Within the ever-evolving panorama of digital currencies, Bitcoin has as soon as once more captured the monetary world’s consideration. Amid a backdrop of serious market actions, Bitcoin is at the moment buying and selling at $45,986, marking a lower of 1.20 p.c as of Friday. This current fluctuation comes on the heels of landmark approvals for Bitcoin Change-Traded Funds (ETFs), which have catalyzed a surge in each buying and selling exercise and costs.

Concurrently, the US greenback skilled a decline, though it recovered from its lowest factors, largely influenced by higher-than-expected inflation charges. This dynamic interaction between Bitcoin’s ETF-driven surge, the greenback’s fluctuation, and prevailing inflation considerations paints a posh image for Bitcoin’s worth trajectory.

Bitcoin ETF Milestones Gas Market Pleasure and Worth Will increase

On Thursday afternoon, U.S.-listed bitcoin exchange-traded funds (ETFs) recorded substantial trading volume, reaching $4.6 billion in shares in accordance with information from LSEG. This surge in exercise was pushed by investor curiosity following the current approval of landmark ETF merchandise by the U.S. securities regulator.

The introduction of 11 spot bitcoin ETFs, together with notable entries like BlackRock’s iShares Bitcoin Belief (IBIT.O) and the Grayscale Bitcoin Belief (GBTC.P), marked the start of a aggressive race for market share within the cryptocurrency business. Main gamers like Grayscale, BlackRock, and Constancy confirmed important exercise in these ETF markets, as indicated by LSEG information.

US bitcoin ETFs see $4.6B in quantity in first day of buying and selling https://t.co/sgFg8qRcW5 pic.twitter.com/IZvyqthNuC

— Reuters U.S. Information (@ReutersUS) January 11, 2024

The U.S. Securities and Change Fee’s (SEC) approval on Wednesday represented a pivotal second for the crypto business, bringing digital property, typically considered as dangerous, beneath the scrutiny of broader acceptance as funding automobiles. This resolution culminated from a decade-long engagement between the SEC and the crypto business, with some executives sustaining a cautious stance on bitcoin as a high-risk funding.

Regardless of the regulatory inexperienced gentle, Vanguard introduced it will not provide the brand new batch of spot bitcoin ETFs to its brokerage shoppers. SEC Chair Gary Gensler, in an announcement on Wednesday, underscored that the approvals don’t equate to an endorsement of bitcoin, describing it as a “speculative, risky asset.”

Coinciding with the ETF launches, Bitcoin’s worth skilled a big improve, reaching its highest stage since December 2021.

Greenback’s Resilience Amid Shocking Inflation Tendencies

Following the discharge of higher-than-expected US client worth inflation (CPI) statistics for December, the US greenback weakened towards main currencies just like the euro and the yen, casting uncertainty on the Federal Reserve’s timeline for rate of interest reductions.

The CPI saw a monthly increase of 0.3%, contributing to a yearly development charge of three.4%, surpassing forecasts. Whereas merchants had beforehand thought of a possible charge reduce in March, the sturdy CPI report suggests this can be delayed. After reaching a five-month low, the greenback index noticed a slight decline.

*SUMMARY OF US DECEMBER CPI REPORT:

1. US CPI rose 0.3% on the month, above expectations for a 0.2% improve.

2. Headline CPI inflation elevated 3.4% Y/Y, accelerating from 3.1% in November.

3. US inflation remains to be rising much more shortly than what the Fed would contemplate… pic.twitter.com/6o7Wc7F72i

— Jesse Cohen (@JesseCohenInv) January 11, 2024

Concurrently, the US Securities and Change Fee’s approval of Bitcoin-linked exchange-traded funds (ETFs) coincided with a surge in Bitcoin’s worth, reaching highs not seen in two years and reflecting a rising institutional curiosity and optimistic sentiment within the cryptocurrency market.

