The Bitcoin (BTC) worth has tumbled greater than 6% from the mid-$46,000s to the mid-$43,000s, because the post-spot Bitcoin ETF “sell-the-fact” response is available in.

The US SEC approved the launch of the first 11 spot Bitcoin ETFs on Wednesday.

Commerce within the new Bitcoin investment products went reside on Thursday and was a giant success.

As per LSEG knowledge cited by Reuters, the new spot Bitcoin ETFs saw $4.6 billion in trading volumes on Thursday.

Greater-than-expected demand helped propel the Bitcoin price to contemporary two-year highs above $49,000 on the time.

However the Bitcoin price has since succumbed to a wave of profit-taking.

When the Bitcoin worth excessive $49,000 on Thursday, that took its spot Bitcoin ETF optimism-fuelled rally prior to now 5 months to a staggering 90%.

Some analysts had warned that this rally left the market weak to a profit-taking-fuelled pullback, or a so-called “sell-the-fact” response.

Friday’s bearish worth motion means that this sell-the-fact response is beginning to are available.

Reviews that Bitcoin miner outflows to exchanges has hit a six-year excessive may additionally have upset the market.

Miners must periodically ship their BTC to exchanges to promote in an effort to fund their mining prices.

CryptoQuant analyst Bradley Park informed the crypto press that mining pool F2Pool was behind a lot of the latest outflows.

He famous that F2Pool could also be promoting cash to fund miner upgrades forward of the halving.

How Low Can the Bears Push the Bitcoin (BTC) Value?

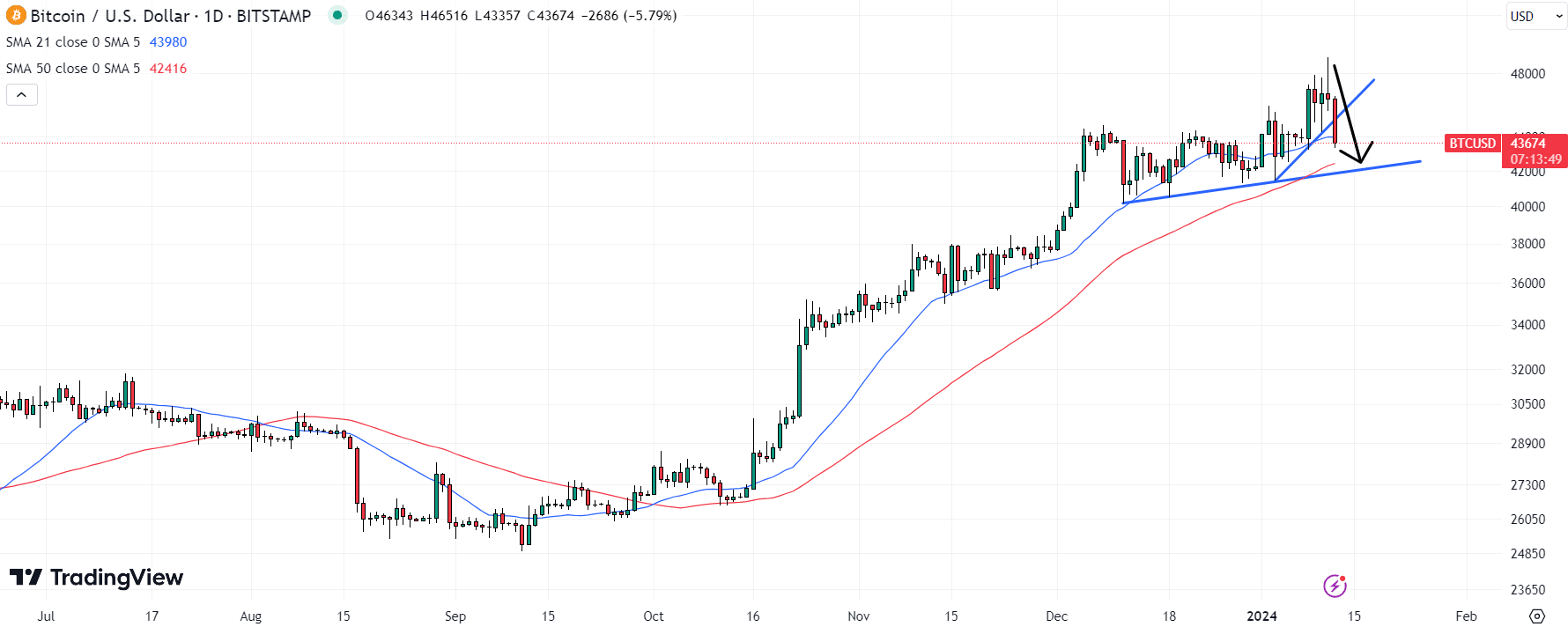

The Bitcoin worth’s newest dive has seen it break beneath a one-week uptrend.

BTC is at the moment probing for a break beneath its 21DMA, which sits at $44,000.

A convincing break beneath right here would open the door to a take a look at of the 50DMA at $42,400, and an uptrend from December.

