With main technical developments and their costs hitting report ranges, Celestia, Aptos, and Osmosis are seeing rising investor curiosity, driving the cryptocurrencies into the highlight as among the finest cryptos to purchase right this moment.

Celestia’s TIA worth continues surging to new all-time highs, whereas Aptos braces for its main token unlock occasion.

Moreover, the Osmosis worth jumped almost 40% yesterday, seemingly fueled by excessive buying and selling quantity and engaging staking rewards for OSMO holders.

In the meantime, Sponge V2 and the newly launched TG.On line casino are positioning themselves as potential Bitcoin options worthy of investor consideration and positioning themselves as among the high presale cryptos to purchase right this moment.

Greatest Crypto to Purchase Immediately within the Information

Celestia’s native cryptocurrency TIA has seen spectacular development since its launch in October. The token’s worth has elevated over 700% from its preliminary worth under $2. Simply yesterday, the TIA worth noticed a spike of almost 30%.

$tia gang on high.

New airdrops introduced.

All time excessive right this moment.

Life’s good. pic.twitter.com/qXR21nmWsa

— Learn2Earn (@Learn2Earnify) January 5, 2024

The momentum has continued over the previous week with a 33% surge that drove the token to achieve a brand new all-time excessive of $17.2987 earlier right this moment.

After pushing previous the $15 mark, the token has captured heightened curiosity. Whereas technical indicators sign room for development, a quick correction may happen earlier than additional ascent.

In the meantime, Aptos has captured market consideration with its upcoming token unlocks on January 12. The mission will launch 24.84 million APT tokens, making up 8.08% of the present circulating provide and valued at round $234.76 million.

These unlocks have led to cost volatility with earlier releases in late 2023. As such, the market will carefully watch this impending provide injection of almost 25 million tokens, which may influence buying and selling habits and sentiment round Aptos within the quick time period.

With the community approaching this main token unlock occasion, contributors are bracing for potential results on the token’s worth and stability.

Osmosis’s token, OSMO, has additionally gained consideration because it has seen its worth soar to its highest for the reason that earlier 12 months, marking over a 650% improve since its 2023 low. The value motion aligns with key technical indicators, and present tendencies level in the direction of a goal of $2.50.

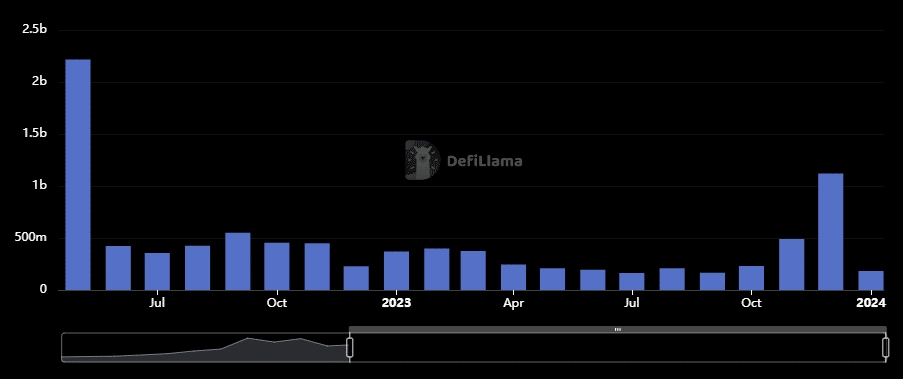

The Osmosis DEX has witnessed elevated utilization as effectively, with December 2023’s buying and selling quantity crossing $1 billion for the primary time in a number of months. The TVL has also shown notable growth.

Whereas the RSI presents a impartial stance, a bearish divergence hints at a potential pattern shift.

Amidst these trending cryptocurrencies, early-stage initiatives like Sponge V2 and TG.On line casino have gotten focal factors for development potential within the cryptocurrency market.

Because the crypto market gears up for elevated volatility, Celestia, Aptos, Osmosis, Sponge V2, and TG.On line casino are on the high of watchlists for merchants looking for the very best crypto to purchase right this moment.

