In a dramatic flip of occasions, Bitcoin, essentially the most distinguished cryptocurrency, lately witnessed a surge to just about $48,000. This surprising rise was triggered by a deceptive tweet from the U.S. Securities and Alternate Fee (SEC), which falsely indicated the approval of Bitcoin exchange-traded funds (ETFs).

Nonetheless, this surge was short-lived because the SEC promptly rectified the state of affairs, confirming their social media account had been compromised and denying the approval of Bitcoin ETFs. This clarification led to Bitcoin’s worth correcting to round $46,000.

Bitcoin Jumps, Then Dumps to $45K As Faux Information About Spot Bitcoin Approval Liquidates $50M

Bitcoin [BTC] endured wild swings throughout Tuesday’s buying and selling session as a U.S. Securities and Alternate Fee (SEC) social media put up about approving spot bitcoin exchange-traded funds… pic.twitter.com/PF9AsKMmNY— ThugsAmbition (@ThugsAmbition) January 10, 2024

The incident brought about vital volatility within the cryptocurrency market, with the worldwide worth of all cryptocurrencies dropping by 0.83% to $1.71 trillion inside 24 hours.

Amidst this tumultuous panorama, the crypto neighborhood is eagerly awaiting the ETF deadline, with some speculating a possible surge in Bitcoin’s worth to $100,000.

This newest episode underscores the rising influence of institutional actions and regulatory selections on the extremely dynamic and speculative crypto market.

False SEC Tweet Triggers Bitcoin Market Turbulence

Just lately, the cryptocurrency market was thrown right into a whirlwind by a deceptive tweet from the U.S. Securities and Exchange Commission (SEC).

The tweet falsely indicated the approval of Bitcoin ETFs, inflicting Bitcoin’s worth to momentarily soar to $47.9K earlier than falling again to $45.4K.

🚨Breaking 🚨: X confirms a safety breach—SEC account hacked as a consequence of lack of two-factor authentication.👇 #Crypto #Cryptocurency #SEC pic.twitter.com/qQXy9RPjgA

— Bitinning (@bitinning) January 10, 2024

The SEC later rectified the state of affairs, admitting their Twitter account was compromised as a consequence of a scarcity of two-factor authentication. This incident led to hypothesis about potential market manipulation or inner errors.

Finally, the misinformation and subsequent correction show how delicate the market is to regulatory information and rumors.

Rising Confidence in Bitcoin Amid Institutional Consideration

Tom Lee of Fundstrat Global Advisors has an optimistic outlook for Bitcoin, predicting a possible rise to $150,000 throughout the subsequent yr and $500,000 inside 5 years, particularly if Bitcoin spot ETFs are greenlit.

Moreover, Glassnode knowledge reveals a surge in institutional curiosity, significantly in Bitcoin futures on the CME Alternate, accounting for a big 36% of the market.

This shift signifies a rising institutional confidence in Bitcoin derivatives, suggesting a maturation and stabilization of the market.

As establishments more and more interact within the crypto market, their influence on buying and selling patterns is turning into extra evident, presumably paving the best way for broader adoption of cryptocurrencies.

Tom Lee’s bullish predictions, coupled with the rising institutional curiosity documented by Glassnode, level in direction of a doubtlessly brighter future for Bitcoin, bolstering investor confidence and presumably resulting in higher demand and better costs in each the quick and long run.

