A small-cap altcoin often called Tellor (TRB) skilled a 150% surge to a brand new all-time excessive above $600, solely to witness a crash that erased all of the good points inside simply hours on December 31, sparking suspicions of worth manipulation.

Citing blockchain data from Etherscan, the on-chain analysts behind the X account Lookonchain mentioned the Tellor staff transferred 4,211 TRB, valued at roughly $2.4 million throughout the surge, to a pockets labelled as belonging to Coinbase at round 8:41 pm UTC.

The timing aligned nearly completely with the excessive throughout the worth pump, including to suspicions of market manipulation.

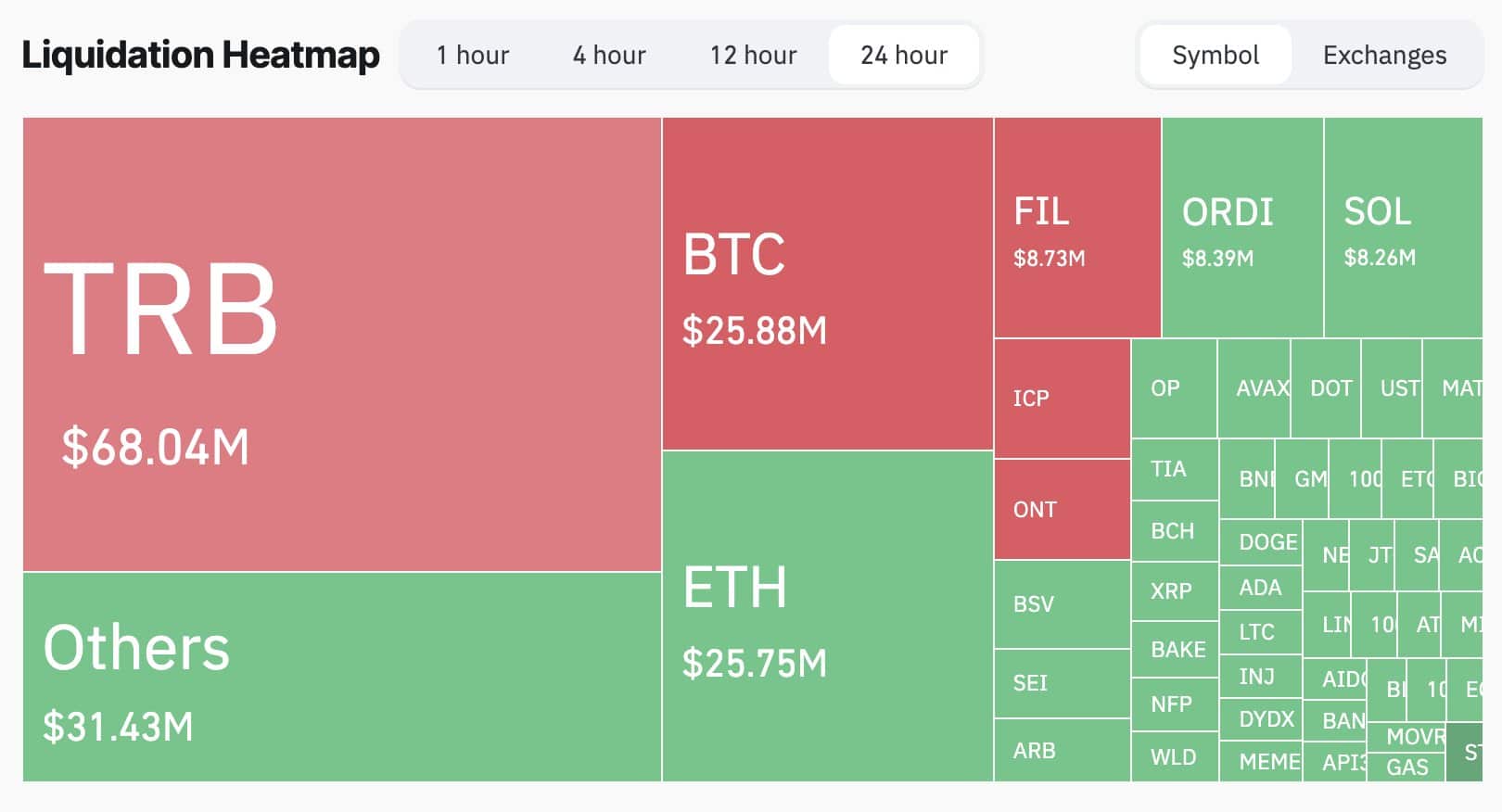

Previously 24 hours, $TRB soared to $600 after which plummeted to $137, inflicting $68M of property to be liquidated, making it essentially the most liquidated token.

We seen that the #Tellor staff deposited 4,211 $TRB($2.4M) after the worth of $TRB skyrocketed.

Handle:https://t.co/efHPXCiMiG pic.twitter.com/IBty2Wf2gI

— Lookonchain (@lookonchain) January 1, 2024

The sudden drop in Tellor’s worth resulted in over $68 million in liquidations, in accordance with CoinGlass knowledge cited by Lookonchain on January 1.

Concentrated TRB provide

On-chain analytics agency Spot on Chain additionally famous on X that 26% of the circulating provide of TRB was held by simply 20 massive wallets.

In response to the agency, these wallets gathered the token at a worth of round $15, and the worth has since then risen by round 15x.

“Over the previous two months, the whales have slowly deposited their tokens onto exchanges, making a pump-and-dump cycle to liquidate their holdings,” the publish added.

🚨🚨 $TRB reached its all-time excessive at this time at $225, however what’s subsequent?

Present state of affairs:

➡️ Among the many 2.5M $TRB in circulation, about 1.7M is on exchanges, and 660K is held by a bunch of 20 whales (which is ~95% of the tokens).

➡️ The group of whales gathered these tokens in… pic.twitter.com/kWbZGxEqcv

— Spot On Chain (@spotonchain) December 29, 2023

Synthetix customers face losses

In response to blockchain protocol Synthetix founder Kain Warwick, the massive worth strikes in TRB led to round $2 million in losses for holders of his protocol’s native SNX token.

The losses had been because of the sudden change in open curiosity and worth of the TRB token which was not correctly mirrored in Synthetix’s decentralized derivatives markets.

“A number of quick positions had been opened as the worth spiked at this time and with the dislocation of spot and perp costs there was no [arbitrage] to steadiness it,” Warwick wrote.

What occurred? TRB had a 250k USD open curiosity cap that ballooned to 12.5m as the worth ran up the previous few months. This could have been adjusted again down, however threat controls had been lax, there was diffusion of duty. The Spartan Council is liable for params although.

— kain.eth (@kaiynne) January 1, 2024

Tellor is a decentralized oracle protocol, and TRB serves because the protocol’s utility and governance token.

TRB is traded on a number of main exchanges, together with Binance, OKX and Coinbase, with Binance liable for near half of the buying and selling quantity within the half 24 hours.

The staff behind Tellor has to date not issued any statements relating to the weird worth actions in TRB.