TIA Value Breaks Out of Consolidation, Eyes Psychological Resistance at $20

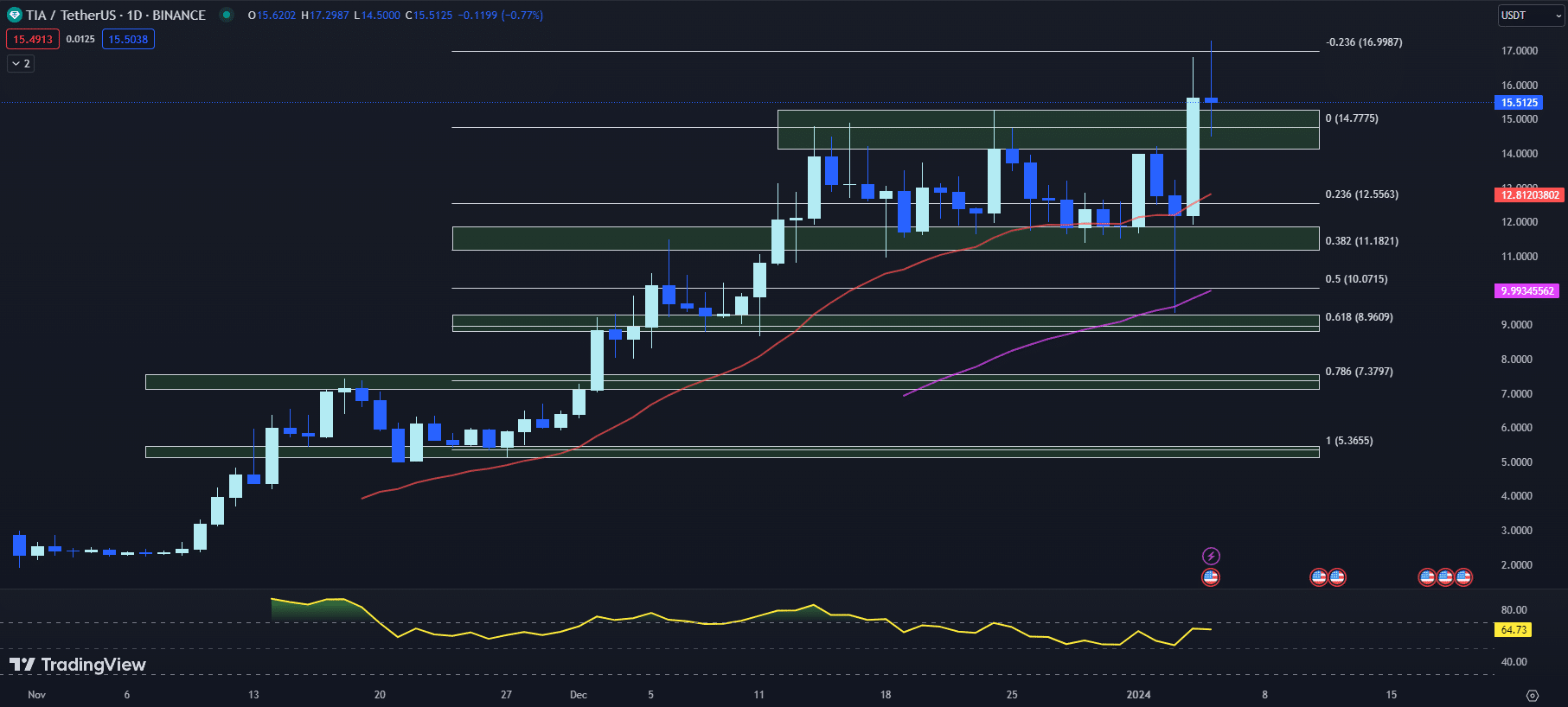

The TIA worth has seen substantial upside, with the cryptocurrency gaining over 28% yesterday to interrupt out of a 3-week consolidation interval and hit a brand new all-time excessive of $17.2987 earlier right this moment.

Nevertheless, TIA has since pulled again from its peak and at present trades at $15.5125, down 0.77% to date right this moment. Because the TIA worth continues testing key help ranges, technical indicators supply blended views on the place this nascent uptrend might go subsequent.

The 20-day EMA for TIA stands at $15.5125 whereas the 50-day EMA is at $12.8120. The bullish alignment between these quick and long-term shifting averages has been intact for weeks now, affirming sustained upside momentum within the cryptocurrency.

Nevertheless, TIA’s failure to carry above the psychologically necessary $16 degree has put its breakout in query.

The RSI for TIA has moderated from yesterday’s 65.39 to 64.73, coming off overbought territory. This means purchaser exhaustion at present ranges, although values above 50 nonetheless signify total bullish management.

