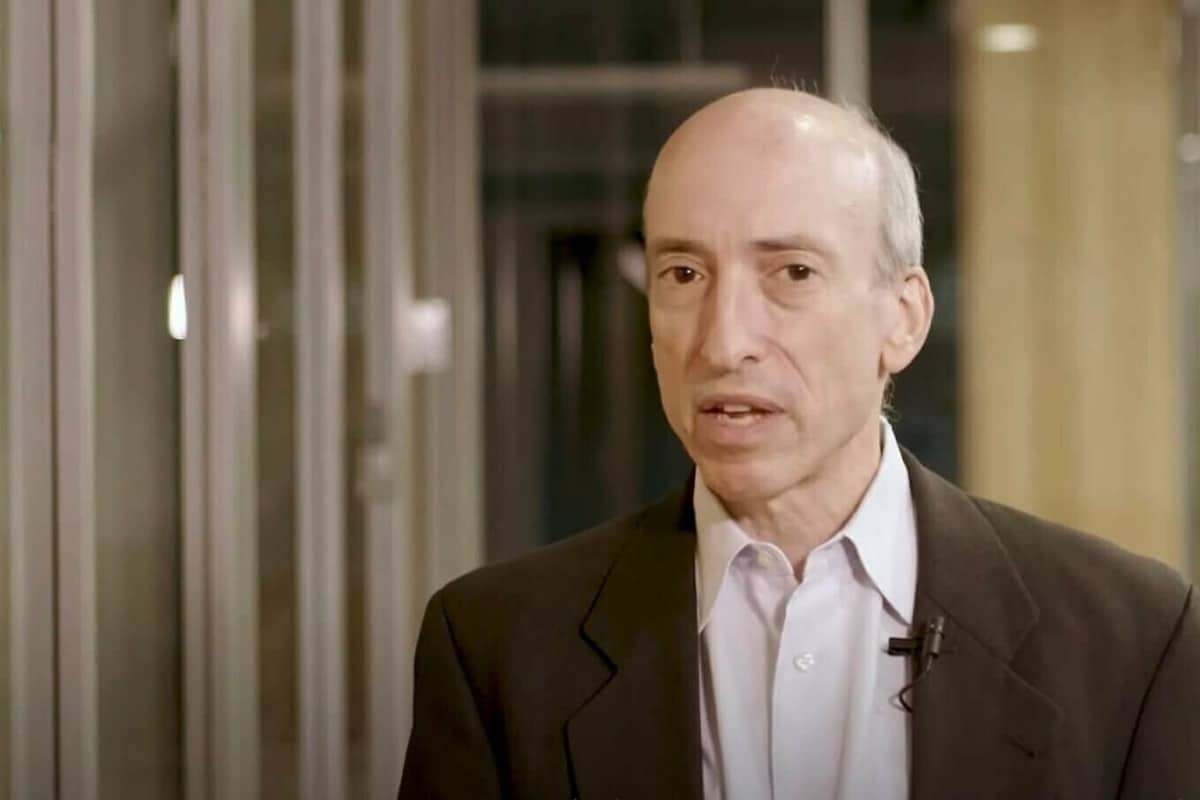

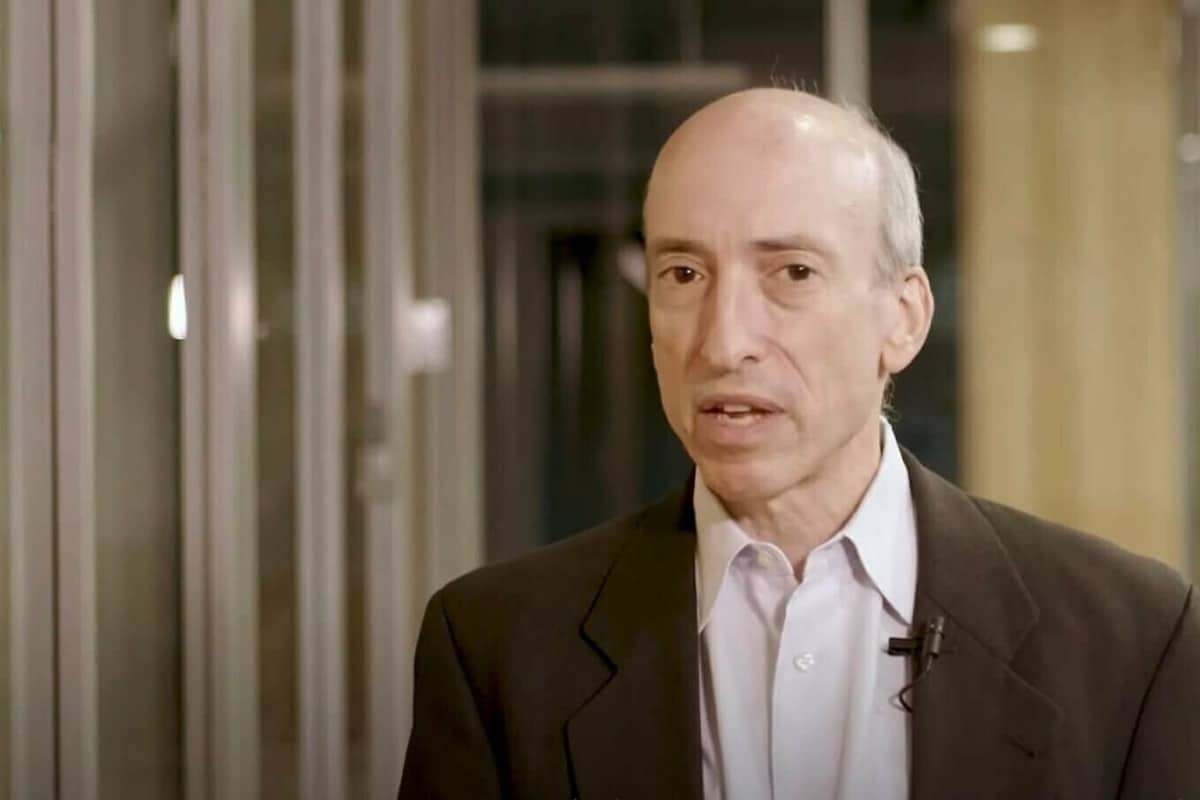

The US Securities and Alternate Fee (SEC) Chairman Gary Gensler has issued a warning for these contemplating investing in crypto belongings forward of potential Spot Bitcoin ETF approval.

A thread 🧵

Some issues to bear in mind in case you’re contemplating investing in crypto belongings:

— Gary Gensler (@GaryGensler) January 8, 2024

On January 8, Gary Gensler, the Chair of the U.S. SEC, issued a cautionary message to crypto traders through a thread on the social media platform X (previously Twitter). Whereas not explicitly mentioning a spot Bitcoin ETF, Gensler urged crypto traders to contemplate sure components.

Gensler highlighted that asset managers providing crypto funding automobiles “will not be complying” with federal securities legal guidelines. He emphasised the distinctive threat and volatility related to cryptocurrencies, cautioning traders that they may lack key info and necessary protections when investing in crypto asset securities. Gensler identified situations of main platforms and crypto belongings turning into bancrupt or shedding worth, emphasizing the continuing important dangers of crypto investments.

3⃣Fraudsters proceed to take advantage of the rising recognition of crypto belongings to lure retail traders into scams. These investments proceed to be replete w/ fraud- bogus coin choices, Ponzi & pyramid schemes, & outright theft the place a mission promoter disappears w/ traders’ cash.

— Gary Gensler (@GaryGensler) January 8, 2024

The SEC Chair warned traders in regards to the prevalence of fraud within the crypto house, the place fraudsters exploit the rising recognition of crypto belongings to deceive retail traders by scams reminiscent of bogus coin choices, Ponzi and pyramid schemes, and outright theft. Gensler urged traders to stay vigilant to keep away from falling sufferer to fraudulent actions.

Whereas Gensler didn’t present express hints in regards to the SEC’s stance on the spot Bitcoin ETF, some observers view his feedback as a closing assertion earlier than the company makes choices on ETF purposes approaching key deadlines. Approval of totally regulated spot ETFs may facilitate simpler buying and selling of digital belongings for a broader vary of traders, potentially leading to significant inflows into the crypto business.

