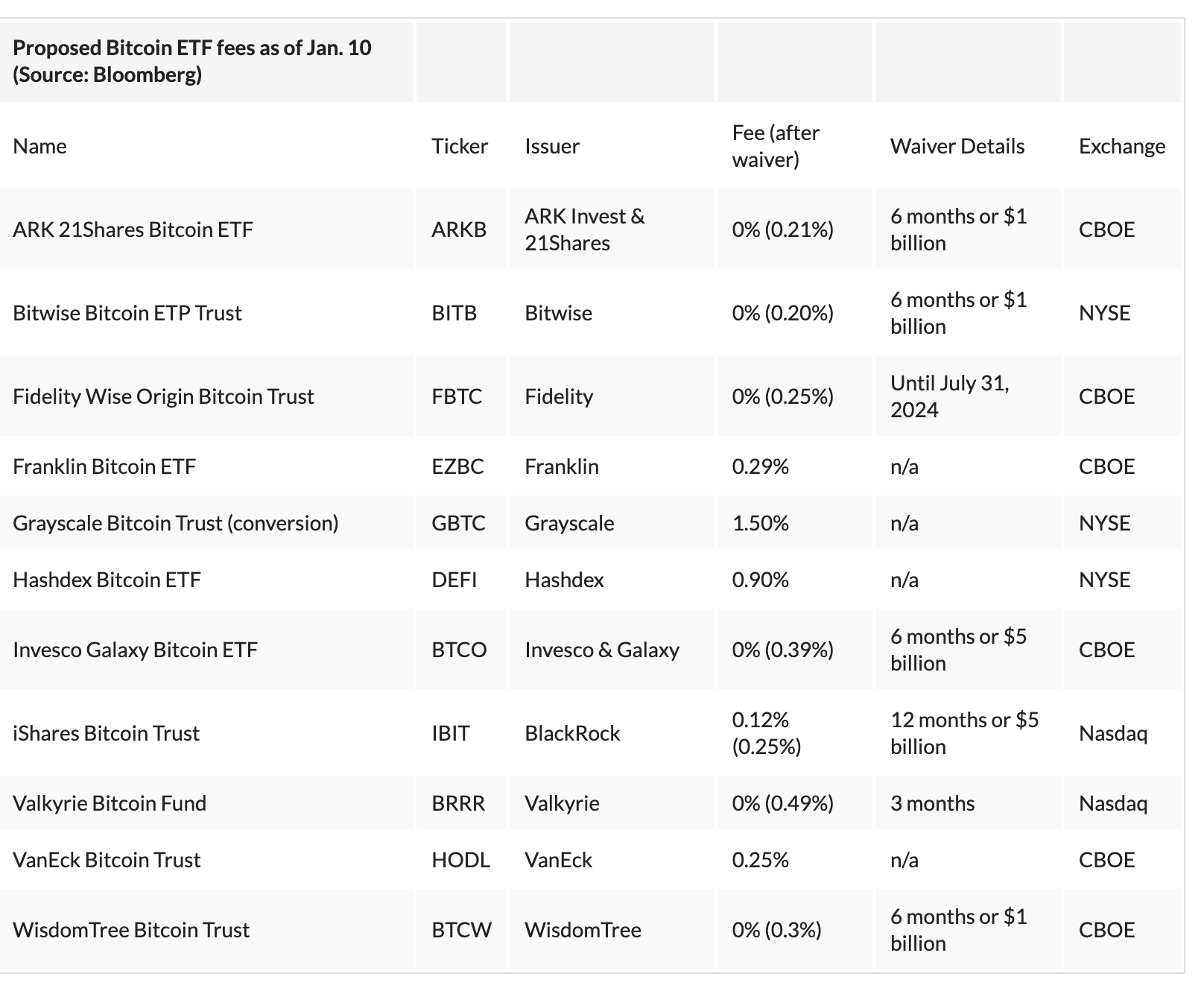

Whereas the spot ETF funds are anticipated to convey billions of {dollars} of recent capital into Bitcoin, it’s vital to notice that charges are related. In an effort to draw traders, most of the corporations providing spot ETFs have introduced low preliminary administration charges with BlackRock’s iShares ETF charging 0.12% for the primary 12 months (or first $5 billion of inflows), and the Invesco Galaxy ETF waiving its fee entirely for the primary six months (or $5 billion).

