In a outstanding shift, Bitcoin has surged to $45,316, marking a 7.06% improve on Tuesday. This breakthrough above $45K comes at a vital time, simply forward of a possible ETF approval that would considerably affect its market trajectory.

Amidst these developments, ChatGPT sheds gentle on the function of synthetic intelligence in forecasting Bitcoin’s ascent to a staggering $100,000 by 2024.

In the meantime, political components corresponding to Donald Trump’s potential loss within the upcoming presidential election are purported to set off a inventory market crash and probably usher in a brand new Nice Despair.

Bitcoin Breaks $45K Barrier Forward of Anticipated ETF Approval

Bitcoin (BTC) has reached above $45,000 for the primary time in over two years, and the value is anticipated to rise additional with the upcoming approval of the primary spot Bitcoin exchange-traded fund (ETF) in the USA.

The cryptocurrency’s worth has now surpassed all 2023 highs, establishing a major new yearly peak simply two days into 2024, after rising greater than 6% within the final 24 hours and 170% within the final yr. The market is ready for the SEC’s verdict on 14 pending purposes for a spot Bitcoin ETF.

Bitcoin’s newest value spike has sparked controversy amongst market observers, because it was final seen above $45,000 practically 20 months in the past in April 2022.

Whereas some anticipate a possible “bull pennant” formation resulting in a $54,000 achieve upon SEC approval, others, corresponding to VanEck advisor Gabor Gurbacs, anticipate an preliminary drop however monumental trillions in inflows sooner or later years.

ChatGPT Foresees AI’s Position in Bitcoin’s Potential Rise to $100K

The most recent incarnation of the AI chatbot, ChatGPT-4, means that Bitcoin’s value may attain $100,000 in 2024 below sure favorable circumstances, citing variables corresponding to optimistic legislative developments, rising acceptance, and foreign money depreciation.

Whereas it’s thought of extremely speculative, ChatGPT exhibits the doable optimistic affect of a spot Bitcoin exchange-traded fund (ETF) approval, which might improve accessibility and liquidity whereas probably drawing institutional buyers.

“ChatGPT’s obtained a idea 🤖💡! Bitcoin may skyrocket to $100k by 2024. Might the magic of #AI assist #Bitcoin take this large leap? Let’s delve into it 👉https://t.co/ltzTMY6aFX. What are your ideas on this thrilling prediction, people? #Cryptocurrency“

— Aitor (@Ozpaniard) January 1, 2024

ChatGPT emphasizes AI’s involvement in market evaluation, buying and selling strategies, and bigger blockchain tech enhancements in response to how AI may contribute to this state of affairs.

AI algorithms, that are able to digesting large quantities of market knowledge and recognizing developments, can allow quicker and extra environment friendly buying and selling execution, however in addition they warn of potential threats like as hacking and cyberattacks.

The findings of ChatGPT level to a doable uptick in Bitcoin values, owing to AI’s affect on market dynamics and buying and selling strategies.

Trump’s Election Loss Might Sign Inventory Market Crash, Warns AI

Former US President Donald Trump has offered a dire warning in regards to the American economic system, forecasting a inventory market crash worse than 1929 and a Nice Despair if he doesn’t win the presidential election.

Trump attacked the present state of the economic system, crediting its survival to his administration’s accomplishments. He claimed that the inventory market’s sturdy valuation is as a result of expectation of his election victory in 2024.

Donald Trump Warns of Inventory Market Crash and Nice Despair if He Does not Win Presidential Election

— Bradicoin (@Bradicoin10) January 2, 2024

Whereas official Bureau of Labor Statistics numbers present a 17% improve in costs since President Joe Biden entered workplace, Trump claims inflation has exceeded 30% within the final three years.

MORE: “If I do not win, it’s my prediction that we are going to have a inventory market ‘crash’ worse than that of 1929 – a Nice Despair!!!” Trump wrote Friday evening on Reality Social. “Make America Nice Once more!” https://t.co/UYey17LQrW

— NEWSMAX (@NEWSMAX) December 30, 2023

The affect of Trump’s warnings on Bitcoin costs stays theoretical, however historic proof means that his re-election may spark a optimistic response within the cryptocurrency market, with Bitcoin expectations reaching all-time highs.