However dangers are titled in direction of a fair larger dip within the Bitcoin worth.

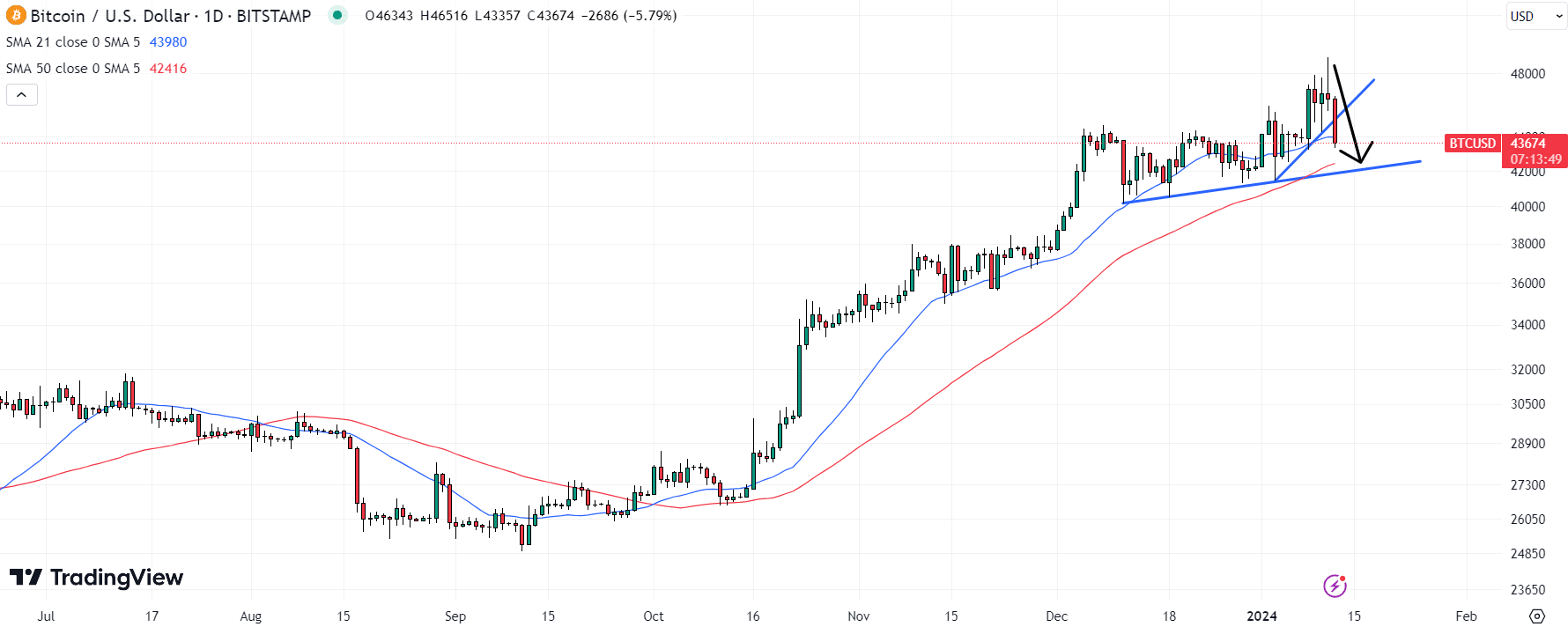

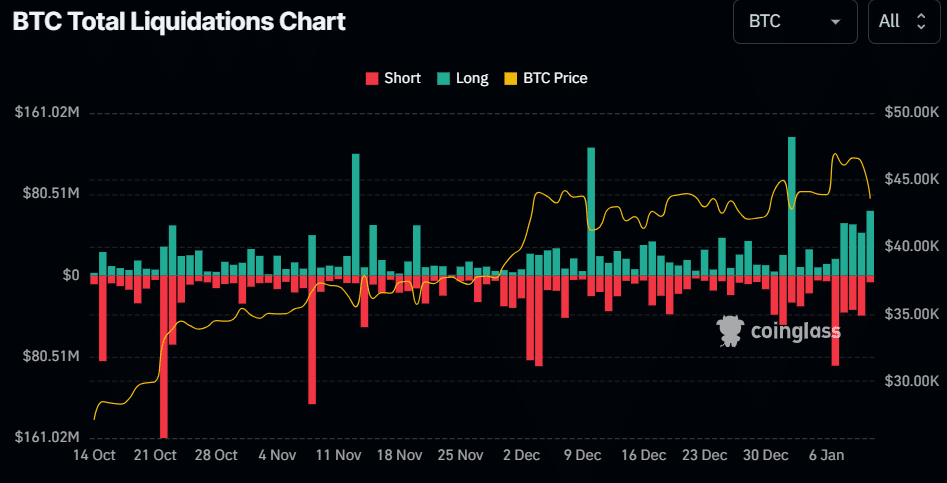

Information offered by coinglass.com exhibits that the newest worth drop hasn’t been fuelled by speculators getting liquidated.