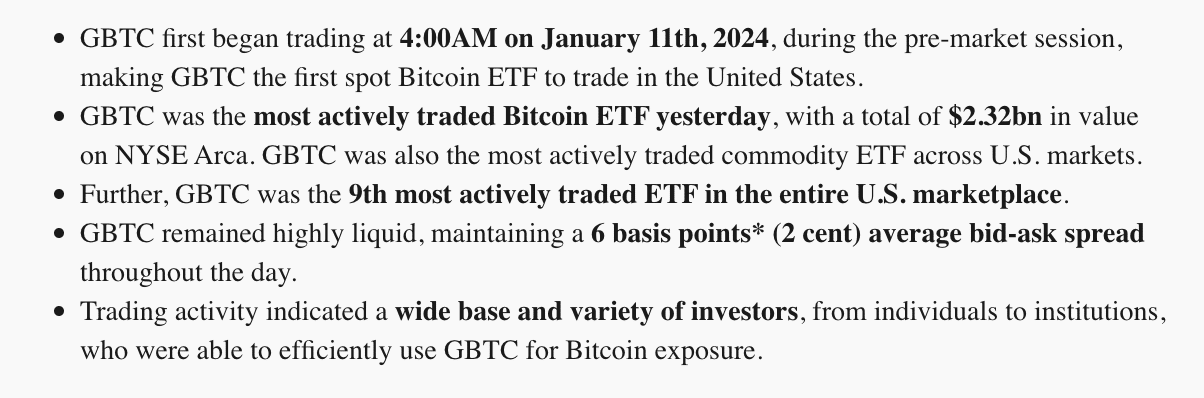

Curiously, it’s been reported that The Grayscale Bitcoin Belief (GBTC) led buying and selling quantity on Jan. 11, even with the best buying and selling price. In response to The Grayscale Workforce Jan. 12 publication, GBTC was essentially the most actively traded Bitcoin ETF on Jan. 11, with a complete of $2.32 billion in worth on NYSE Arca. The put up additionally famous that CBTC was essentially the most actively traded commodity ETF throughout US markets.

Brian Dixon, chief govt officer of Off The Chain Capital – an funding fund specializing in digital property – informed Cryptonews that he thinks there are large implications related to Grayscale’s ETF product, noting that it has a first-mover benefit in comparison with Blackrock, Constancy, and different suppliers. He stated:

“Grayscale has an estimated 619,000 Bitcoins in its ETF. As Blackrock, Constancy, and different suppliers go into the market to safe their provide for his or her ETFs, this can inherently drive up the worth of Bitcoin, creating an amazing enhancement of Grayscale’s ETF worth and property underneath administration (AUM).”

Dixon added that even with some stage of attrition to Grayscale’s Bitcoin ETF – which is to be anticipated as some traders might swap for decrease charges – the {dollars} flowing into aggressive merchandise will proceed to push up the worth of Grayscale’s AUM. “Historical past exhibits us with ETFs that the largest and most liquid ETFs entice the vast majority of the AUM. As of right now, that is precisely what Grayscale’s Bitcoin ETF offers,” he stated.

Why Spot Bitcoin ETFs are monumental for the US

Whereas there was buzz relating to the impression spot ETFs are having on the price of Bitcoin and different cryptocurrencies, there are lots of different components that make this a watershed second. For example, Seyyfart talked about that it’s uncommon for ETFs to create a brand new bridge to a brand new asset. He stated:

“The final time one thing like this occurred it was a gold ETF in 2004. Earlier than that was equities and bonds. You can also make arguments that there have been others, however that is actually the following one I’m watching — it’s the primary digital asset ETF and it exhibits each the flexibleness and advantages of the ETF wrapper.”

Seyyfart added that he thinks there’s a better than 50 p.c probability (possibly 70 p.c), {that a} spot Ethereum ETF is subsequent. Nevertheless, he famous that every other digital asset is probably going a lot farther behind and unlikely to be authorized anytime quickly.

Dixon additional famous that because the Bitcoin ETFs increase adoption of the asset, the US might enter a geopolitical race for international locations to seize Bitcoin on their stability sheet. “As international locations proceed to teach themselves on Bitcoin, I imagine there might be a race to amass as a lot as potential for his or her reserves. If Bitcoin turns into the financial base layer for the planet sooner or later, the nation that holds essentially the most Bitcoin holds essentially the most management,” he stated.

According to Nasdaq, as of October of 2023 the US Authorities is among the largest holders of Bitcoin with over 200,000.