Bitcoin Value Prediction

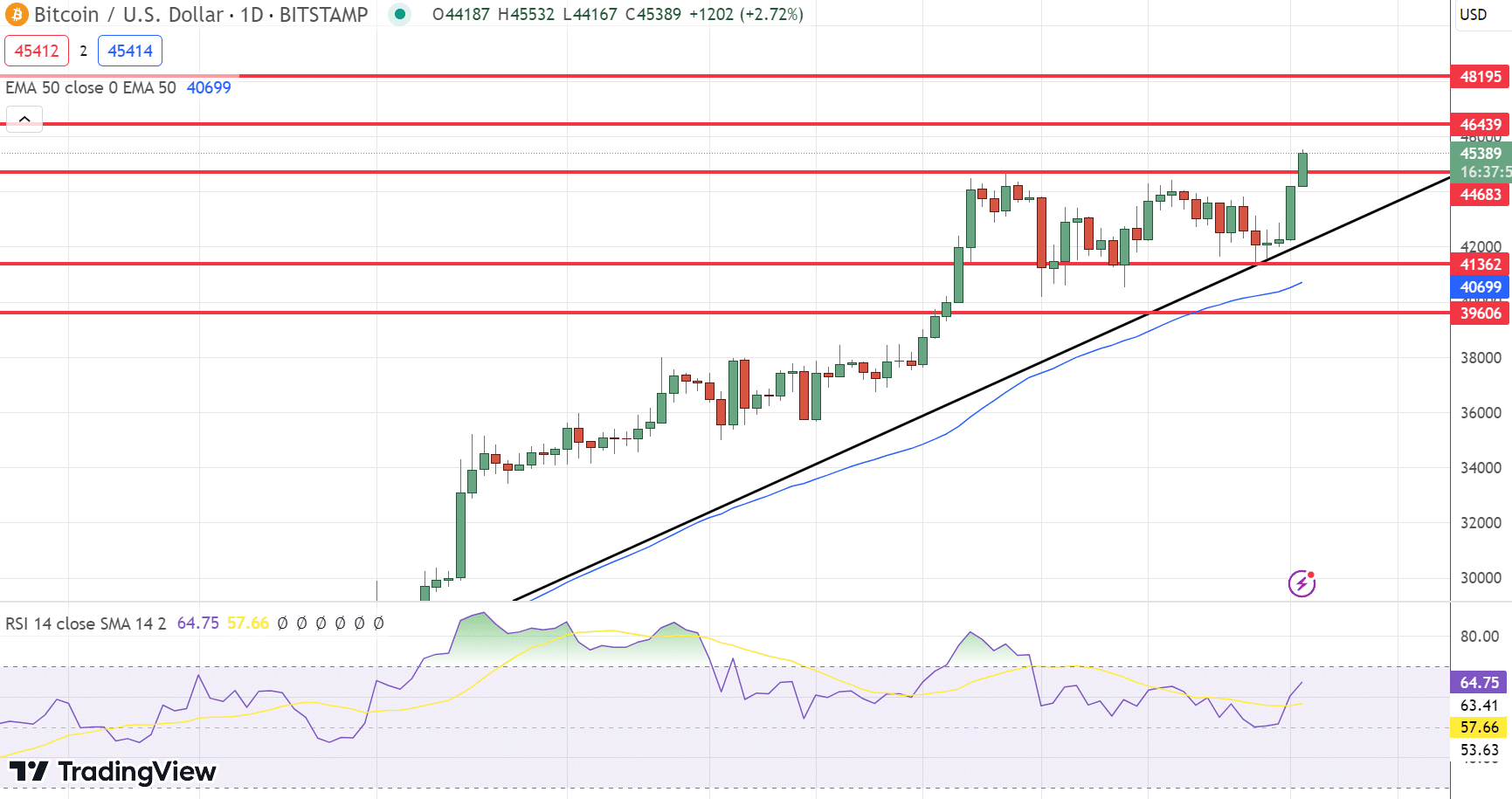

On January 2nd, Bitcoin, the pioneering cryptocurrency, displayed a major upward pattern, marking a formidable begin to the brand new yr. Buying and selling across the $44,501 pivot level, Bitcoin exhibits potential for additional positive aspects, as indicated by key technical ranges and market sentiment.

Fast resistance ranges for Bitcoin are set at $46,439, $48,195, and $49,857. These ranges function potential targets for Bitcoin’s upward journey, suggesting room for progress if the bullish momentum continues. Conversely, help ranges are recognized at $43,096, $41,884, and $40,238, providing essential thresholds that would shield Bitcoin from any important value drops.

The technical indicators current a compelling image. The Relative Energy Index (RSI) stands at a excessive 81, indicating overbought circumstances. This stage may recommend that Bitcoin is likely to be nearing a short-term peak, with potential for a correction or consolidation within the close to future. Nevertheless, the RSI additionally displays the sturdy shopping for curiosity and momentum that has characterised Bitcoin’s current market motion.

Including to this bullish narrative is the commentary of the ‘Three White Troopers’ candlestick sample, usually seen as a bullish sign. This sample suggests a powerful shopping for pattern and will point out that buyers are assured about Bitcoin’s prospects. Nevertheless, the overbought RSI warrants a cautious strategy, because the market may very well be poised for a volatility swing.

In conclusion, the technical evaluation factors to a bullish pattern for Bitcoin, with the cryptocurrency aiming to check and probably breach greater resistance ranges.