The MACD histogram has turned optimistic at 0.0521, a reversal from yesterday’s -0.0643 studying. This highlights enhancing short-term momentum that might gasoline a retest of TIA’s report excessive.

With TIA’s market capitalization extending above $850 million, 24-hour buying and selling volumes have spiked to $38 million. This elevated investor participation underscores TIA’s breakout credibility. Nevertheless, failure to take out resistance may result in a pointy pullback.

On the upside, TIA faces instant resistance at its all-time excessive of $17.2987, which aligns with the Fib 0.236 degree at $16.9987. Acceptance above this space is required to open the door to psychological resistance at $20.

On the draw back, the TIA worth is at present retesting help at $14.1337 to $15.2658, the earlier swing excessive zone. Notably, the 20-day EMA and Fib 0.382 degree converge at $15.1250 so as to add to help. If this space fails to carry, TIA may rapidly drop in the direction of the 50-day EMA round $12.80.

With Celestia consolidating under report highs, its short-term outlook stays bullish however warning is warranted. A break above $17 resistance would affirm the uptrend, whereas a drop underneath $15 help may result in a deeper correction.

Merchants might look to purchase dips given strong technicals, however outlined threat practices are key amid volatility.

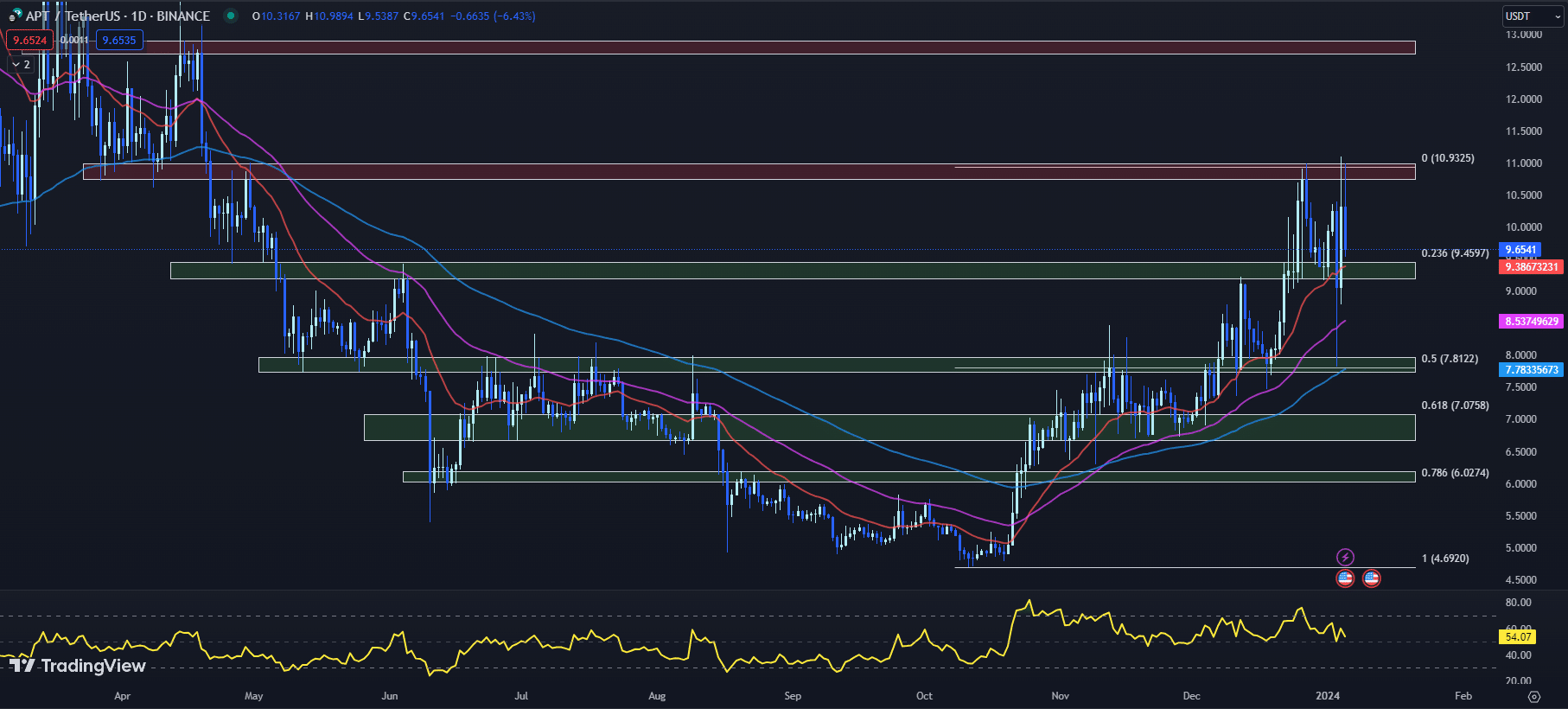

APT Value Struggles to Maintain $10 Stage: Indecision Looms

The APT worth stays caught in a spread, with the cryptocurrency shedding 6.43% right this moment to $9.6542. This comes even after a 13.91% surge yesterday, highlighting APT’s directionless buying and selling.

With technical indicators blended, the market awaits a possible catalyst from APTOS’ upcoming token unlock event.

