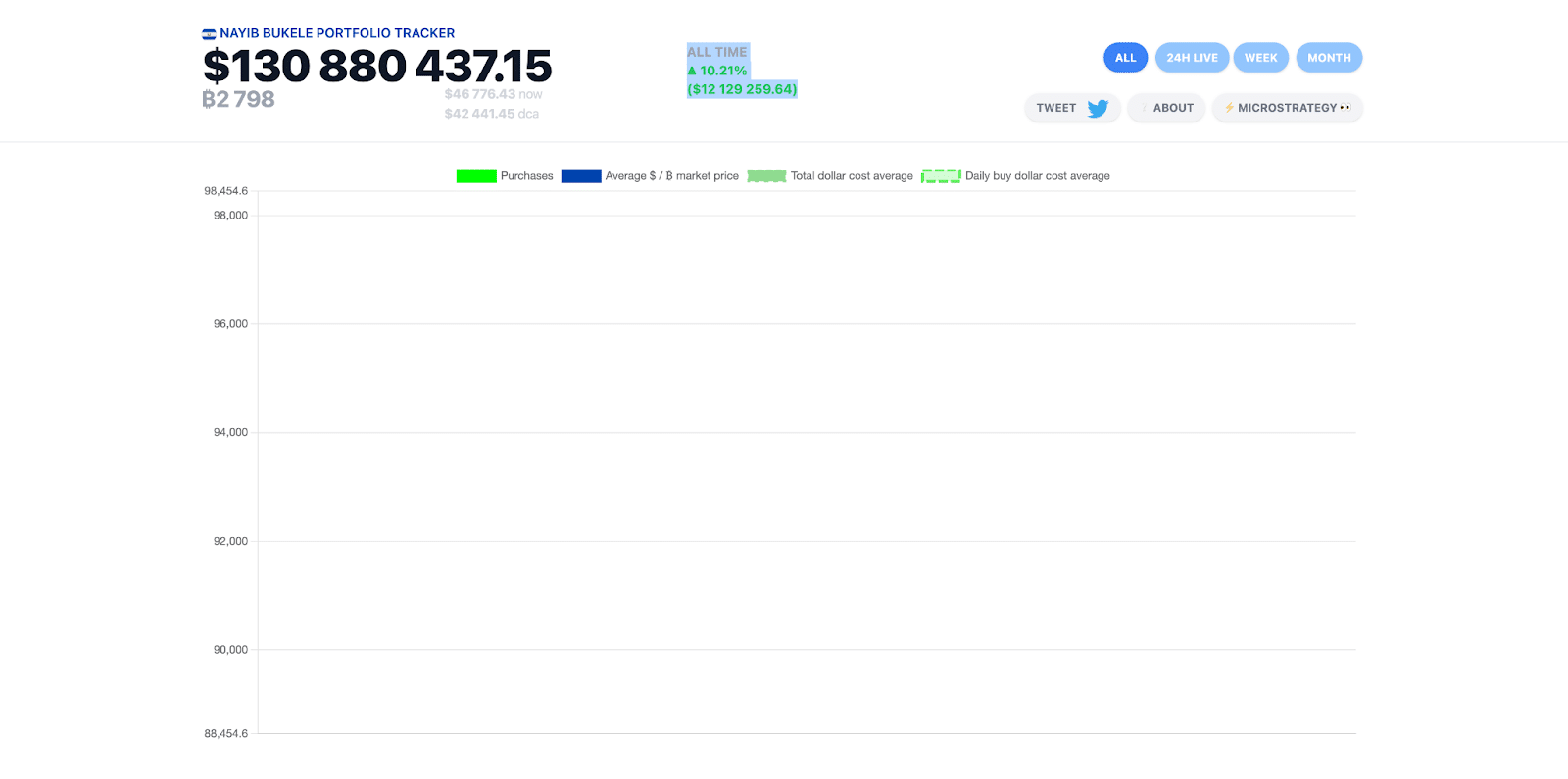

El Salvador’s Bitcoin (BTC) portfolio of two,798 tokens has yielded an unrealized revenue of $12.6 million, and there are not any plans to promote.

