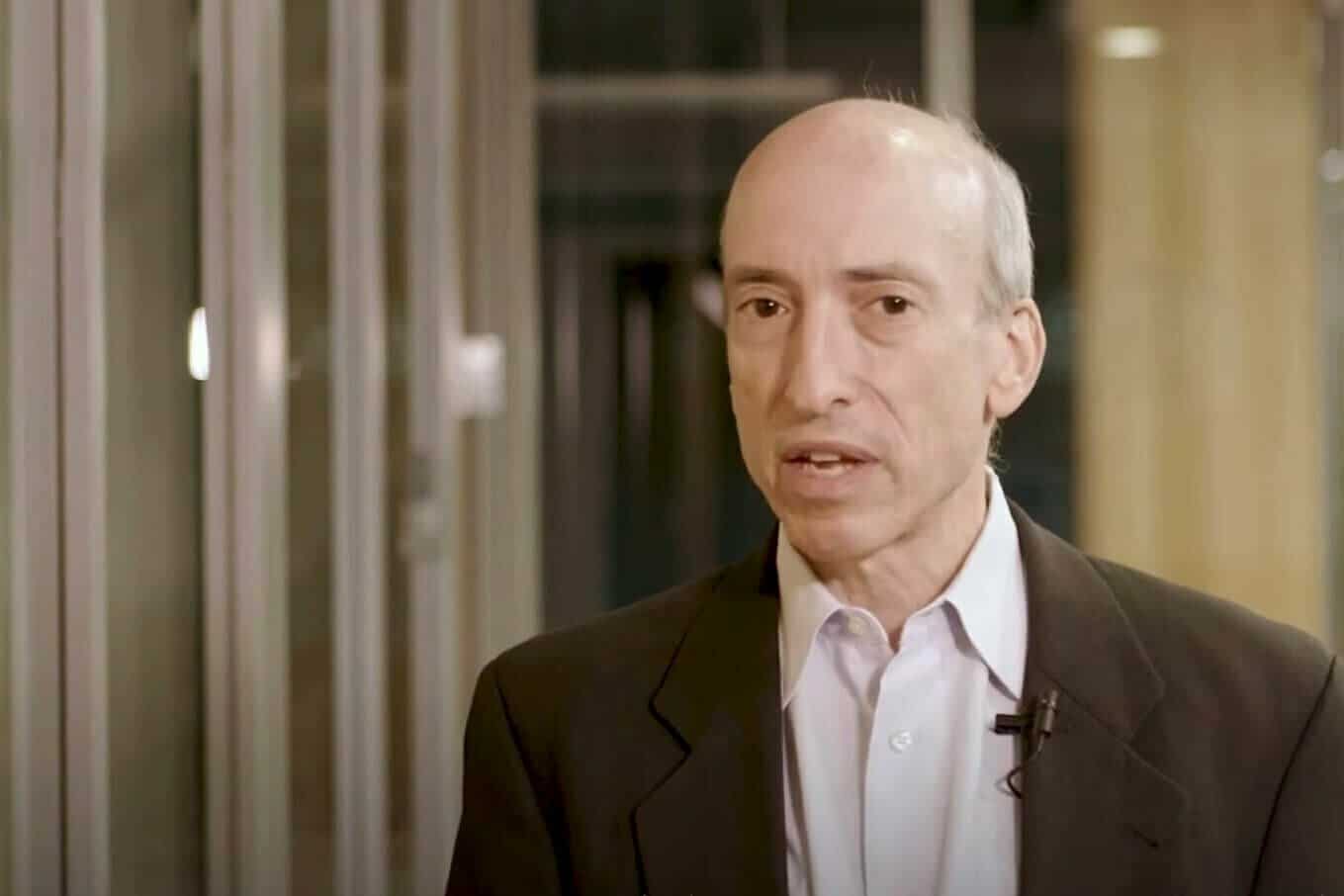

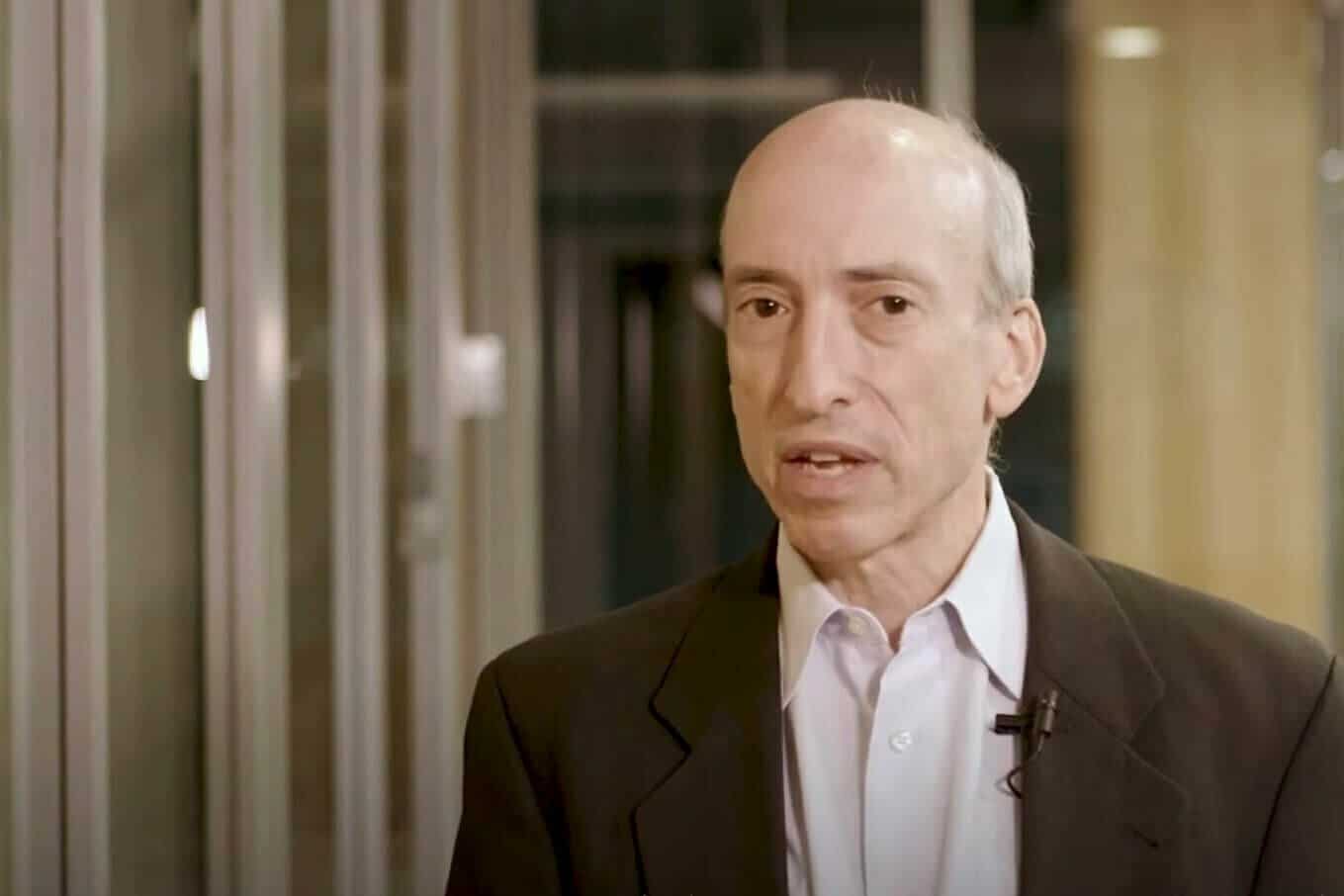

When the Securities and Alternate Fee (SEC) determined to approve Spot Bitcoin ETFs for public buying and selling on Wednesday, the deciding vote fell to chairman Gary Gensler.

After years of criticizing and rejecting such merchandise, what brought on the chairman to vary his thoughts? Based mostly on his current feedback, it could appear that the authorized system pressured his hand.

In a statement following the approvals, Gensler stated that “circumstances have modified” whereas referencing the SEC’s court docket loss to Grayscale in August. On the time, the company “did not adequately clarify its reasoning,” for rejecting the latter’s ETF software.

“Based mostly on these circumstances and people mentioned extra absolutely within the approval order, I really feel probably the most sustainable path ahead is to approve the itemizing and buying and selling of those spot bitcoin ETP shares,” wrote Gensler on Wednesday.

At the start of his assertion, the chairman emphasised that the SEC “acts throughout the legislation and the way the courts interpret the legislation.”

He additionally made clear that the company hasn’t reformed its pessimistic view on the crypto business extra broadly. The approvals, he stated, “ought to by no means sign the Fee’s willingness to approve itemizing requirements for crypto asset securities.” He added:

“As I’ve stated previously, and with out prejudging anyone crypto asset, the overwhelming majority of crypto property are funding contracts and thus topic to the federal securities legal guidelines.”