With its uneven worth motion, the 20-day EMA for APT stands at $9.3867 whereas the 50-day EMA resides at $8.5375. Whereas the bullish EMA alignment stays intact, APT has struggled to carry the $10 degree amid its tight buying and selling vary. This alerts constructing indecision that might foreshadow a bigger transfer.

The RSI for APT has pulled again from yesterday’s overbought studying of 60.15 to 54.07 right this moment. Whereas nonetheless in bullish territory above 50, the moderation highlights fading upside momentum at present ranges.

The MACD histogram has turned damaging at -0.0442, a deterioration from -0.0201 beforehand. This displays a rising bearish momentum that might push APT to retest vary help.

With its market capitalization at $2.9 billion, 24-hour buying and selling volumes for APT have declined 6.72% to $535 million. Waning curiosity throughout this era of directionless worth motion poses a draw back threat. A decisive breakout or breakdown from its vary is required to spur renewed dedication from buyers.

On the upside, APT faces instant resistance at $10.7452 to $10.9668, the higher boundary of its two-week buying and selling vary. Acceptance above this space is required to open the trail to psychological resistance at $12.

To the draw back, preliminary help lies at $9.1925 to $9.4571, with the 20-day EMA and Fib 0.236 degree converging at $9.4597. Failure to carry this space may see APT rapidly drop in the direction of the 50-day EMA at $8.50. A break under would sign the top of its uptrend.

With APTOS buying and selling sideways forward of its unlocking, its near-term outlook is impartial leaning bearish. An in depth under $9 help would affirm draw back strain, whereas a rally via $11 resistance is required to reinvigorate bullish momentum.

Warning is warranted amid the uncertainty, with outlined threat practices important.

