This week marks a probably transformative second for cryptocurrency because the U.S. Securities and Change Fee (SEC) is anticipated to make a key resolution on the approval of several spot Bitcoin exchange-traded funds (ETFs).

The SEC’s resolution, due by Jan. 10, will decide the destiny of a number of Bitcoin ETF purposes, together with these from main monetary gamers equivalent to BlackRock and Constancy. The issuers would have till Monday morning to submit their remaining revisions.

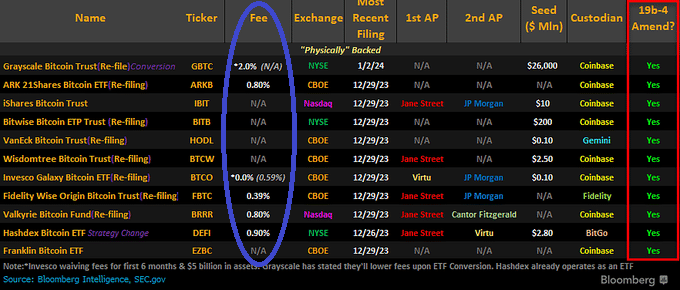

Spot Bitcoin ETFs on the Verge of SEC Approval

To provoke the buying and selling of a spot Bitcoin ETF, the SEC should first approve the 19b-4 filings supplied by the exchanges planning to record these ETFs. Subsequently, the regulator should additionally approve the S-1 registration purposes previous to the launch.

Because the SEC is anticipated to resolve on each the 19b-4 and S-1 filings, the Bitcoin ETFs could be listed and begin buying and selling on exchanges as quickly as the following enterprise day as soon as accepted, hypothetically Jan. 11. In accordance with Bloomberg Intelligence ETF analyst Eric Balchunas, the SEC has by no means voted on the choice.

“The SEC has by no means voted on bitcoin ETFs (spot denials or the futures approvals),” mentioned Balchunas in a social media submit. the purposes “have been denied or accepted by way of ‘Delegated Authority’ … which might make sense right here too since this has been a ‘tenth ground’ pushed initiative because the Grayscale win.”

Re the “however the SEC hasn’t voted” and the way that is some form of poss rug pull. Few issues, the SEC has by no means voted on bitcoin ETFs (spot denials or the futures approvals), they have been denied or accepted by way of “Delegated Authority” (see under from commish Peirce speech) which might make… pic.twitter.com/X8pzQchexj

— Eric Balchunas (@EricBalchunas) January 6, 2024

Even when there have been a vote, it’s unlikely for the SEC Chair Gary Gensler to vote no for 2 causes, “a) there’s no foundation to disclaim,” mentioned Balchunas. “And b) he’s actually the one who directed the Employees to place in hundreds of man hours to work w 11 issuers on 5-10 rounds of feedback.”

Awaiting Price Disclosures and Bitcoin Possession

The ETF Retailer President Nate Geraci shared what he will likely be watching this week concerning spot Bitcoin ETFs. And the very first thing that got here in thoughts is the pending disclosure of the unrevealed charges.

“Particularly from BlackRock & Grayscale. Can’t overstate significance of charges on this competitors,” mentioned Geraci, “Constancy present chief at 0.39%. Invesco at 0.59% (although waiving price for first 6mos).”

Balchunas additionally reinstated that when one invests in a spot Bitcoin ETF, they do personal the Bitcoin that has been deposited with the designated custodian.

“It’s true while you promote you may’t get btc again however nobody who would use an ETF desires btc back- they’d moderately have USD,” mentioned Balchunas in another post. “For the true believers who wish to personal btc instantly, you SHOULD.”