Cryptocurrency analyst Lark Davis has predicted that Ethereum will attain a value of $15,000 per coin within the upcoming bull cycle of 2024-2025.

Regardless of the asset’s comparatively subdued efficiency this yr, Davis foresees a major upswing that might probably yield substantial positive aspects for buyers.

In a video printed on X on December 25, Davis defined that the anticipated surge wouldn’t be triggered by way of shopping for, promoting, or staking however reasonably by way of Ethereum layer-2 property.

Ethereum Will Make Millionaires In 2024, BUT Not How You Assume pic.twitter.com/00YCLPyGCl

— Lark Davis (@TheCryptoLark) December 25, 2023

The YouTuber additionally delved into the present and upcoming layer-2 listings, together with zkSync, Starknet, Linea, Scroll, Blast, Manta, and Celestia. He highlighted the potential for short-term income related to these new listings.

Whereas acknowledging the historic pump-and-dump patterns noticed in newly launched tokens, Davis identified situations the place tokens gained vital traction after being listed on main exchanges.

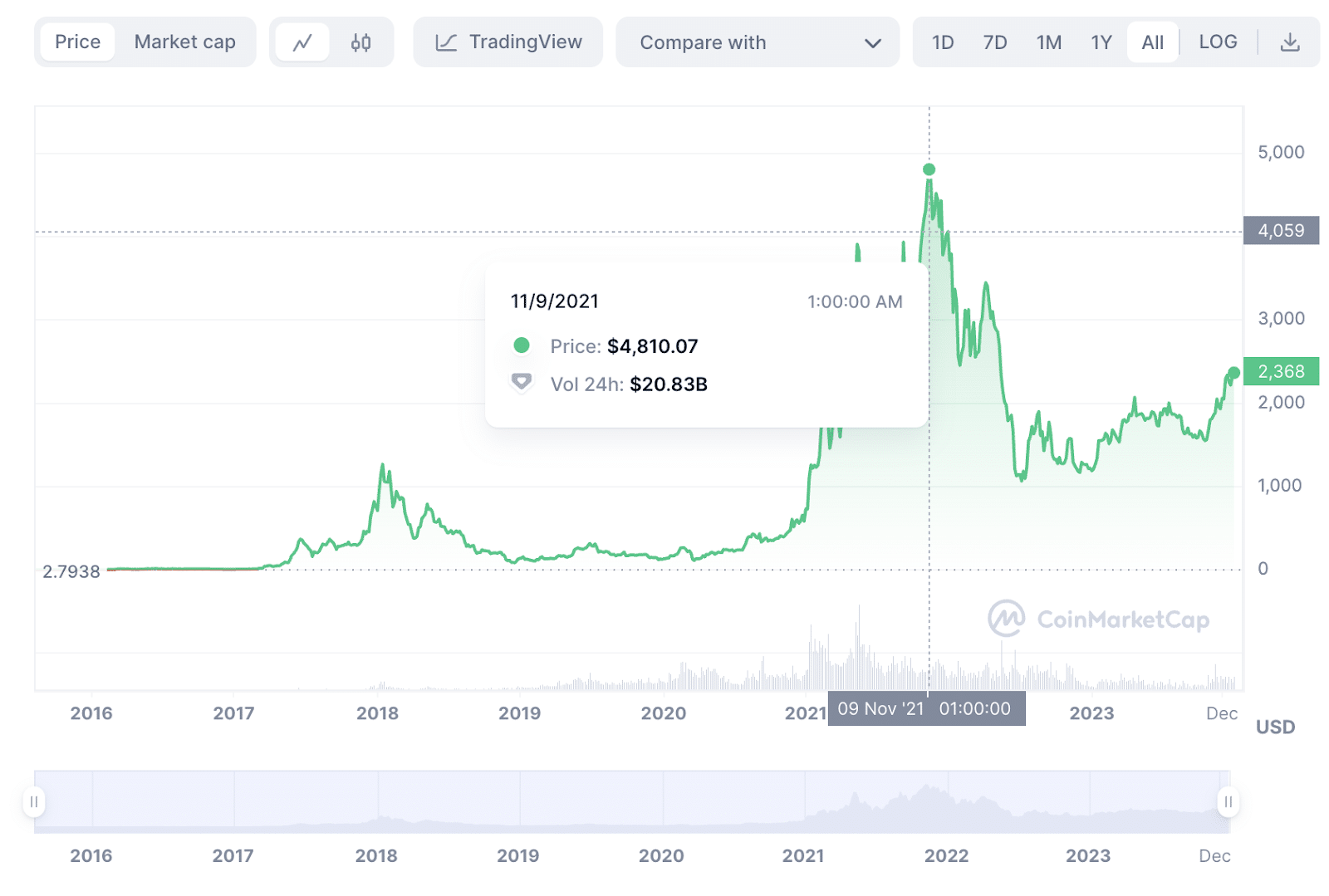

Regardless of presenting potential alternatives, Davis supplied a cautious outlook for Ethereum in 2024. Drawing comparisons with historic positive aspects, he predicted substantial development if Ethereum replicates or barely surpasses its earlier cycle’s highs, which reached around $4,800 in November 2021.

Following its all-time excessive, ETH skilled a notable 81% decline in the course of the bear cycle, reaching its lowest level at $880 on June 18, 2022.

Subsequently, Ethereum launched into a restoration trajectory, predominantly exhibiting an upward development all through 2023. This culminated in a noteworthy excessive of $2,400 on December 9 and a press time value of $2,367.

Nonetheless, Davis cautioned that people coming into the market on the present Ethereum value might solely expertise vital positive aspects in the event that they make substantial investments.

