In a outstanding surge, Bitcoin has reached $43,499, marking a 0.71 % improve on Tuesday. This notable ascent will be largely attributed to the burgeoning curiosity in Spot Bitcoin ETFs, that are poised to surpass the mixed inflows of all 150 crypto ETPs at present out there.

Including to the optimistic momentum, Japan’s Cabinet has lately proposed a groundbreaking reform, aiming to eradicate the company tax on unrealized cryptocurrency good points. This transfer might considerably affect the worldwide crypto panorama.

In the meantime, in the USA, a Consultant has highlighted a sequence of crypto payments which have been permitted by the Home Committee this yr, signaling a rising legislative curiosity within the crypto sector. These developments collectively underscore a pivotal second for Bitcoin and the broader cryptocurrency market.

Spot Bitcoin ETF Inflows Set to Eclipse 150 Crypto ETPs

The panorama of cryptocurrency funding is present process a seismic shift. Presently, the market boasts 150 crypto exchange-traded products (ETPs), amassing a powerful $50.3 billion in belongings below administration. This assortment primarily contains funds monitoring the titans of the crypto world, Bitcoin and Ethereum.

In a big growth, Grayscale’s Bitcoin Trust, the most important participant within the ETP area, is ambitiously vying to rework right into a spot ETF.

The potential for spot Bitcoin ETFs to realize a foothold in the USA paints a promising image, with expectations of surpassing the whole thing of the present $50 billion crypto ETP market.

In only a few years, spot Bitcoin ETFs could possibly be larger than your entire $50 billion international crypto ETF market at present. https://t.co/AZKuv8txlc

— Cointelegraph (@Cointelegraph) December 26, 2023

Analysts are casting bullish forecasts, envisioning a spectacular development trajectory for these ETFs over the subsequent 5 years. Projections vary from a strong $2.4 billion to a staggering $72 billion in belongings below administration, underscoring the unbridled optimism within the sector.

This upswing, if it continues, could possibly be a game-changer for Bitcoin costs, additional fueled by the increasing involvement of institutional entities within the cryptocurrency market.

Japan’s Cupboard Goals to Abolish Tax on Unrealized Crypto Positive factors

In a landmark transfer, Japan’s Cupboard, below the management of Prime Minister Fumio Kishida, has handed a proposal to exempt corporation tax on unrealized good points from cryptocurrencies. This progressive step is aimed toward catalyzing the expansion of the nation’s burgeoning Web3 business.

The proposed laws, which is at present below deliberation within the Food regimen, seeks to abolish the company taxation on the distinction between the market and e-book values of crypto belongings, particularly these issued by exterior firms.

This legislative shift is poised to rectify a discrepancy within the tax remedy of third-party issued belongings in comparison with these held by people. Presently, people should not subjected to tax on mark-to-market costs.

Japan to finish taxation on unrealized mark-to-market good points of third-party-issued crypto belongings it seeks to advertise the event of Web3 within the nation. @sheldonreback stories. https://t.co/NHo3FgQ0ok

— CoinDesk (@CoinDesk) December 25, 2023

If enacted, this reform would stage the taking part in discipline, doubtlessly spurring the expansion of Web3 enterprises inside Japan by reducing the fiscal boundaries they at present face. This transfer is anticipated to not solely retain current Web3 companies but additionally appeal to new ventures to Japan.

The Japanese authorities’s proactive stance underscores its dedication to nurturing the cryptocurrency sector as a pivotal factor of its financial transformation technique. This growth might additionally positively affect Bitcoin costs, because it indicators a conducive regulatory atmosphere in a big international market.

US Lawmaker Spotlights Crypto Laws Handed by Home Committee

Congressman Tom Emmer of Minnesota has spotlighted main achievements in crypto laws for 2023, with important progress made by the Home Monetary Companies Committee. Notably, a provision now prevents the SEC from utilizing taxpayer funds for crypto enforcement till Congress grants specific jurisdiction.

This displays the committee’s concentrate on selling innovation in capital markets. Key legislative milestones embrace the Blockchain Regulatory Certainty Act and the Securities Readability Act, which purpose to decrease boundaries within the digital asset sector and make clear token classification.

Try U.S. Congressman Tom Emmer’s recap of crypto payments permitted by the Home Monetary Companies Committee in 2023. The laws goals to spice up capital markets and maintain regulators accountable. Learn the complete overview right here: https://t.co/WCcOBfNahm

— Bony Bean (@bonybean) December 26, 2023

Moreover, the CBDC Anti-Surveillance State Act, handed in September, goals to curb authorities surveillance through digital currencies.

These developments, together with the November appropriations modification limiting the SEC’s enforcement attain, are poised to positively affect Bitcoin’s pricing by enhancing transparency and fostering business development.

