Because the spot Bitcoin exchange-traded fund (ETF) issuers filed functions for his or her revisions to disclose beforehand undisclosed payment constructions, the U.S. Securities and Trade Fee (SEC) has returned feedback.

The SEC’s critiques got here swiftly on the heels of the up to date payment disclosures, sparking hypothesis inside the crypto group a couple of potential delay within the extremely anticipated approvals of the Bitcoin ETFs.

🚨SPOT BITCOIN ETF UPDATE: The SEC simply issued further feedback on pending applicant’s S-1s. This can be a delay sign.🚫 #BitcoinETF #bitcoin

— Perianne (@PerianneDC) January 9, 2024

“SPOT BITCOIN ETF UPDATE: The SEC simply issued further feedback on pending applicant’s S-1s,” acknowledged Chamber of Digital Commerce CEO Perianne Boring in a social media publish. “This can be a delay sign.”

Will Bitcoin ETFs Get Delayed? Analysts Voice Disagreement

The publish quickly acquired over a million views and sparked insecurity of the crypto traders. Responding to the hypothesis, Bloomberg Intelligence ETF analyst James Seyffart shared his views concerning the SEC’s pending resolution.

“I don’t suppose that is essentially a delay sign,” stated Seyffart. “Actually this simply reveals how shortly the SEC is popping this stuff round.”

“Borderline unprecedented to ship over a doc to the SEC within the morning and get feedback again the identical day,” added Seyffart. “In the event that they wished to delay — the issuers wouldn’t have gotten feedback again tonight.”

Actually this simply reveals how shortly the SEC is popping this stuff round. Borderline unprecedented to ship over a doc to the SEC within the morning and get feedback again the identical day (I feel)

In the event that they wished to delay — the issuers would not have gotten feedback again tonight

— James Seyffart (@JSeyff) January 9, 2024

Extra importantly, because the submitted revisions are S-1 types, the SEC doesn’t have to approve them earlier than they approve 19b-4, the spot Bitcoin ETF utility types.

“S-1s don’t NEED to be full when 19b-4s are authorised,” defined finance lawyer Scott Johnsson. “Take futures ETFs in 2022. Hashdex didn’t even get preliminary feedback till after its 19b-4 was authorised.”

“Greater than something, these fast feedback exhibit SEC working to push the whole lot ahead for a fast approval and launch (vs what we noticed with futures),” concluded Johnsson.

Fox Enterprise journalist Eleanor Terrett additionally confirmed with sources that the SEC has no intention to vary the schedule, saying, “Simply spoke with a few individuals who acquired further feedback. They are saying they’re not frightened and the SEC hasn’t conveyed a change of plans.”

Simply spoke with a few individuals who acquired further feedback. They are saying they’re not frightened and the @SECGov hasn’t conveyed a change of plans.

My sense is that they’re pretty assured that is simply a part of the method to get the whole lot in earlier than January tenth. https://t.co/B9PvuHo6yX

— Eleanor Terrett (@EleanorTerrett) January 9, 2024

“My sense is that they’re pretty assured that is simply a part of the method to get the whole lot in earlier than Jan. 10,” stated Terrett.

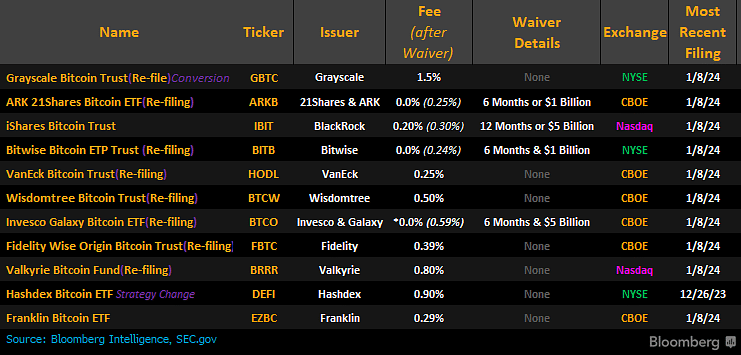

Issuers Unveil Charges in S-1 Varieties

Within the unveiled S-1 types, Bitcoin ETF fees differ considerably amongst issuers. Bitwise units a aggressive tone with a payment of 0.24%, whereas VanEck and ARK Make investments each edge barely increased at 0.25%. Invesco notably provides a payment waiver, lowering its payment from 0.59% to zero for the primary six months.

Grayscale stands out with the best payment of 1.5%. But Grayscale’s Bitcoin Belief (GBTC) demonstrated important trading volume near half a billion {dollars}, surpassing the vast majority of ETFs on Jan. 8.