Main bug bounty and safety providers platform Immunefi printed a report detailing the lack of funds resulting from hacks and fraud within the Web3 ecosystem this 12 months – and what would possibly await within the subsequent.

The staff appeared into the amount of crypto funds the group misplaced in 2023, discovering it to be decrease, however nonetheless substantial. And it might rise.

In its ‘Crypto Losses in 2023’ report, Immunefi warned that,

“With the persistent rise in cryptocurrency costs, subsequent 12 months may even see probably the most substantial losses in Web3 ever.”

The continued challenges associated to initiatives’ infrastructure will stay a serious supply of vulnerabilities subsequent 12 months as properly. The “common strategy throughout the business isn’t altering quick sufficient.”

In accordance with Mitchell Amador, Founder and CEO at Immunefi, regardless of a discount in general losses in 2023 in comparison with 2022, Web3 nonetheless noticed “a considerable surge in hacking makes an attempt and fraud incidents” this 12 months.

The frequency of such instances, he mentioned, practically doubled.

Amador argued that,

“Sadly, extra initiatives have gotten inclined to assaults. Whereas decentralized finance remained the first goal of profitable exploits, this 12 months marked a major shift as CeFi started to attract extra consideration from hacker teams, together with the infamous Lazarus.”

And talking of the Lazarus Group…

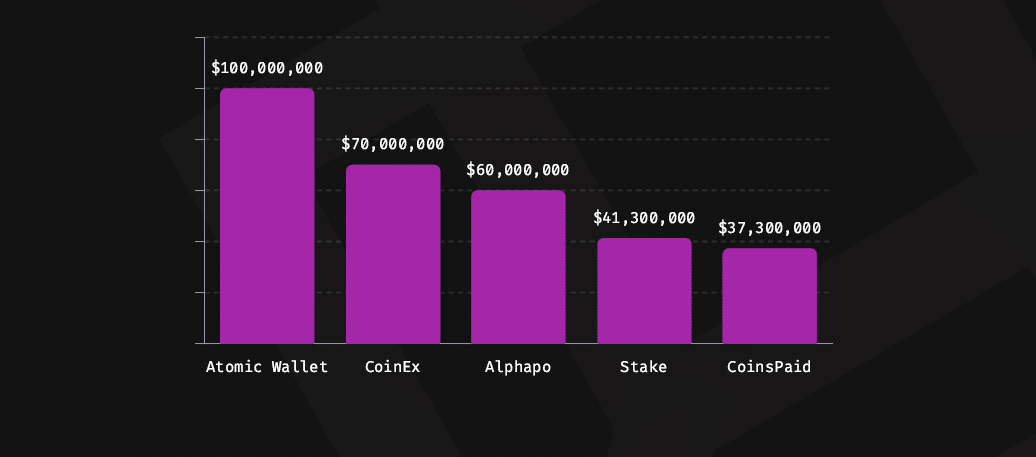

Lazarus is Liable for a Fifth of the Whole Losses

The North Korea-affiliated hacker group Lazarus was liable for $308.6 million stolen in 2023, Immunefi discovered. This can be a whopping 17% of the overall 12 months losses, practically a fifth.

The group was allegedly behind the high-profile assaults on Atomic Wallet, CoinEx, Alphapo, Stake, CoinsPaid, and the huge Ronin Network assault, ensuing in a $625 million loss.

The Immunefi staff lately printed a report focusing particularly on the Lazarus Group.

It discovered that, between 2021 and 2023, the group stole $1,903,600,000 throughout the Web3 ecosystem.

Decentralized finance (DeFi) represented 83.8% of the overall assaults carried out by Lazarus. In these two years, $1.595 billion was stolen in DeFi throughout 5 incidents. The vast majority of the sum comes from the Ronin Community and Poly Network assaults.

Centralized finance (CeFi) represented 16.2% of the overall assaults between 2021 and 2023. Lazarus stole $308.6 million throughout 5 incidents.

That mentioned, Amador famous that, in 2023, Lazarus completely focused CeFi initiatives. He added,

“As we strategy 2024, their escalating sophistication is regarding. Their proficiency in exploiting infrastructure vulnerabilities, good contract weaknesses, in addition to their meticulous social engineering operations, underscores their emergence as maybe probably the most urgent menace to web3 right now.”

$1.8 Billion Misplaced in 2023

In accordance with the most recent ‘Crypto Losses in 2023’ report, the worldwide Web3 house was valued at over $934 billion in 2022.

“That capital represents an unparalleled and engaging alternative for blackhat hackers.”