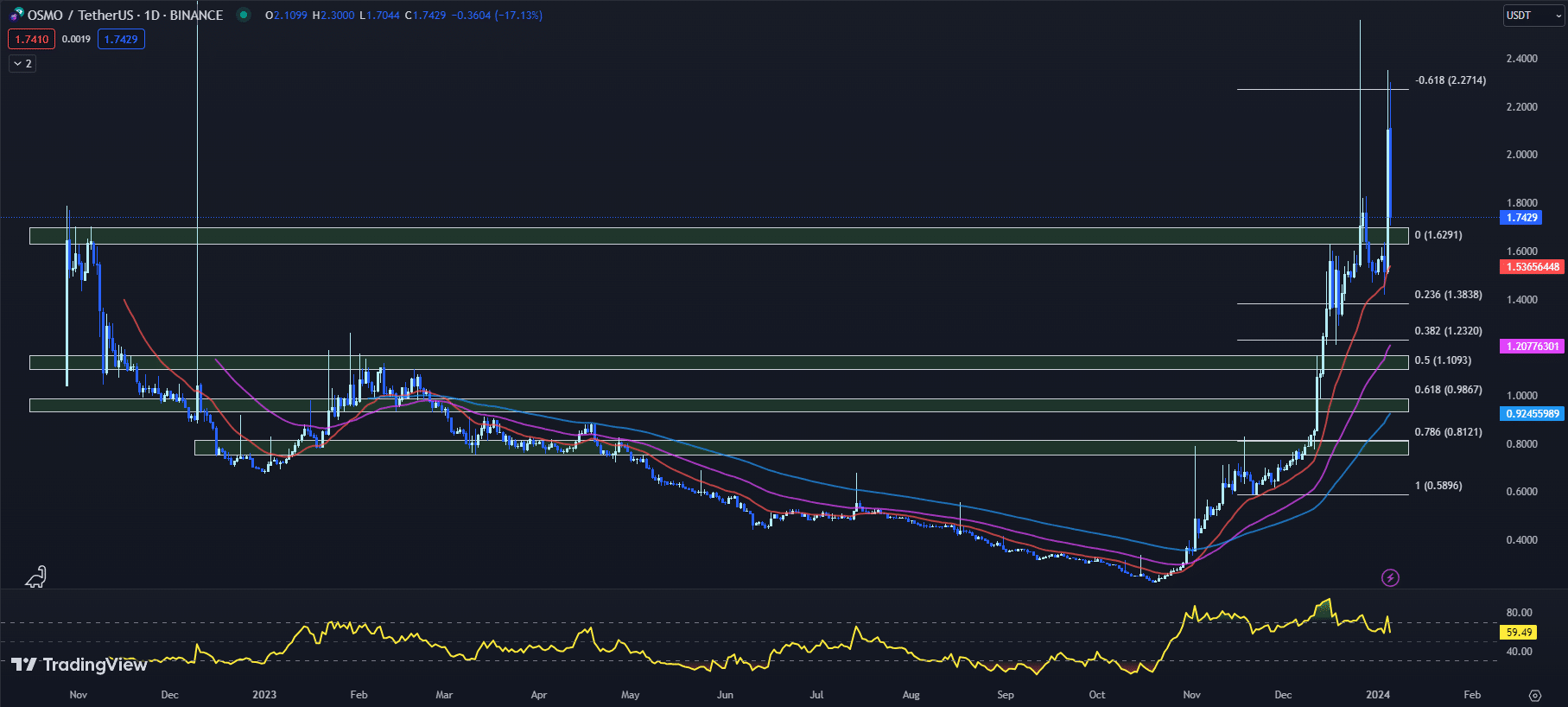

OSMO Value Outlook Weakens: Pullback Challenges Latest Breakout

After surging almost 40% yesterday, the OSMO worth has pulled again sharply, with the cryptocurrency dropping 17.13% to date right this moment to $1.7429. As OSMO retraces from its latest highs, key technical indicators are flashing warning across the sustainability of this nascent uptrend.

The 20-day EMA for OSMO stands at $1.5366, whereas the 50-day EMA resides at $1.2078. Regardless of the bullish alignment between these quick and long-term shifting averages, OSMO has been unable to carry above the $2 degree. This highlights potential exhaustion after its parabolic advance.

The RSI indicator has plunged from yesterday’s overbought studying of 75.78 right down to 59.49 right this moment. Whereas nonetheless in bullish territory, this sharp comedown suggests waning upside momentum within the OSMO worth.

In the meantime, the MACD histogram has turned damaging at -0.0027, unable to carry its bullish crossover. This factors to constructing downward strain.

On the upside, OSMO faces instant resistance on the prolonged Fib -0.618 degree round $2.2714. Acceptance above this space is required to verify bullish continuation.

On the draw back, preliminary help lies between $1.6284 and $1.6993, a earlier space of provide turned help. Notably, the 20-day EMA is approaching this zone at round $1.5366.

Failure to carry may see OSMO goal the 50-day EMA close to $1.20 subsequent.

With its sharp pullback right this moment, Osmosis’ near-term outlook has weakened regardless of the latest breakout. A each day shut under the $1.60 space would elevate purple flags and shift the bias decrease.

Alternatively, a transfer above the $2.25 resistance would put OSMO again on monitor.

Whereas the worth motion, indicators, and outlooks for TIA, APT, and OSMO dominate short-term discussions, the lengthy view shifts to budding cryptos like Sponge V2 and TG.On line casino’s $TGC.

Early-bird buyers stand to realize handsomely ought to these initiatives obtain their bold visions.

Diversifying with Bitcoin Options: Tapping Into Ignored Crypto Alternatives

As we embark on 2024, the crypto market panorama is present process a significant shift. Traders who beforehand invested solely in Bitcoin are starting to discover past it and diversify into different cryptocurrencies.

This transformation highlights buyers’ eagerness to faucet into crypto initiatives nonetheless of their early phases, enticed by their potential for development. Relatively than simply diversifying, buyers are eager to capitalize on the enthralling prospects these growing cryptocurrencies current.

Amongst these choices, Sponge V2 stands out as an thrilling Bitcoin different quickly gaining traction. As an enhanced model of the unique Sponge meme coin, it appeals via its lively involvement within the meme coin house and distinct community-driven presence.

