Chinedu Albert, a authorized professional specializing in Nigerian tech and innovation, has attributed the challenges dealing with the adoption of the eNaira, the Central Financial institution of Nigeria’s digital forex (CBDC), to a earlier crypto ban.

In an unique interview with Cointelegraph on December 29, Albert described the eNaira as an formidable idea. Nevertheless, he noticed that it displays the government’s response to its “ill-advised” choice to implement a sweeping ban on cryptocurrencies and different digital property on February 5, 2021.

Central Financial institution of Nigeria bans Crypto forex transactions

That is 2021, and the Nigerian authorities needs to ban crypto. They by no means like to progress, no marvel Nigeria can’t transfer ahead. pic.twitter.com/knYzTwwuIT

— Eyèn Drone Boss ❤️🇳🇬🇬🇧 (@ItsGreatman) February 5, 2021

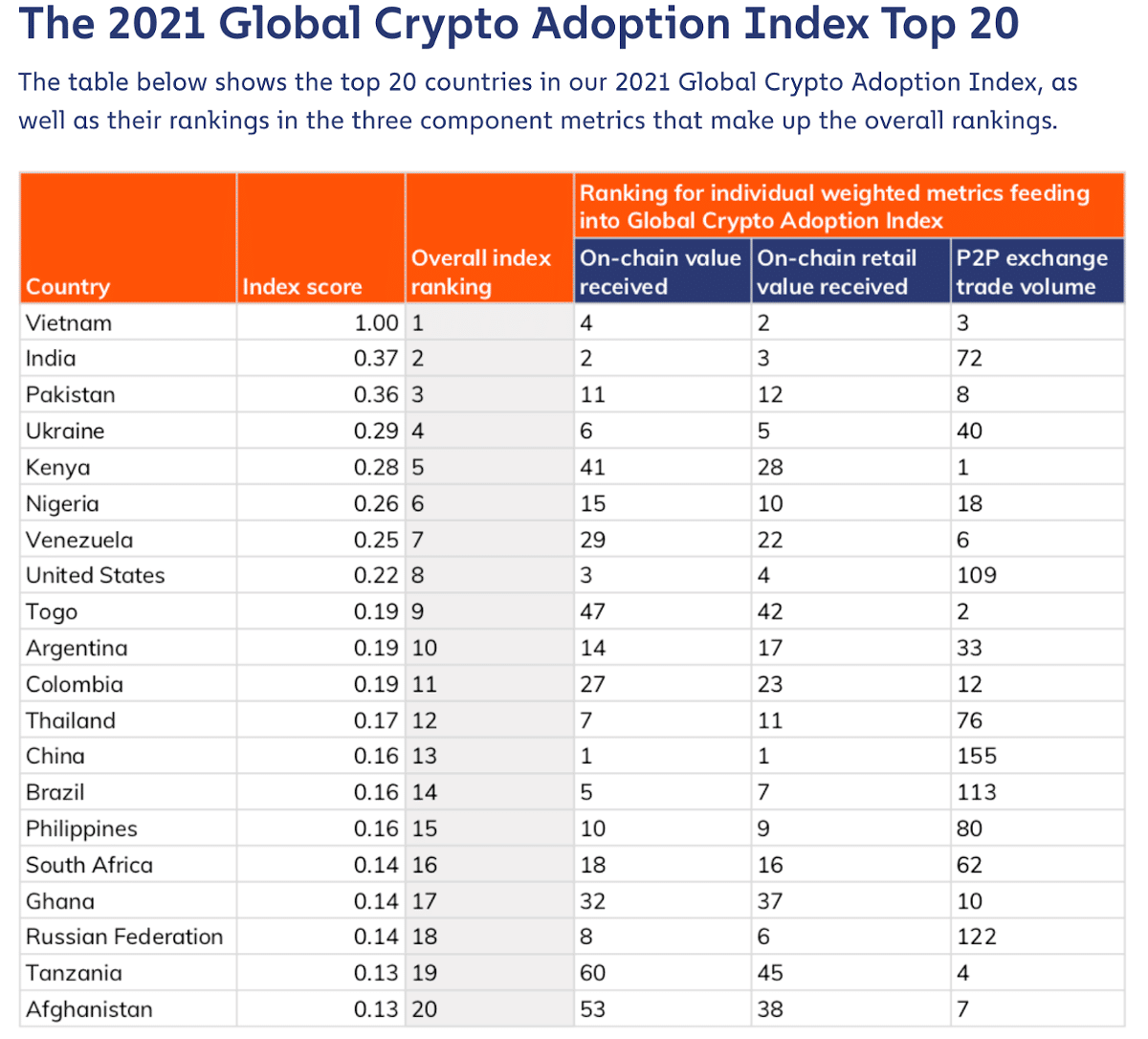

In 2021, Chainalysis data revealed that Nigeria secured the sixth place within the International Crypto Adoption Index, boasting an total rating of 0.26%, barely surpassing the USA at 0.22%.

Regardless of this seemingly commendable standing, Albert argued that the eNaira faces challenges as a consequence of its vulnerability to authorities insurance policies and inflation, key components contributing to its subdued adoption.

The eNaira debuted on October 25, 2021, and achieved the excellence of changing into the world’s second public CBDC following the Bahamas’ Sand Dollar project. Nevertheless, two months previous its second anniversary, the digital forex grapples with adoption hurdles.

In keeping with a May 2023 report from the Worldwide Financial Fund (IMF), the common weekly eNaira transactions totaled 14,000, constituting just one.5% of month-to-month transactions per pockets.

This knowledge signifies that 98.5% of wallets remained inactive in any given week.

Moreover, Albert harassed that Nigerians want extra confidence within the nationwide forex, the naira, and the central authority overseeing it. He emphasised that adopting the CBDC hinges on the federal government incomes the belief of Nigerians and the naira attaining a extra credible standing.

This sentiment aligns with the views expressed by Mr. Tobi Aremotobi, a digital finance professional primarily based in Nigeria, whose viral remark in July 2023 deemed the eNaira an “train in futility.”

