Bitcoin’s price has soared to $47,000, marking its highest stage since April 2022, pushed by fervent hypothesis concerning the U.S. Securities and Trade Fee (SEC) presumably approving Bitcoin exchange-traded funds (ETFs).

This surge in worth isn’t just a stand-alone occasion however a mirrored image of the escalating optimism within the cryptocurrency market. As anticipation builds across the SEC’s impending resolution, Bitcoin’s progress trajectory has been outstanding, with a ten% enhance this month and an astonishing 173% rise year-to-date.

The cryptocurrency market’s general valuation now stands at $1.73 trillion, having skilled a major 6.70% enhance up to now day alone. This uptick in market worth and the extraordinary concentrate on regulatory developments underscore the essential function of institutional acceptance in shaping Bitcoin’s future.

Good morning Fam! ☀️#BitcoinETF is simply across the nook and the consequences are seen as properly. $BTC crossed $47k final evening and loads of specialists are saying that the spot BTC ETF is inevitable and it is solely a matter of time earlier than the official announcement.

Are you bullish or… pic.twitter.com/xBMGL4tvrZ

— Karan Singh Arora (@thisisksa) January 9, 2024

With knowledgeable forecasts from main monetary establishments like VanEck, Bitwise, BlackRock, and Customary Chartered projecting Bitcoin to achieve a staggering $200,000 by 2025, the crypto neighborhood is abuzz with anticipation, eyeing the subsequent milestone of $49,000 with eager curiosity.

Crypto Market Surge: Bitcoin Soars, $1.8 Trillion Valuation as SEC Resolution Nears

The worldwide cryptocurrency market is witnessing a major surge, with its valuation hovering to $1.8 trillion, marking an over 6% enhance in simply 24 hours. This upswing is mirrored within the concern and greed index, which has risen by 6 factors since yesterday, indicating a shift in market sentiment.

Amidst this market progress, all eyes are on the U.S. Securities and Trade Fee (SEC) because it nears a choice on the ARK/21 Share’s Bitcoin ETF. SEC Chief Gary Gensler’s current tweets cautioning concerning the dangers related to crypto investments echo his earlier statements made previous to related approvals in October 2021. These warnings come at a time when Bitcoin has surged previous the $47,000 mark, bolstered by the rising optimism across the approval of Bitcoin spot ETFs.

Hiya Colleagues,#Bitcoin is now $46,863.

Crypto Market Cap elevated to $1.73 Trillion {Dollars} (4.49%)Simply alert me whenever you see it 😁 pic.twitter.com/RtCCWSDSBW

— Vindicated Chidi (@Vindicatedchidi) January 8, 2024

This uptrend within the crypto market, coupled with heightened investor curiosity, hints at a burgeoning confidence within the sector. Nonetheless, the long run trajectory of this market closely depends on forthcoming regulatory choices, significantly the SEC’s verdict on Bitcoin ETFs.

Such choices are pivotal in figuring out the market’s stability and shaping the general investor sentiment. The crypto neighborhood thus stays keenly attentive to those regulatory developments, that are poised to considerably affect the market dynamics.

SEC ETF Hopes Gas Market, $200K Bitcoin Worth Predicted by 2025

The current surge of Bitcoin previous $47,000 is essentially fueled by the market’s optimism over the doable approval of a spot Bitcoin ETF by the US SEC this week. This optimism has contributed to an 87% enhance in Bitcoin’s worth since September 2023.

The joy is additional amplified by vital monetary establishments like BlackRock and Constancy updating their ETF filings, sparking a concern of lacking out (FOMO) amongst traders.

Analysts are bullish concerning the future, anticipating a surge in demand and enhanced market credibility for Bitcoin ETFs. Projections from Customary Chartered recommend an inflow of $50-100 billion in 2024, with Bitcoin probably reaching a staggering value of $200,000 by 2025.

US Bitcoin spot ETFs on the verge of SEC approval! Regardless of weekend volatility, #Bitcoin targets $50k as anticipation for the ETF approval grows. This may very well be a recreation changer for each the crypto world and Wall Avenue! 💰

#BTC #Crypto $BTC pic.twitter.com/92GFBtLgca— LitFXMogul 🇪🇸 (@LitFXMogul) January 8, 2024

Merchants are eyeing profit-taking alternatives across the $48,500 and $50,000 ranges, though there’s warning as a result of market’s present volatility. Lengthy-term prospects stay robust, buoyed by elements such because the Federal Reserve’s tapering cycle, the upcoming Bitcoin halving, and the rising adoption of cryptocurrencies by main firms by new ETFs.

High Companies Predict $200K Bitcoin by 2025: VanEck, Bitwise, BlackRock, Customary Chartered

The panorama of Bitcoin Trade-Traded Funds (ETFs) is witnessing vital developments with main monetary entities like BlackRock, Constancy, and others updating their filings with the U.S. Securities and Exchange Commission (SEC). These updates mark a considerable step within the evolving narrative of cryptocurrency investments. VanEck has infused its potential ETF with a formidable $72.5 million, whereas Bitwise has contributed $500,000, and BlackRock has invested $10 million.

In a notable transfer, Pantera Capital has proven an curiosity in investing a staggering $200 million. VanEck has additionally pledged 5% of its ETF earnings to assist Bitcoin builders by the group Brink. This dedication underscores a rising recognition of the significance of nurturing the Bitcoin ecosystem.