Bitcoin Worth Prediction

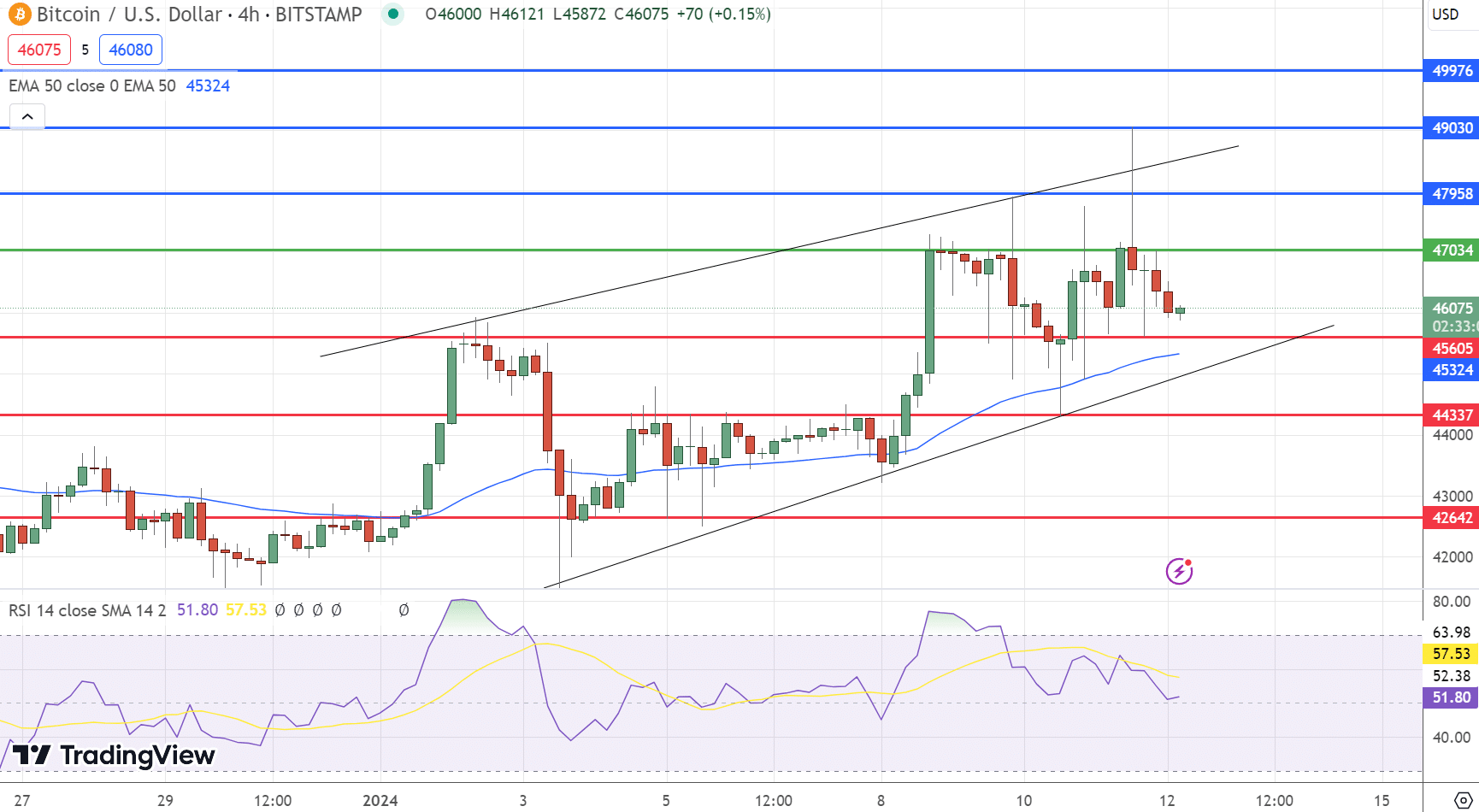

Bitcoin’s current pivot point stands at $47,034, a vital stage for merchants. Rapid resistance is noticed at $47,958, with additional hurdles at $49,030 and $49,976. On the help aspect, $46,605 acts as the primary line of protection, adopted by stronger ranges at $44,337 and $42,642.

The Relative Power Index (RSI) is presently at 51, suggesting a impartial to barely bullish sentiment available in the market. The 50-Day Exponential Shifting Common (EMA) is at $45,339, indicating that the value is at the moment buying and selling above this stage, signifying a short-term bullish development.

The chart exhibits Bitcoin going through a significant hurdle round a double-top resistance stage of round $47,000. Under this stage, a bearish sentiment is probably going, with potential motion in direction of the $45,600 mark. This sample means that breaking above $47,000 might shift the development to bullish, whereas staying under this level could reinforce bearish tendencies.