South Korean crypto-related KOSDAQ shares “soared” on the information of the US Securities and Exchange Commission (SEC)’s approval of 11 Bitcoin spot ETFs.

No South Korean crypto agency has but floated on the Korean Change. Nevertheless, a number of listed corporations have crypto-related pursuits.

Kangwon Domin Ilbo reported that enterprise capital corporations with stakes in large South Korean crypto exchanges have been the most important winners available in the market on January 11.

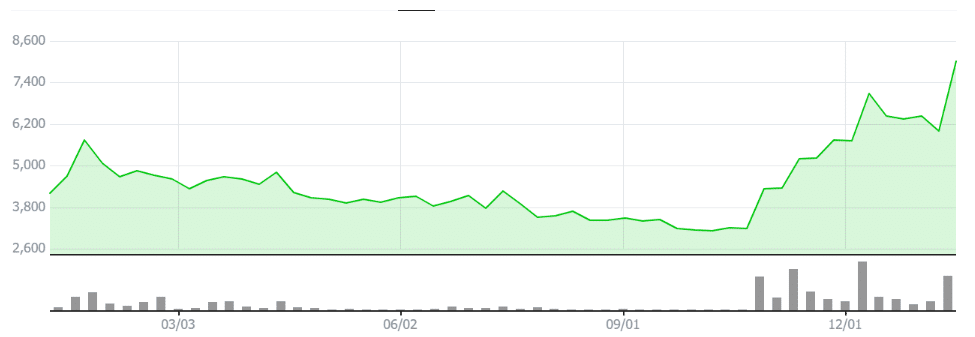

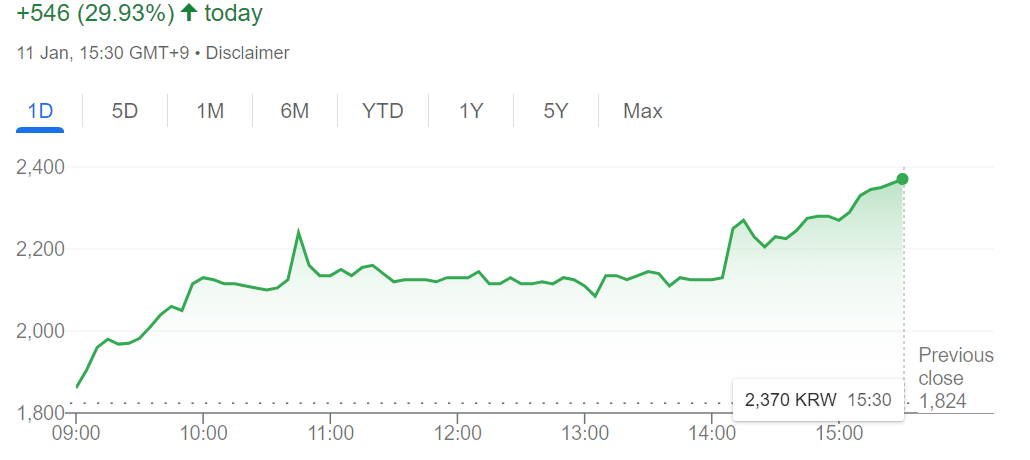

These embody Woori Expertise Funding, which noticed its worth rise virtually 30% to a 12-month excessive on January 11.

Hanwha Funding & Securities additionally posted a 30% day-on-day share worth rise after the American ETF information broke.

Each corporations personal shares in Dunamu, the operator of Upbit. The latter is South Korea’s largest digital forex trade by income and buying and selling quantity.

One other crypto trade investor, T Scientific, posted a share worth rise of over 20% on the identical day.

The agency’s dad or mum firm Wizit additionally witnessed a 29.89% rise. T Scientific owns a stake in Bithumb Korea, the operator of the crypto trade Bithumb, Upbit’s closest rival.

🇰🇷 South Korean Change Searches for ‘Misplaced’ Homeowners of $206M Price of Crypto

The South Korean crypto trade Bithumb needs to search out the “dormant” house owners of $206 million value of cash, together with #Bitcoin, #Ethereum, and #XRP.#CryptoNewshttps://t.co/lfLfubkD6t

— Cryptonews.com (@cryptonews) January 1, 2024

Bitcoin ETF Revitalizing South Korea’s Inventory Market?

Bithumb has previously announced its plans to launch on the Korean Exchange in 2025, and can hope the buoyant share costs assist its trigger.

There have been additional beneficial properties for different blockchain and crypto-related corporations, with Daesung Non-public Fairness recording a 29.93% worth rise.

Daesung launched an $83 million metaverse fund on the finish of 2022 with different Daesung group corporations, in addition to the Industrial Financial institution of Korea and Shinhan Capital.

One other winner was Atinum Funding, with a 15.43% rise. Final 12 months, Atinum led a $6.5 million Collection A funding into the US-based knowledge analytics platform CryptoQuant’s operator Crew Blackbird.

Extra modest beneficial properties have been recorded within the blockchain and fintech house, with the likes of Galaxia MoneyTree posting beneficial properties of over 7%.

Through the 2021 bull run, South Korean market analysts claimed Dunamu could follow Coinbase onto the New York Stock Exchange.

Consultants predicted Dunamu may increase $17.9 billion with a US IPO, however speak on this entrance cooled rapidly following the onset of crypto winter.