SOL Poised to Be the Higher Asset

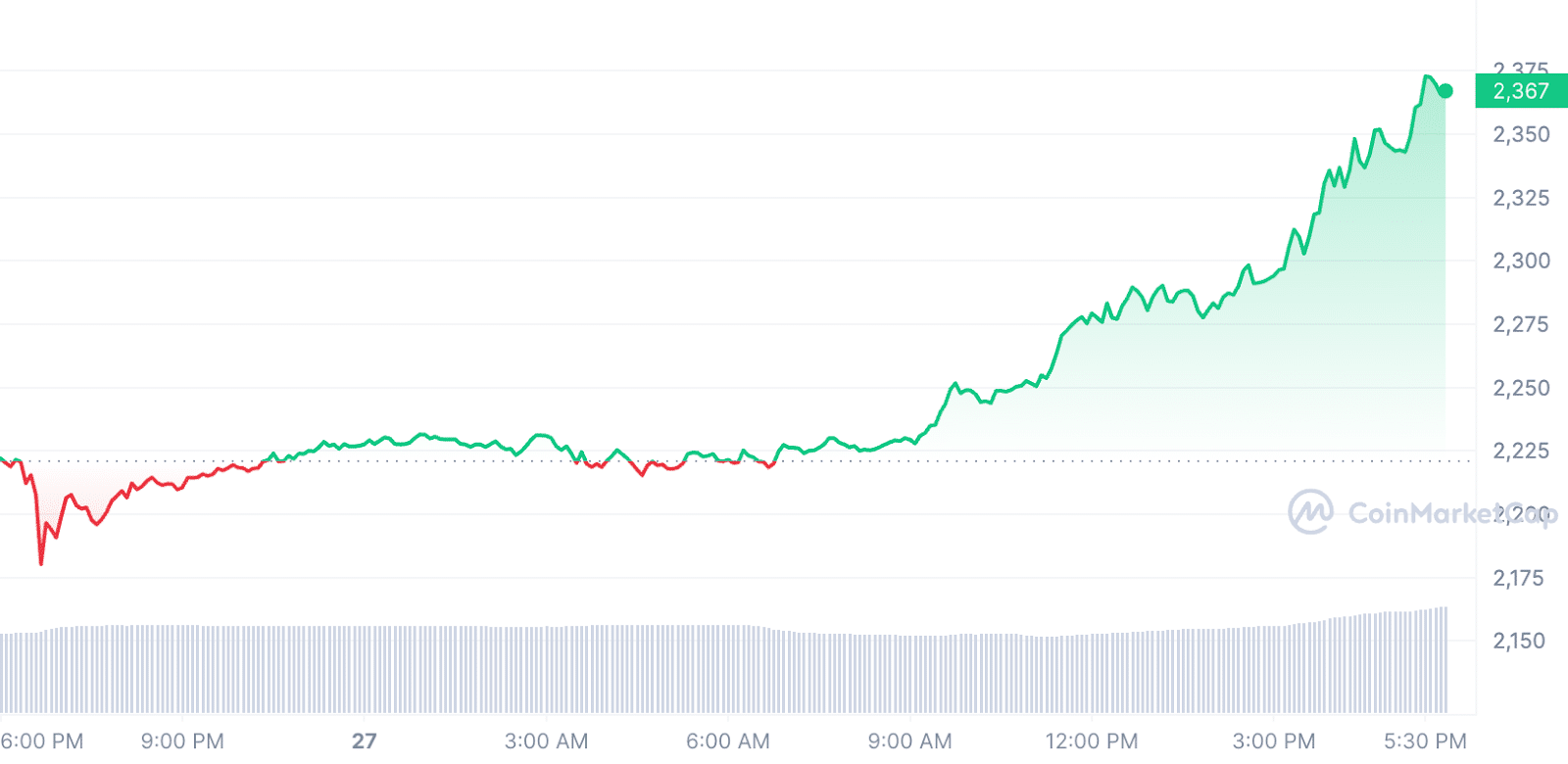

The value of SOL, the native cryptocurrency of the smart-contract-enabled layer-1 Solana blockchain protocol, has surged considerably, surpassing the $118 mark and reaching its highest worth in eighteen months. As of December 27, the asset’s value stood at $108.59.

This notable uptick coincided with a surge in fuel charges inside the Ethereum ecosystem, the place transaction prices briefly spiked above $10. Some customers even reported charges as excessive as $150 for transactions price solely $50 on the Ethereum blockchain.

$150 in fuel charges to bridge $50 price of ETH. #newparadigm #Ethereum #thefutureishere

— Matt Trienis (@digimat) December 19, 2023

Though Ethereum fuel charges have since decreased by 50% from the week’s peak, customers have actively explored different blockchain platforms with decrease transaction prices, resulting in elevated exercise on Solana.

Messari’s December 14 report additional highlights a staggering 400% improve in lively addresses on Solana within the final three months, in comparison with Ethereum’s 3%.

In This fall alone, lively addresses on Solana have elevated by practically 400% in comparison with a mere 3% improve on Ethereum.

Dive into the report 👇https://t.co/70XuVFgax0

— Messari (@MessariCrypto) December 18, 2023

Solana’s enchantment is underscored by its persistently low charges, averaging lower than $0.01, in keeping with CoinCodex’s recent report.