Customary Chartered Financial institution says #Bitcoin may see $50-100 billion in spot ETF inflows upon approval in 2024

The financial institution additionally famous that #Bitcoin may attain a value of $200,000 by the tip of 2025. #BitcoinETF #crypto #GoldenGlobes pic.twitter.com/HiEUPhL4YG

— Crypto Make investments (@PassiveIncom22) January 9, 2024

Standard Chartered Bank has made a daring forecast, predicting that Bitcoin may attain an eye-opening $200,000 by 2025. This prediction hinges on the profitable influx of investments into Bitcoin ETFs. Including to the market dynamics, a strategic whale transaction just lately occurred, with 4,000 BTC (valued at $178.7 million) being deposited on the cryptocurrency trade Binance, capitalizing on the newest surge in Bitcoin costs.

These developments, characterised by substantial investments from distinguished gamers and optimistic forecasts from revered monetary establishments, have been instrumental in driving Bitcoin’s value past the $47,000 threshold. This surge not solely displays the rising investor confidence in Bitcoin but additionally highlights the essential function of institutional assist in shaping the long run trajectory of this main cryptocurrency.

BTC Worth Prediction

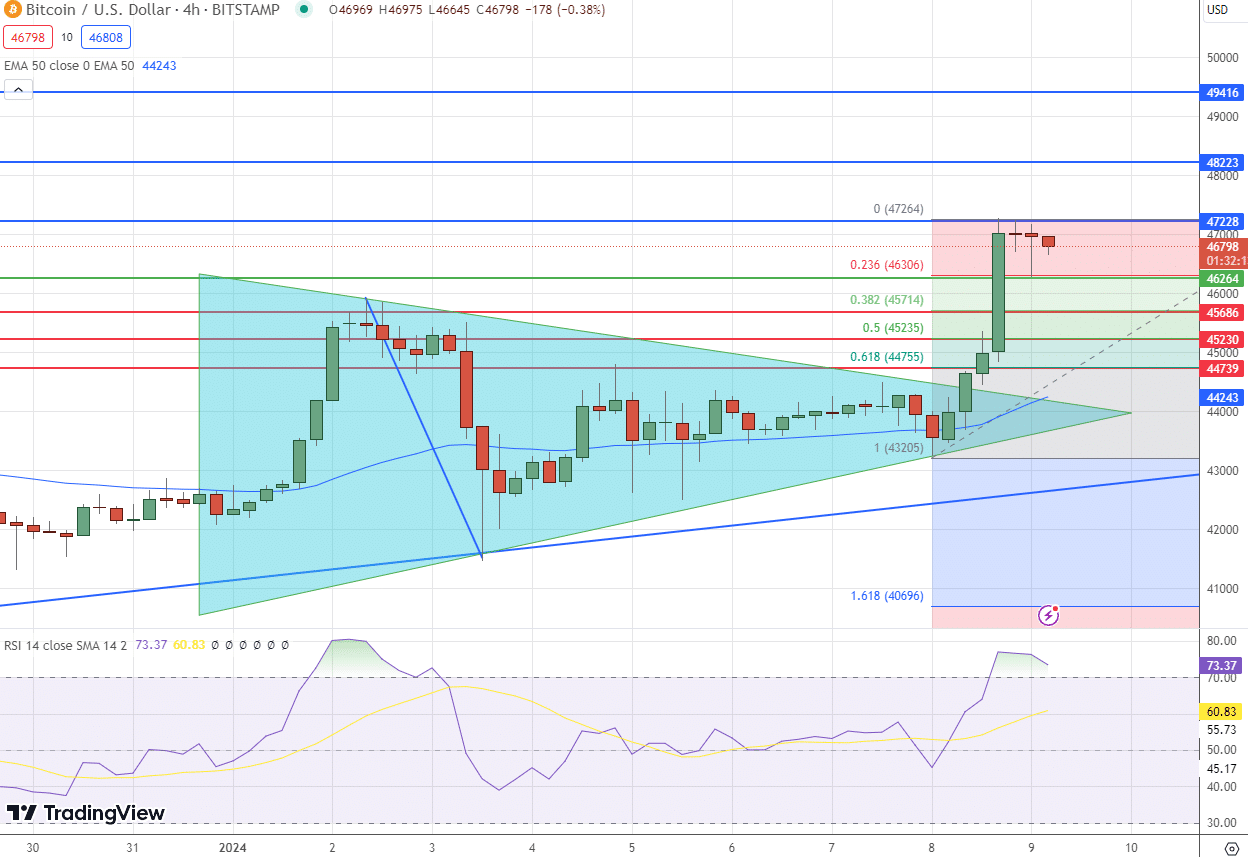

On Tuesday, January 9, Bitcoin (BTC) is buying and selling slightly below the $47,000 mark, reflecting persistent investor curiosity and bullishness within the cryptocurrency market. Regardless of its current excessive, technical indicators recommend potential for a bearish correction.

Bitcoin’s pivot level stays at $45,900, with instant resistance close to $48,420. The numerous ranges of $50,000 and $51,375 stand as additional resistance factors that will curb Bitcoin’s upward trajectory.

Assist ranges are discovered at $44,520, $42,925, and $41,500, providing doable stabilization in case of a downturn. The Relative Energy Index (RSI) signifies an overbought situation at 76, hinting at the potential of a value correction quickly.

Bitcoin’s chart evaluation reveals a breach of the symmetrical triangle sample at $45,890, with bullish engulfing and Marubozu patterns suggesting a continued uptrend. If Bitcoin surpasses the $48,450 resistance, it may problem the essential $50,000 mark.