Bitcoin Value Prediction

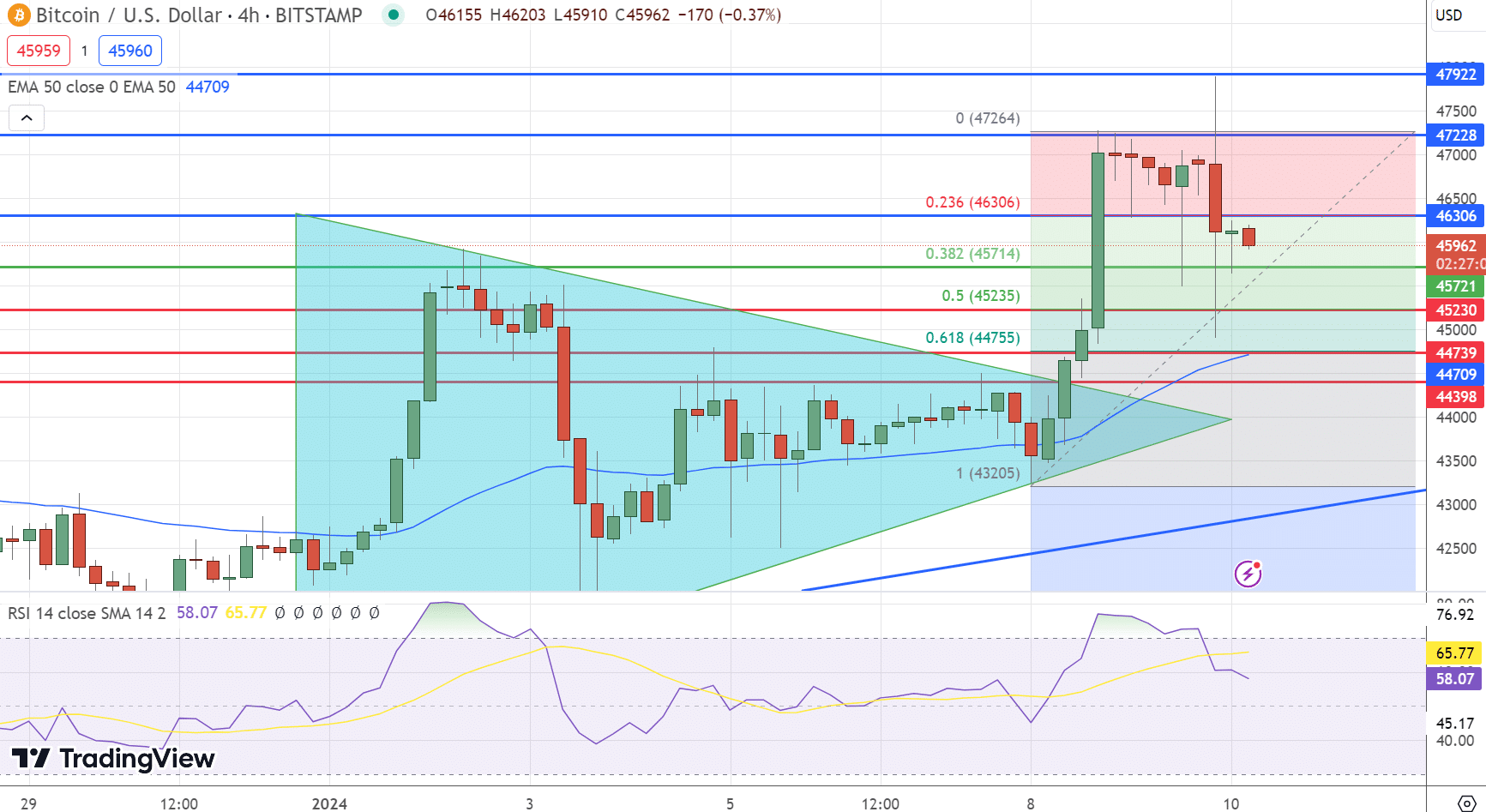

As of January 10, throughout the US buying and selling session, Bitcoin is hovering round $45,990, displaying a consolidation sample. The cryptocurrency’s pivot level for the day is about at $45,721. When it comes to resistance, Bitcoin is encountering its first problem at $46,306, with additional obstacles at $47,228 and $47,922 that would restrict its upward momentum.

On the draw back, assist ranges are established at $45,230, with extra security nets at $44,739 and $44,398. These ranges are essential in halting any additional worth dips.

The Relative Energy Index (RSI) for Bitcoin presently stands at 57, suggesting a reasonably bullish sentiment however not venturing into overbought territory, which generally alerts a possible worth pullback.

Bitcoin’s worth is buying and selling above its 50-Day Exponential Transferring Common (EMA) of $44,708.0, indicating a prevailing short-term bullish pattern.

The technical chart evaluation factors out that Bitcoin has lately undergone a Fibonacci retracement at $45,721, coinciding with the 38.2% Fibonacci degree.

This retracement is a crucial indicator; a steady transfer under this mark may intensify promoting pressures, particularly as Bitcoin corrects from beforehand overbought situations.

Total, Bitcoin’s present pattern leans in direction of cautious optimism, particularly if it stays above the $45,250 mark. Brief-term forecasts counsel that Bitcoin may try to breach its instant resistance ranges within the close to future.