El Salvador is sitting on $12.6 million in unrealized income on its bitcoin (BTC) funding after being within the purple for 2 years, in response to information from Nayibtracker. El Salvador holds a complete of two,798 bitcoin ($131.3 million). CoinDesk https://t.co/0o2CjwKCEQ

— Wu Blockchain (@WuBlockchain) January 9, 2024

In an update on January 9 by Nayibtracker, a devoted web site monitoring El Salvador’s crypto holdings, the most recent BTC funding by the Central American nation exhibits a powerful all-time upward value trajectory of 10.21%.

This improvement follows a December 4 X put up by Nayib Bukele, the President of El Salvador, revealing a revenue of $3.6 million.

El Salvador’s #Bitcoin investments are within the black!

After actually hundreds of articles and hit items that ridiculed our supposed losses, all of which have been calculated primarily based on #Bitcoin’s market value on the time…

With the present #Bitcoin market value, if we have been to promote… pic.twitter.com/gvl2GfQMfb

— Nayib Bukele (@nayibbukele) December 4, 2023

Regardless of short-term value fluctuations, the president emphasised a dedication to a long-term technique, indicating that El Salvador views its Bitcoin funding as a part of a broader and enduring strategy reasonably than reacting to quick market circumstances.

Nonetheless, the potential approval of a spot Bitcoin ETF may set off vital inflows and propel BTC costs to new highs.