Equally engaging is the newly launched $TGC token by TG.On line casino, the world’s first totally licensed on line casino on Telegram.

The debut of $TGC on DEX platforms signifies a notable development for the blockchain-based playing platform.

All through 2024, the hunt amongst buyers for the very best crypto to purchase right this moment is intensifying, as they rigorously consider the long-term prospects and potential returns of those Bitcoin options.

With the rise of numerous new choices like Sponge V2 and TG.On line casino, the crypto market is unveiling a wealth of promising funding avenues past Bitcoin.

For buyers seeking to increase their horizons, these pioneering cryptocurrency projects present compelling opportunities worth exploring.

Sponge V2 Token Presale ($SPONGEV2): Bridging From Sponge V1 and Gaining Momentum — Is It the Greatest Crypto to Purchase Immediately?

The builders behind the favored meme coin Sponge V1 ($SPONGE) have introduced a presale occasion for the upcoming Sponge V2 ($SPONGEV2).

This comes after Sponge V1 gained notable traction final 12 months, rising to a peak market capitalization of $100 million in Might 2023.

Based on the Sponge V2 web site, the brand new token intends to construct on the unique’s success by introducing staking rewards and a play-to-earn recreation.

Sponge V1 holders will have the ability to stake their tokens to obtain Sponge V2 tokens when it launches.

The group says staked Sponge V1 tokens will likely be locked completely in alternate for passive rewards in Sponge V2 over 4 years, beginning with a minimal APY of 40%.

The play-to-earn recreation will enable customers to earn further Sponge V2 tokens by taking part in. Each free and paid variations will likely be out there.

Sponge V2’s tokenomics allocate 8% to play-to-earn rewards, 43.09% to staking rewards, and 26.93% to bridging from Sponge V1.

Sponge V2’s presale is at present open to contributors, with more details available on the meme coin’s website.

As with all cryptocurrency funding, consultants advise researching completely and solely allocating disposable revenue.

The Way forward for On-line Playing: $TGC is the Greatest Crypto to Purchase Immediately for Playing Lovers

TG.On line casino, a licensed on-line on line casino on the favored messaging platform Telegram, not too long ago concluded a profitable presale for its native $TGC token.

The presale allowed early buyers to amass $TGC at a reduced $0.16 worth forward of the general public itemizing.

The presale hit its $5 million fundraising goal amid robust curiosity within the promising crypto-gambling project.

TG.On line casino moved swiftly, with $TGC already listed on CoinMarketCap shortly after concluding the presale.

$TGC debuted on the decentralized alternate Uniswap earlier right this moment, opening at $0.1886.

TG On line casino Newest Numbers 🧮

🎰 Gamers: TG On line casino has greater than 3500 gamers, a quantity any considered one of us might be pleased with!

💰 Deposits: One other beautiful milestone! Our gamers’ collective deposits have now crossed the $8million mark!

🌟 Wagering: Over the previous few months and… pic.twitter.com/UwoRsZHqzQ

— TG On line casino (@TGCasino_) January 4, 2024

Within the first 20 minutes of buying and selling, the worth quickly elevated over 50% to $0.28 as buying and selling volumes exceeded $3 million.

The surge highlights the optimistic sentiment surrounding the TG.On line casino platform. $TGC affords utility advantages like staking rewards and on line casino cashback.

In the meantime, TG.On line casino’s income present ongoing funding for $TGC buybacks and burns.

These dynamics have attracted dealer consideration, with many viewing $TGC as a possible breakout amongst playing tokens and probably the most effective cryptos to purchase right this moment.

The crypto playing house total has seen immense enlargement not too long ago, with main tokens like RLB and FUN delivering triple-digit beneficial properties in 2023.

As an early chief in Telegram-based crypto playing, TG.On line casino is ready to experience the surging interest in online casinos.

With plans to develop its options and consumer base, 2024 may show a pivotal 12 months because the platform establishes itself.

The profitable $TGC presale and itemizing have kicked off an thrilling new chapter for TG.On line casino.

Traders are desperate to see if $TGC can comply with the success of high playing tokens reminiscent of TG.On line casino cements itself as a premier vacation spot for crypto gaming.

Disclaimer: Crypto is a high-risk asset class. This text is offered for informational functions and doesn’t represent funding recommendation. You might lose your whole capital.