The SEC, beneath Gensler’s management, has been actively addressing the compliance of cryptocurrency companies with securities legal guidelines. Authorized battles over the SEC’s regulatory strategy have yielded blended outcomes, with some judges discovering the company on the fallacious facet of arguments. Nevertheless, the SEC has additionally secured victories, together with a recent ruling in the Terraform Labs case, affirming the regulator’s stance on the improper promotion of unregistered crypto securities by the corporate.

SEC Anticipated to Resolve on Spot Bitcoin ETF Purposes Amid Rising Anticipation

The assertion comes amid expectations {that a} Spot Bitcoin ETF may obtain its first approval in the USA this week. Bloomberg has not too long ago upgraded its projection, now anticipating a 95% chance of approval.

A decision is widely anticipated in the coming days, significantly because of the January 10 deadline for the SEC to answer the primary software within the latest wave, submitted by ARK Funding and 21Shares.

Numerous well-known corporations, together with Valkyrie, WisdomTree, BlackRock, VanEck, Invesco, Galaxy, Grayscale, Constancy, Bitwise, and Franklin Templeton, have additionally submitted their applications for spot Bitcoin ETFs. The SEC’s resolution on these purposes stays unsure, and it’s unclear whether or not they are going to be authorised concurrently or individually.

With exchanges, together with Nasdaq, NYSE, and Cboe, submitting amended 19b-4 forms on Friday, the SEC is now ready to make choices. If these types are authorised, buying and selling can start as soon as the parallel technique of S-1 types turning into “efficient” is accomplished.

Nevertheless, analysts observe that the SEC holds broad authority within the course of and will doubtlessly contemplate delaying a choice once more. Criticism has been directed at Chairman Gensler because of the SEC’s delay in approving a spot crypto ETF regardless of a number of purposes from asset managers spanning a number of years.

SEC Chair Gary Gensler didn’t present any clear indication of his stance in his latest feedback, which align with previous warnings he has issued to crypto traders. In August, a federal choose instructed the SEC to reevaluate a spot BTC ETF software from Grayscale, asserting that the fee’s denial of the funding automobile was “arbitrary and capricious.”

In late November, Gensler kept away from preemptively expressing views on the continuing evaluate course of for spot Bitcoin ETFs, emphasizing the company’s “time-tested” evaluate course of.

The SEC retains the choice to disclaim purposes, though it might seemingly require totally different causes than these beforehand cited for denying different ETFs.