The Bitcoin (BTC) worth simply vaulted above $47,000 for the primary time since April 2022 as FOMO is available in forward of the anticipated approval of spot Bitcoin ETFs by the US SEC later within the week.

Bitcoin is up 7% on the day, taking its positive aspects for the reason that begin of the 12 months to 11%.

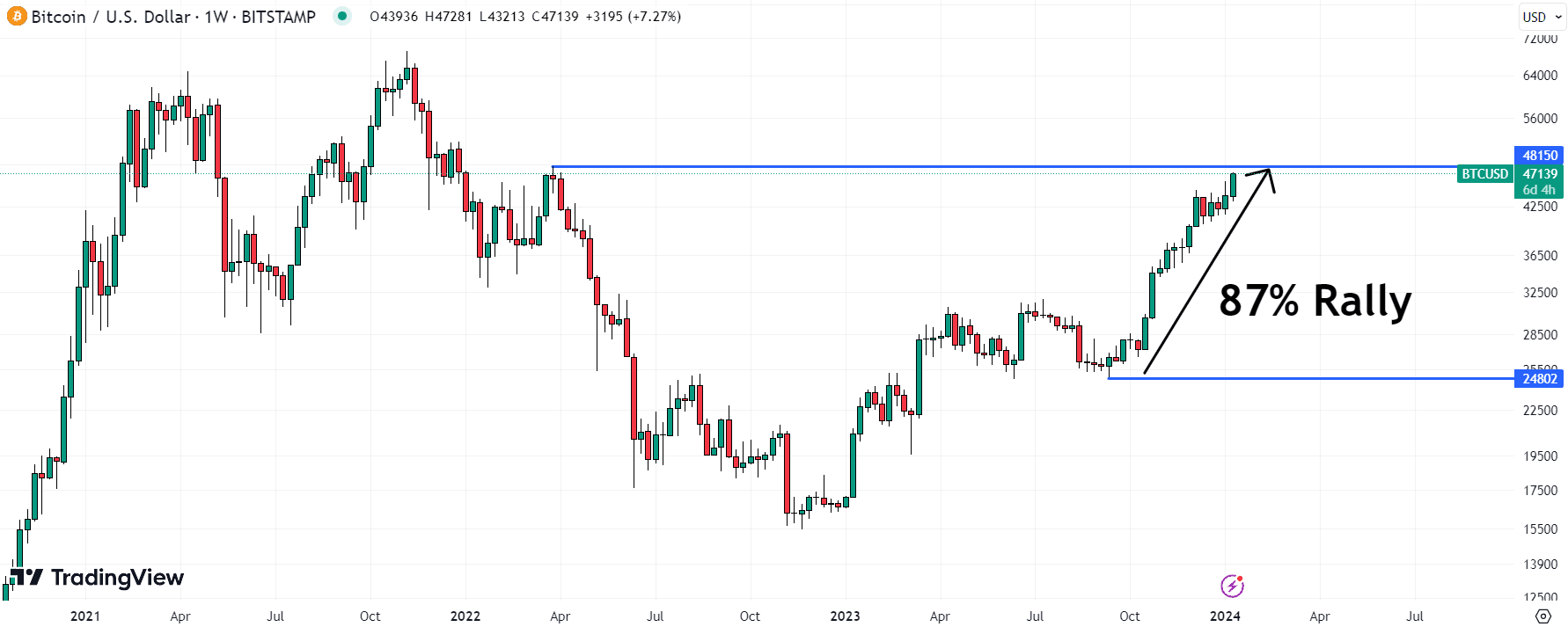

Which means the Bitcoin (BTC) price is now up a staggering 87% from its September 2023 lows at $25,000.

The consensus expectation amongst market individuals is that the SEC will approve multiple spot Bitcoin ETFs by Wednesday.

⚠️ Wanting like Weds now for Bitcoin etf descion, anticipated to be authorised – Kate Rooney on CNBC

— *Walter Bloomberg (@DeItaone) January 8, 2024

Spot Bitcoin ETF Approval Rising FOMO

Numerous US spot Bitcoin ETF candidates together with BlackRock, Grayscale and Constancy up to date their filings as soon as once more on Monday.