As per the derivatives analytics web site, $64 million price of leveraged lengthy Bitcoin futures positions had been stopped out on Friday.

That’s a lot smaller than latest lengthy liquidation occasions, akin to on the twond of January and 10th of December.

The chance is that as the worth continues to say no, the autumn is accelerated as long-position liquidations rise.

Futures open curiosity at two-year just lately pumped to contemporary two-year highs above $19.5 billion.

Excessive participation within the Bitcoin derivatives market by speculators suggests the worth stays at a excessive danger of liquidation event-fuelled volatility, together with to the draw back.

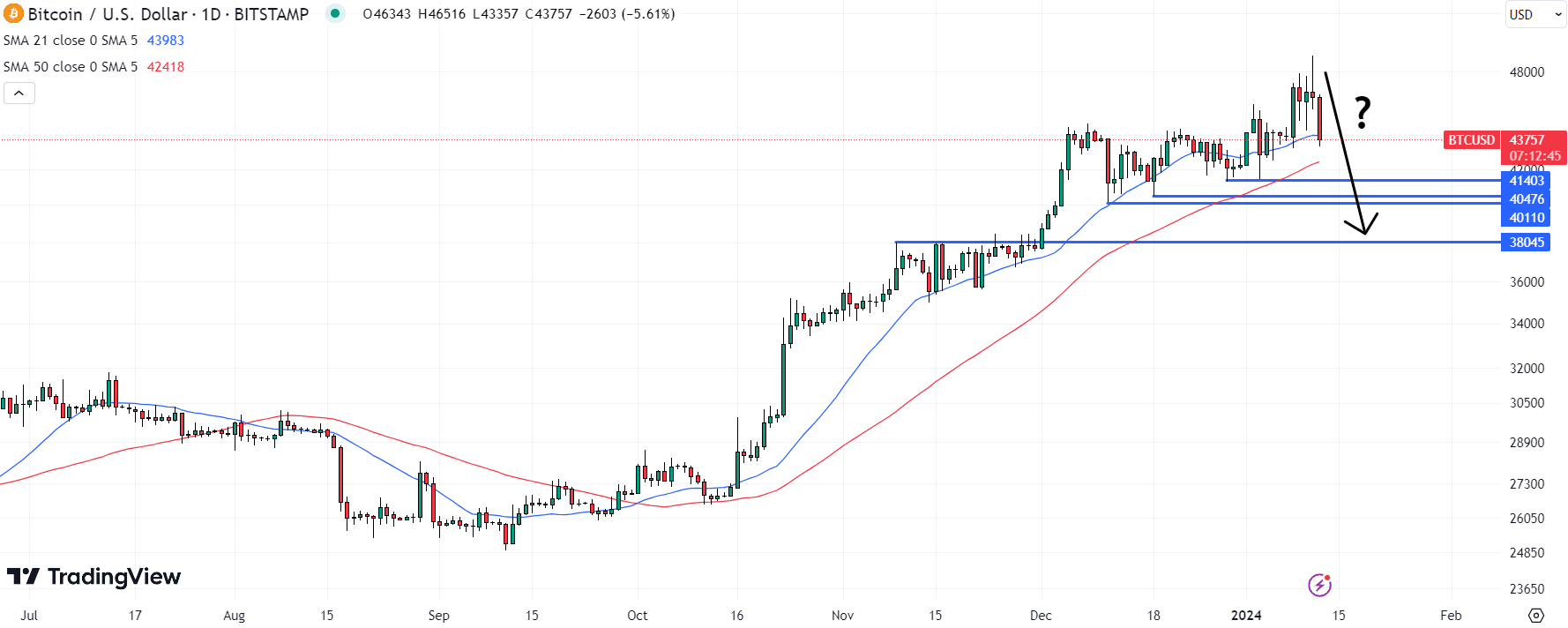

If Bitcoin fell beneath December assist ranges between $40,000 and $41,500, issues would actually get fascinating.

Whereas a return to sub-$40,000 ranges is feasible, it’s questionable as to how lengthy the Bitcoin worth would stay at these ranges.

Right here’s Why Bitcoin Bulls Will Purchase the Dip

Bitcoin ETF demand and an upcoming Fed cutting cycle are anticipated to supply long-term assist to the Bitcoin worth.

In the meantime, decreased provide as soon as the Bitcoin halving takes place in April can be probably to supply long-term tailwinds.

Bitcoin continues to virtually completely monitor its usual four-year market cycle.

BTC has traditionally rallied for round three years following every year-long bear market.

Every of those rallies has traditionally seen the Bitcoin worth blast previous its prior file highs.

14 months on since its worth bottomed round $15,000 in November 2022, Bitcoin is effectively on its manner again to its 2021 highs round $69,000.

But when historical past is any information, this bull market might see the Bitcoin worth simply surpass $100,000 throughout the subsequent 22 months.

Historic patterns plus the aforementioned cocktail of constructive fundamentals imply that dip shopping for demand for BTC will probably stay sturdy.

Consequently, the bears are unlikely to have the ability to push the Bitcoin worth considerably beneath $40,000.