As a lot hate as Gensler acquired main as much as ETF vote, on the finish of the day it’s a must to give him credit score that he did the correct factor https://t.co/m8ikf1xucP

— WhiteBelt (@WhiteBeltCrypto) January 11, 2024

Gensler Blasts Bitcoin

But even Bitcoin – the only real cryptocurrency that Gensler has explicitly labeled a “non-security commodity – didn’t escape his criticism. “We didn’t approve or endorse bitcoin,” he wrote, arguing that it poses “myriad dangers” to buyers.

Although Bitcoin has usually been likened to “digital gold” by BlackRock’s CEO and different proponents, Gensler famous methods wherein it could be inferior. He wrote:

“Although we’re advantage impartial, I’d observe that the underlying property within the metals ETPs have shopper and industrial makes use of, whereas in distinction, bitcoin is primarily a speculative, unstable asset that’s additionally used for illicit exercise together with ransomware, cash laundering, sanction evasion, and terrorist financing.”

Gensler’s criticisms aligned with lots of his fellow Democrats who converse on crypto, equivalent to Elizabeth Warren, who continuously calls for strict controls on blockchain software program customers and their means to maneuver cash or dodge sanctions.

Nonetheless, extra crypto-supportive politicians throughout the aisle had been supportive of Gensler’s ETF approval. Representatives Patrick McHenry and French Hill of the Home Monetary Providers Committee referred to as Bitcoin ETFs a “historic milestone” for the business.