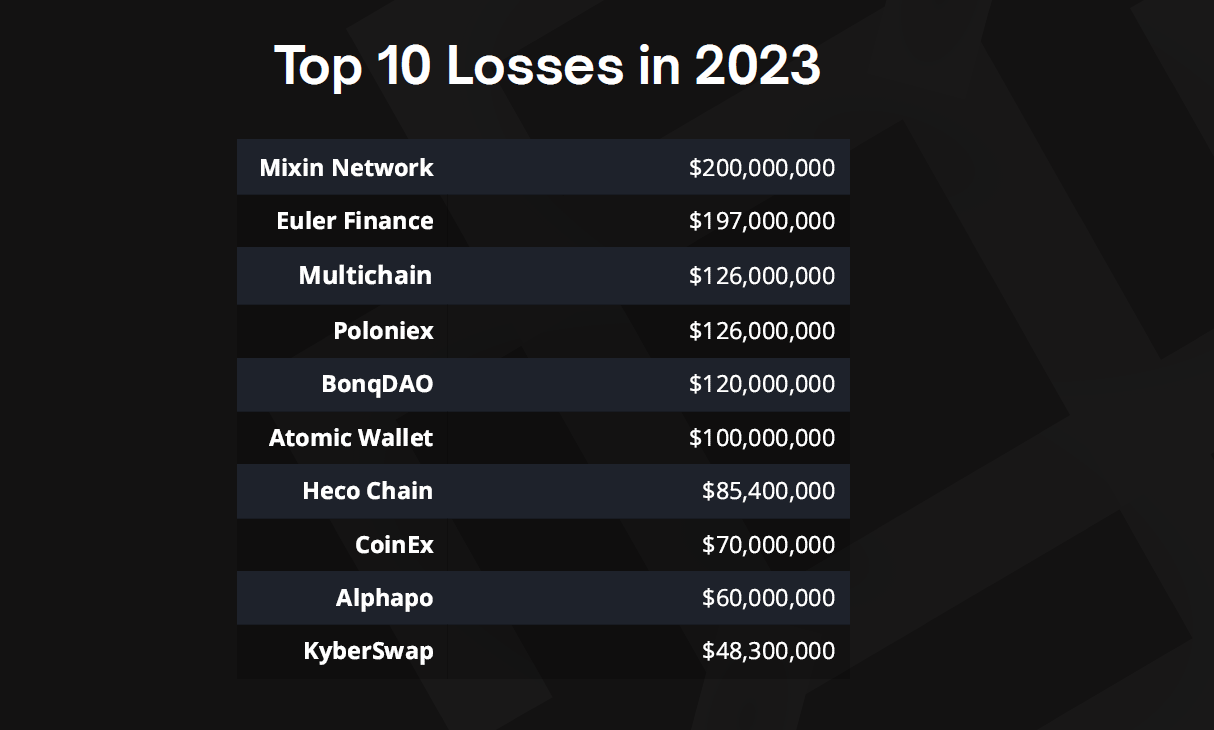

Immunefi checked out all cases the place blackhat hackers exploited crypto protocols in 2023, in addition to protocols allegedly performing a rug pull. They discovered 319 instances.

In whole, Web3 noticed a lack of $1,803,050,600 this 12 months. Particularly,

- $1,699,632,321 was misplaced to hacks throughout 247 incidents,

- $103,418,279 was misplaced to fraud throughout 110 incidents.

Transactional community Mixin Network and DeFi protocol Euler Finance misplaced a lot of the whole sum, totaling $397 million (22%).

That mentioned, the $1.8 billion whole loss nonetheless represents a 54.2% lower in comparison with final 12 months’s $3.948 billion.

In 2023, Q3 was probably the most ‘busy’ interval, with $685.5 million in losses throughout 75 incidents, representing 38% of the overall loss.

Within the meantime, $241.7 million – or 13.4% of the 2023 losses – has been recovered from stolen funds in 19 conditions.

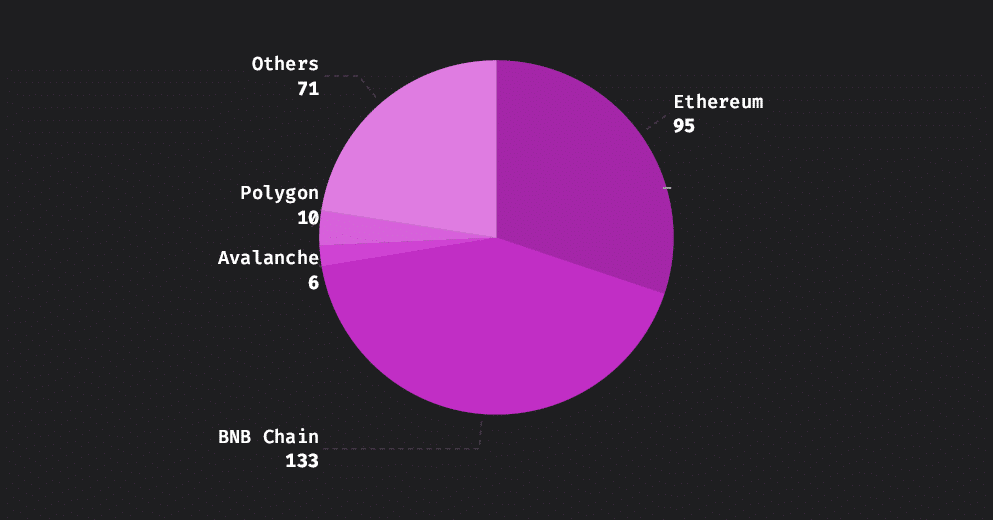

BNB Chain and Ethereum Are Most Focused

The 2 most focused chains this 12 months had been, maybe unsurprisingly, had been BNB Chain and Ethereum.