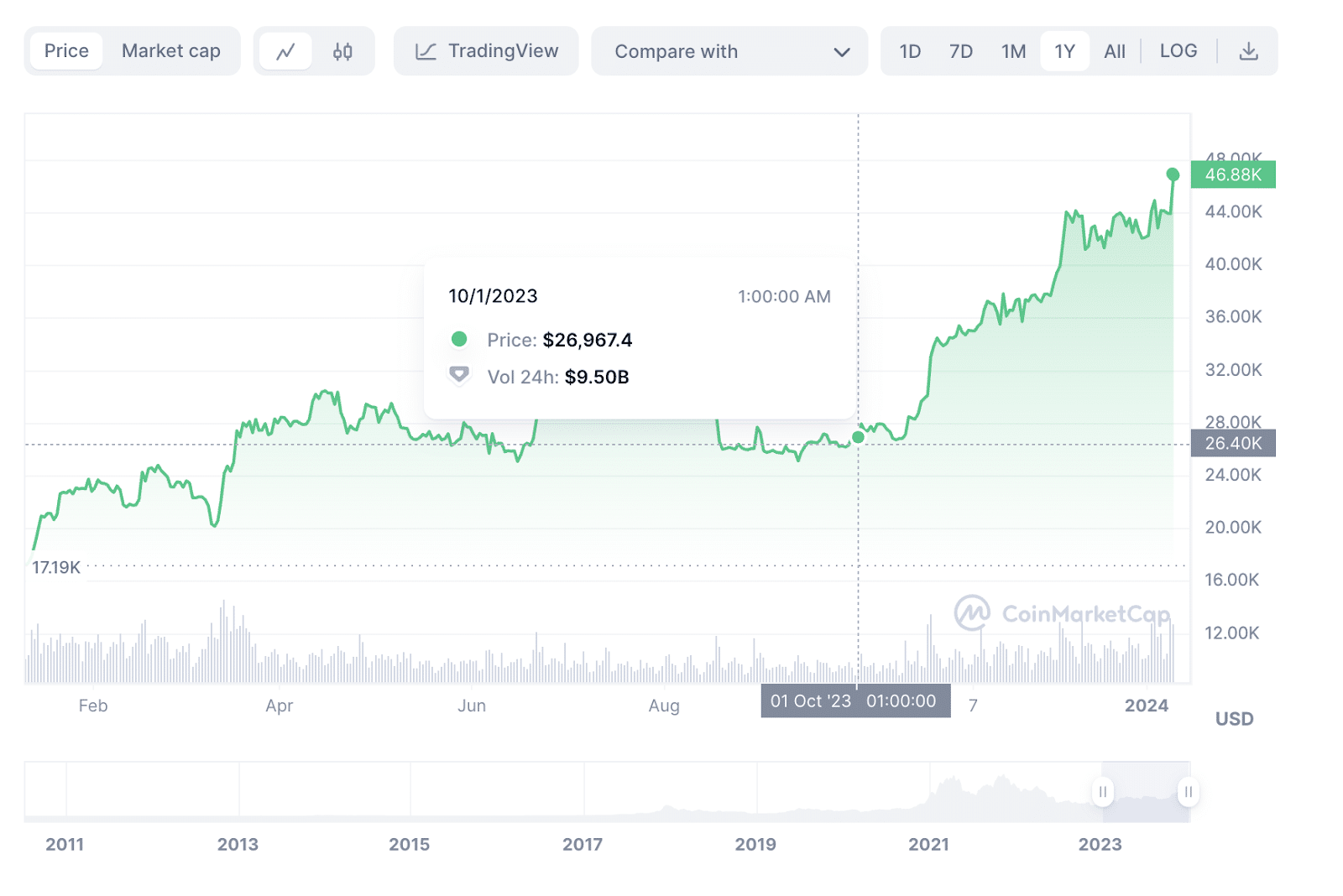

BTC has seen a substantial increase of 75% since October 2023, pushed by optimism surrounding the approval of a spot Bitcoin ETF in the USA.

The Securities and Trade Fee (SEC) is about to decide on this matter on January 10, 2024. Numerous asset managers who had beforehand filed for a proposed ETF fund have submitted new amendments in response to regulatory conferences with SEC officers.

JUST IN: #Bitcoin ETF candidates are submitting last-minute amendments to decrease their charges: 👀

Bitwise’s lowered to 0.20%

Valkyrie’s lowered to 0.49%

Invesco Galaxy’s lowered to 0.39%

WisdomTree’s lowered to 0.30%Prepared for approval 🔥

— Bitcoin Journal (@BitcoinMagazine) January 9, 2024

At press time, Bitwise, Valkyrie, Invesco, and WisdomTree have lowered their buying and selling charges to 0.20%, 0.49%, 0.39%, and 0.30%, respectively.

The Rise of 2021 BTC Dip Funding

On September 7, 2021, President Nayib Bukele disclosed that his authorities had acquired 200 BTC, leading to a complete of 2798 cash.

Shopping for the dip 😉

150 new cash added.#BitcoinDay #BTC🇸🇻

— Nayib Bukele (@nayibbukele) September 7, 2021

This announcement got here a day earlier than the approval of El Salvador’s Bitcoin Law, establishing cryptocurrency as authorized tender within the Central American nation.

The latest acquisition occurred in November 2022, when Bitcoin was priced at $27,780. This introduced the typical value of the amassed holdings to $42,440.

El Salvador has been making notable developments in Bitcoin adoption via innovation. Notably, a major milestone was achieved with the regulatory approval of Volcano Bonds from CNAD on December 12, 2023.

🚨BREAKING NEWS🚨

The Volcano Bond has simply acquired regulatory approval from the Digital Belongings Fee (CNAD).

We anticipate the bond can be issued through the first quarter of 2024.

That is just the start for brand spanking new capital markets on #Bitcoin in El Salvador.

🇸🇻🌋🚀

— The Bitcoin Workplace (@bitcoinofficesv) December 12, 2023

This marked a brand new period for capital markets in Bitcoin, because the bonds can be issued on the Bitfinex Securities Platform, a blockchain-based buying and selling platform for equities and bonds registered in El Salvador.