Aremotobi shared his expertise with Tech Cabal, a neighborhood Nigerian media firm, highlighting the sensible challenges related to eNaira.

He talked about that the phrase “I’ll pay you with eNaira” was used teasingly amongst colleagues, however in actuality, spending cash saved within the eNaira pockets posed important hurdles.

Most retailers in Nigeria don’t settle for the digital currency, and a notable majority of tech-savvy people stay unconvinced concerning the suitability of blockchain-based forex for mainstream adoption.

Whereas the restriction on digital property for Nigerian banks and monetary establishments was formally lifted on December 23, the eNaira will seemingly hover round crimson zones.

🚨Nigeria unbans CRYPTO🚨

Nigeria, which has simply sacked their central financial institution Governor, has lifted its 2021 ban on cryptocurrencies.

As one of the populous nations on this planet (~215 Million), this transfer paves the way in which for Africa-wide crypto adoption.

Bullish for Bitcoin.… pic.twitter.com/WxFhFdE9n1

— Inspiry Day (@InspiryDay) December 23, 2023

It’s because Nigerians have restricted enthusiasm for the digital forex, touted as Africa’s first CBDC, and there are considerations about looming crypto laws sooner or later.

A Distinct Hope for eNaira?

The IMF report on the eNaira underscores its goal to deal with Nigeria’s substantial casual financial system and enhance transparency in casual funds.

To realize this objective, the eNaira goals to combine with present cell cash frameworks, presenting two potential approaches for the Central Financial institution of Nigeria. This entails leveraging established native cell cash networks equivalent to Kuda, oPay, and Flutterwave or developing a retail entry community.

The previous choice entails routing funds by way of cell cash accounts to eNaira wallets, incurring further service prices.

Lately, the CBN has partnered with the African-focused monetary expertise agency Flutterwave to introduce eNaira as a cost choice for retailers and monetary establishments.

This strategic transfer is geared toward boosting eNaira adoption. Nevertheless, the IMF knowledge views it as a de-risking measure, which can not align with Nigeria’s cell cash market, the place money transactions dominate.