BNB Chain suffered probably the most particular person assaults, with 133 incidents, representing 41.6% of the overall loss throughout focused chains.

Ethereum noticed 95 incidents, representing 29.8%.

Per the report,

“Ethereum and BNB Chain characterize greater than half of the chain losses in 2023.”

Polygon got here in third with ten incidents (3.1%), whereas Avalanche adopted with six.

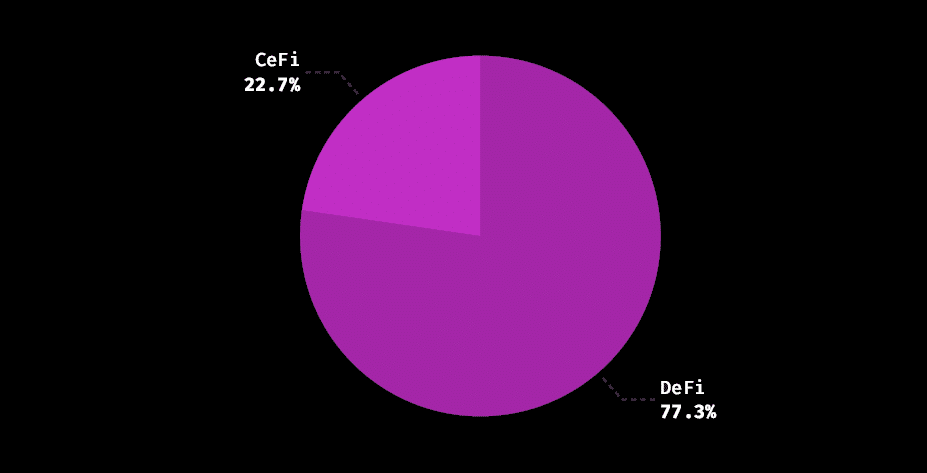

DeFi vs CeFi

The report mentioned DeFi suffered way more losses than CeFI, representing 77.3% of the overall loss in 2023. In the meantime, CeFi represented 22.7%.

That mentioned, DeFi misplaced $1.394 billion throughout 306 incidents – a 56.1% lower in comparison with 2022.

CeFi, in the meantime, misplaced $408,9 million this 12 months throughout 13 incidents. This can be a 46.8% lower in comparison with 2022.

The main target, as mentioned, appears to be shifting to CeFi. Per Immunefi’s prediction for 2024,

“Whereas the DeFi sector could expertise a rise in particular person assaults, organized teams are anticipated to give attention to CeFi initiatives resulting from their potential of outsized returns.”

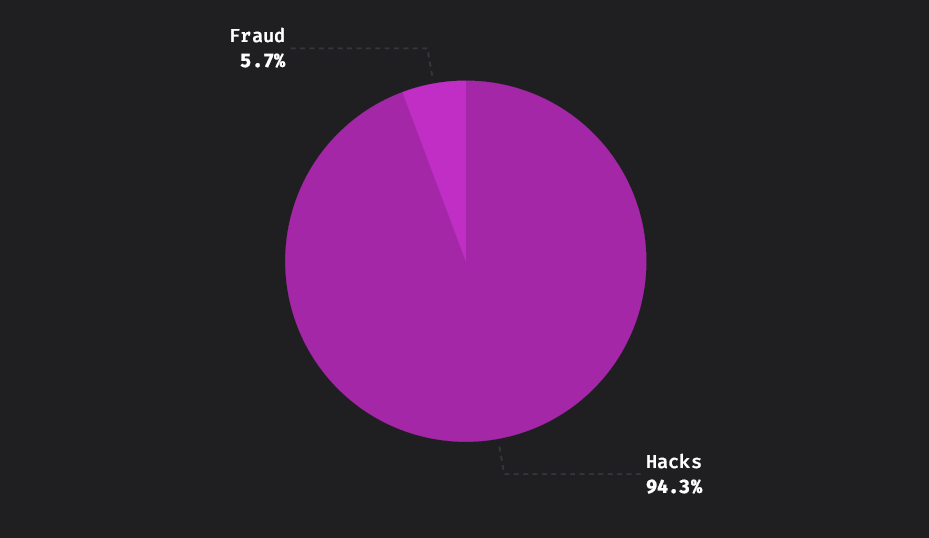

In the meantime, hacks remained the primary cause for the lack of funds in 2023, in comparison with frauds, scams, and rug pulls.

Hacks accounted for 94.3% of the losses this 12 months, whereas fraud accounted for five.7%.

Practically $1.7 billion was misplaced to hacks in 2023 – a 54.9% lower in comparison with 2022.

In the meantime, $103.4 million was misplaced to fraud – a 40.9% improve in comparison with 2022.

____

Learn extra: Are Hackers Two Steps Ahead of Security in a Cat-and-Mouse Game? Experts Answer