Bloomberg analyst Eric Balchunas has shared insights on the most recent necessities imposed by the U.S. Securities and Trade Fee (SEC) to control the involvement of third events in Spot Bitcoin ETFs via a “cash-create” redemption mannequin.

The SEC has set a deadline of December 29, 2023, for spot Bitcoin exchange-traded fund (ETF) candidates to submit the ultimate S-1 modification.

Confirming the date for last amendments to all S-1s by Friday the twenty ninth. The @SECGov has advised issuers that purposes which are absolutely completed and filed by Friday might be thought of within the first wave. Anybody who is just not won’t be thought of. As well as, the filings can’t… https://t.co/syyINu1BEI

— Eleanor Terrett (@EleanorTerrett) December 24, 2023

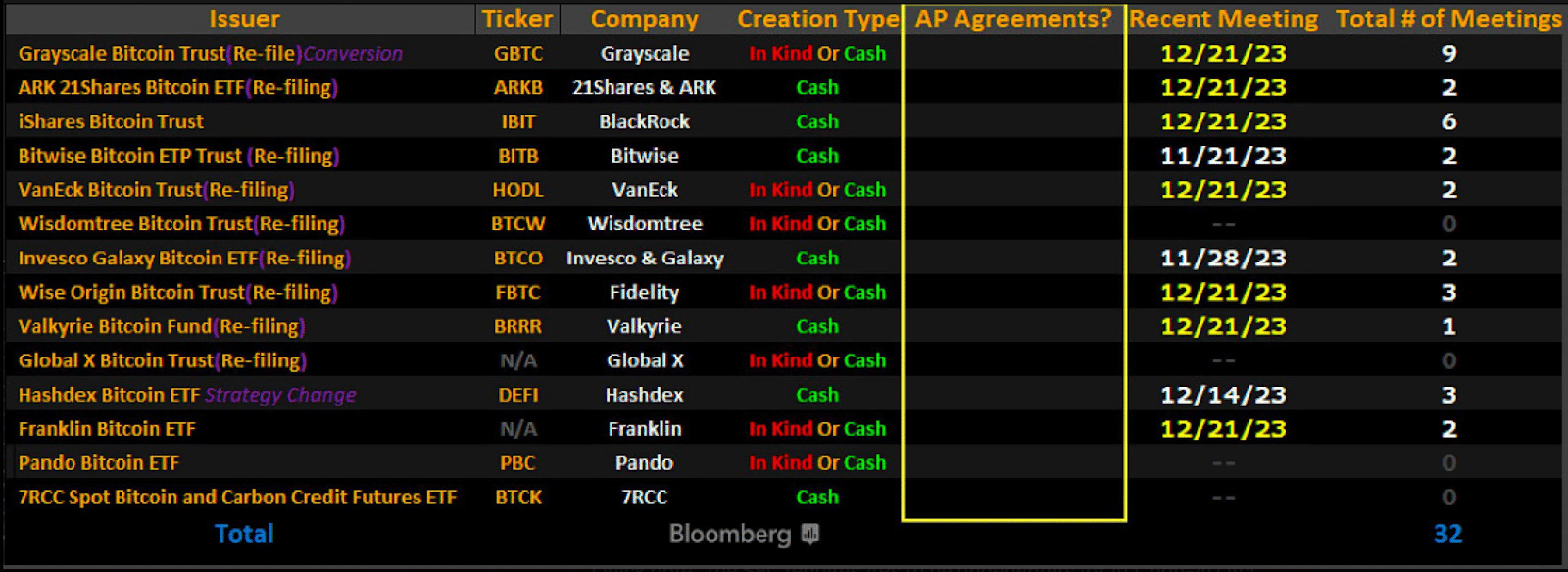

Different deadline necessities embody issuers getting into into agreements with Licensed Individuals (APs) and specifying the cash-create or in-kind redemption fashions that might be employed.

In a thread publish on X, Balchunas highlighted the importance of the S-1 Amendment deadline for ETFs and the challenges tied to figuring out APs for approval.

Glad S-1 Modification Deadline Day to all (the maniacs) who have fun.. unfort right this moment might not inform us who’s formally within the Cointucky Derby but as most S-1s prob have clean area the place AP title ought to go. Want these to declare horse certified. Might see some right this moment, however guessing… pic.twitter.com/o830GFqQvP

— Eric Balchunas (@EricBalchunas) December 29, 2023

He identified that the SEC not solely calls for APs to be named within the paperwork but additionally to function underwriters, guaranteeing the issuance of recent ETF shares to the market.

This extra requirement raises considerations amongst potential APs, given the novelty of the asset class and potential authorized dangers.

In the meantime, there was a noteworthy improvement associated to the modification of purposes in accordance with the deadline.

Seven out of the 14 candidates have adjusted their ETF filings to undertake a cash-create construction, indicating a choice for money settlements.

The remaining candidates have chosen a mix of cash-create and in-kind fashions of their registration statements, suggesting a various vary of approaches among the many candidates in structuring their ETFs.

Balchunas beforehand highlighted that Ark Investment was the primary issuer to implement the S-1 modification.

ARK kicks off the S-1 Modification-athon. Forward of the pack as typical. Unclear but what was modified tho, AP talked about a ton however not named. Assuming that can prob come within the very last efficient replace simply previous to launch. However we nonetheless do not know if they’ve signed settlement. https://t.co/mcNgpoR451

— Eric Balchunas (@EricBalchunas) December 28, 2023

Nevertheless, there was no point out of an AP or signed settlement, which is anticipated to happen within the last hours main as much as the December 29 deadline.

Crypto Communities Stay Optimistic

Over the previous years, the SEC has persistently postponed or rejected approval for a spot Bitcoin exchange-traded fund (ETF).

In the meantime, the regulatory physique has scheduled January 10, 2024, to announce the decision on the Ark and 21Shares ETF utility.

Regardless of earlier disapprovals, business insiders, together with Eric Balchunas and fellow analyst James Seyffart, specific optimism that the SEC might lastly greenlight the spot Bitcoin ETF this time.

New Analysis observe from me right this moment. We nonetheless consider 90% likelihood by Jan 10 for spot #Bitcoin ETF approvals. But when it comes earlier we’re getting into a window the place a wave of approval orders for all the present candidates *COULD* happen pic.twitter.com/u6dBva1ytD

— James Seyffart (@JSeyff) November 8, 2023

If authorized, the spot Bitcoin ETF can be formally listed on conventional inventory exchanges, much like firm shares.

This may facilitate simple buying and selling for retail buyers via customary brokerage accounts, eliminating the need for a devoted cryptocurrency alternate account.

The introduction of such ETFs is anticipated to streamline retail funding within the crypto market, probably leading to elevated demand.

Whereas the precise particulars of the appliance amendments requested by the SEC should not explicitly confirmed, earlier updates counsel a shift from non-monetary funds to money redemption.

Moreover, the SEC’s insistence on ETF filers naming the APs of their purposes underscores the importance of transparency and accountability within the regulatory course of.