Furthermore, varied candidates additionally revealed the charges they plan to cost ETF traders.

The #Bitcoin ETF Charges:

Grayscale: 1.50%

Hashdex: 0.90%

Valkyrie: 0.80%

Invesco Galaxy: 0.59%

Wisdomtree: 0.50%

Constancy: 0.39%

Blackrock: 0.30%

Franklin: 0.29%

Ark: 0.25%

VanEck: 0.25%

Bitwise: 0.24%#BitcoinETF #BitcoinETFs— LondonCryptoClub (@LDNCryptoClub) January 8, 2024

These headlines have clearly helped pump concern of lacking out (FOMO) of potential Bitcoin worth upside amongst market individuals.

Most crypto market analysts, traders and observers view the long-awaited approval of spot Bitcoin ETFs within the US as prone to be a historic second for the Bitcoin market.

The approval of spot Bitcoin ETFs shall be interpreted as a regulatory thumbs up from regulators on this planet’s largest financial system.

This may increase BTC’s legitimacy, easing skepticism that has lengthy saved many traders away from the crypto market.

Spot Bitcoin ETFs may also be simple for conventional traders to spend money on.

Moderately than needing to open an account at a crypto alternate, and perceive web3 nuances akin to the way to use wallets, traders will be capable of purchase the ETF straight with their current brokers.

All mentioned, spot Bitcoin ETFs within the US are anticipated to draw vital demand, bringing a wave of contemporary capital into the crypto area.

The belief is that this can present vital help to the Bitcoin (BTC) worth within the years forward.

As per extensively adopted crypto investor Mike Alfred by way of a tweet on X, Normal Chartered simply projected $50-100 billion of spot Bitcoin ETF inflows this 12 months.

Additionally they challenge that the BTC worth might hit $200,000 by the top of 2025.

Normal Chartered simply put out a word saying that we might see $50-100B of spot Bitcoin ETF inflows in 2024 and a BTC worth of $200,000 by the top of 2025. This can be a large conventional financial institution, people. The entire world is about to get up on this.

— Mike Alfred (@mikealfred) January 8, 2024

That’s why merchants have been aggressively shopping for BTC on Monday; to front-run this anticipated wave of recent demand.

The place Subsequent for the Bitcoin (BTC) Value?

Bitcoin’s newest leg larger has seen the worth pop to the north of a short-term upward development channel.

This opens the door for an acceleration of near-term positive aspects in direction of the 2022 highs round $48,500.

Assuming spot Bitcoin ETFs do get the inexperienced mild, the chance of testing the 2022 excessive is robust.

A surge in direction of the important thing psychological $50,000 stage can be on the playing cards, although profit-taking is prone to maintain buying and selling situations extremely uneven.

Many analysts have been warning that the Bitcoin (BTC) market may see a sell-the-fact response to identify ETF approvals.

That is the place traders determine to promote as a way to e-book income following the affirmation of a constructive market catalyst.

Merchants shouldn’t be stunned to see BTC swing anyplace between $40,000-$50,000 within the days and weeks forward.

However in the long run, Bitcoin (BTC) worth dangers are closely tilted in direction of additional upside.

That’s as a result of the worth is prone to additionally profit from tailwinds like a Fed cutting cycle and the traditionally bullish Bitcoin issuance rate halving in 2024, at a time when institutional adoption within the US can be about to leap ahead due to the brand new ETFs.

we’re actually going to have Bitcoin spot ETF’s and a Bitcoin halving inside a couple of months of one another

the 2024 script be loopy

— RookieXBT 🧲 (@RookieXBT) January 8, 2024

On a aspect word, if the slim chance that the SEC decides to reject spot Bitcoin ETF applications this week – a transfer many have equated to the company going to struggle towards the crypto business – BTC might rapidly flush again into the $30,000s.