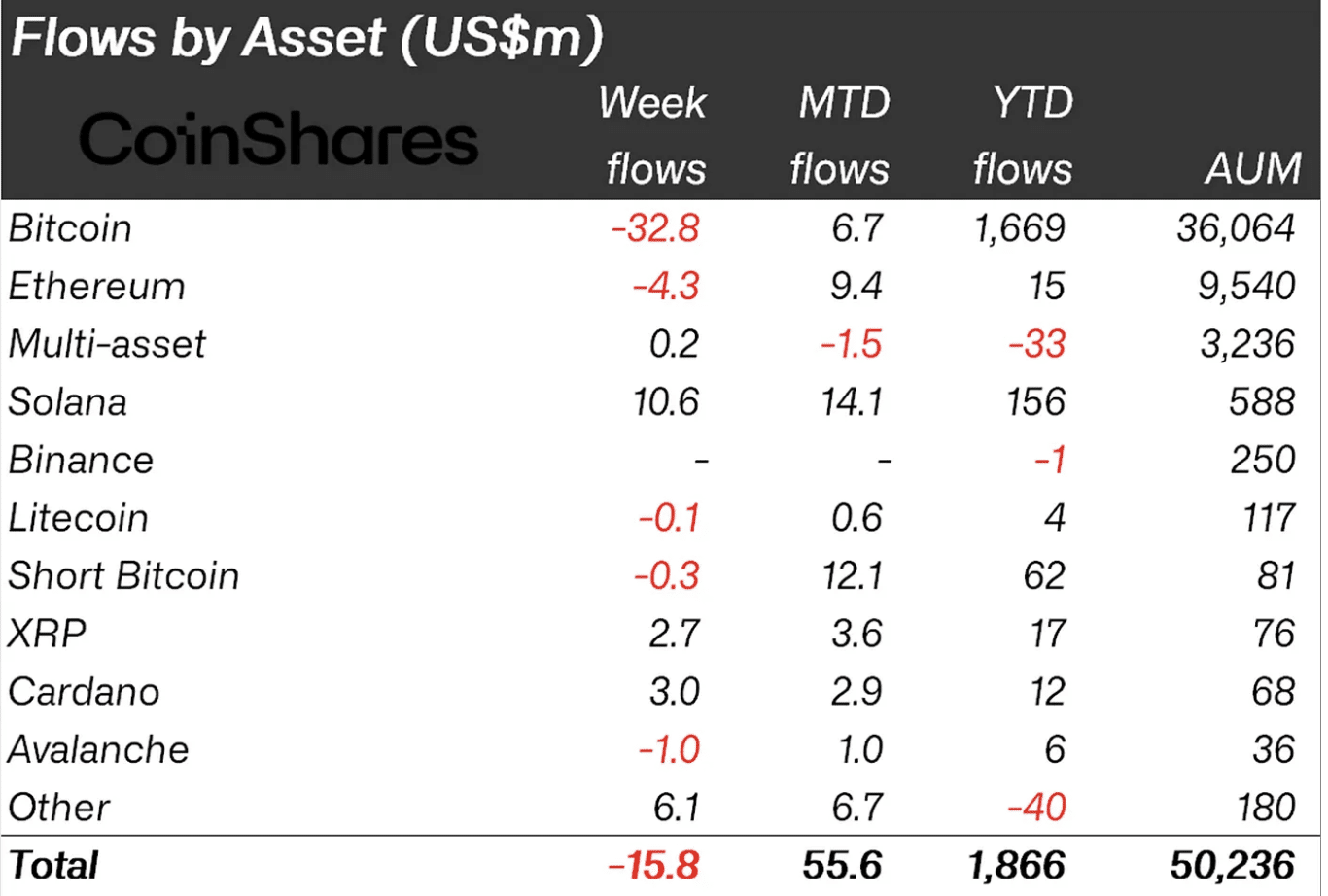

Moreover, the platform has recorded a constructive development in fund flows. Solana-based funding funds attracted $10.6 million within the week ending December 16, surpassing inflows into main property like Bitcoin and Ethereum.

In December alone, Solana funds noticed inflows of $14.1 million, marking the very best within the cryptocurrency sector. At present, SOL’s trajectories outpace these of ETH, suggesting its potential as a superior asset for a major surge within the upcoming bull run subsequent yr.

Nonetheless, this swift ascent prompts a vital query inside the crypto group: Is the exceptional rise in Solana’s worth a fleeting incidence, or does it mark the graduation of a brand new period in its market dominance?

The reply is entwined in a posh interaction of market tendencies, investor sentiment, and the evolution of the cryptocurrency panorama.