Bitcoin Value Prediction

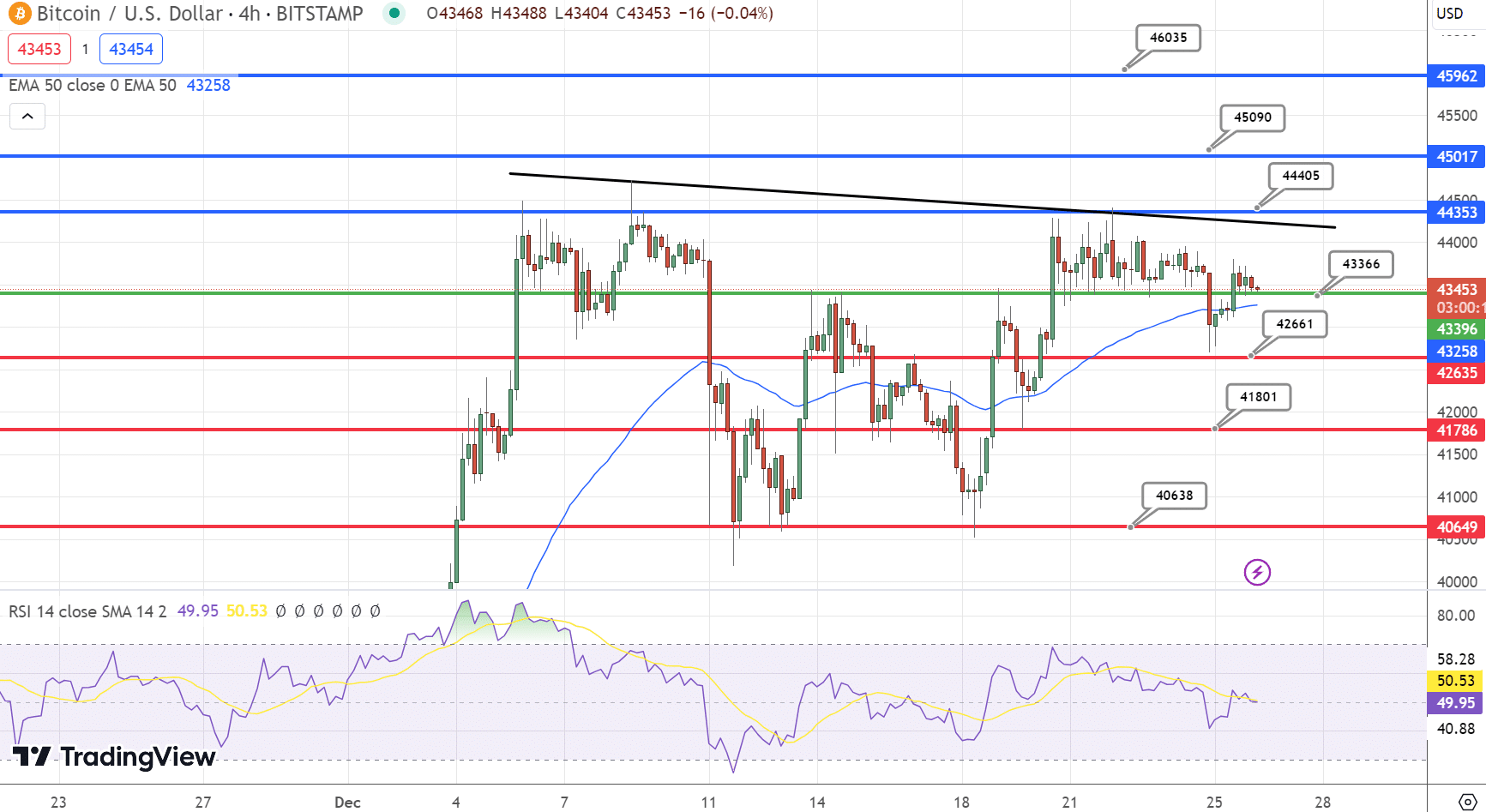

In at present’s technical evaluation of Bitcoin (BTC/USD) for December 26, the cryptocurrency is buying and selling at $42,936, marking a 1.79% decline. Presently ranked extremely in market cap, Bitcoin’s actions are essential indicators for the broader crypto market.

The pivot level stands at $43,501, with quick resistance noticed at $44,393. Additional resistance ranges are at $45,045 and $45,975, whereas quick help lies at $42,772, adopted by $41,801 and $40,638.

📉 #BitcoinUpdate: BTC/USD dips to $42,936, down 1.79%. Eyeing pivotal resistance at $44,393, $45,045, $45,975 & help at $42,772, $41,801, $40,638. RSI at 40 indicators bearishness. 📊 Beneath 50 EMA – look ahead to additional downward traits. Keep alert merchants! #CryptoAnalysis #BTC pic.twitter.com/VmEceWrGpe

— Arslan Ali (@forex_arslan) December 26, 2023

The Relative Energy Index (RSI) is at 40, suggesting bearish sentiment as it’s beneath the 50 mark. The Shifting Common Convergence Divergence (MACD) exhibits a price of -73 with a sign of -31, indicating potential downward momentum.

The 50-Day Exponential Shifting Common (EMA) stands at $43,238. Bitcoin’s present worth beneath the 50 EMA suggests a short-term bearish development.

Chart patterns reveal that BTC has crossed beneath the 50 EMA line on the $43,238 mark, signaling {that a} bearish bias might dominate if it stays beneath this threshold.

The general development seems bearish beneath $43,238, and the short-term forecast signifies potential testing of decrease help ranges within the coming days. This evaluation factors to a cautious method for merchants, with an in depth watch on key resistance and help ranges.

High 15 Cryptocurrencies to Watch in 2023

Keep up-to-date with the world of digital belongings by exploring our handpicked assortment of the perfect 15 various cryptocurrencies and ICO initiatives to keep watch over in 2023. Our checklist has been curated by professionals from Trade Discuss and Cryptonews, making certain professional recommendation and demanding insights on your cryptocurrency investments.

Reap the benefits of this chance to find the potential of those digital belongings and hold your self knowledgeable.

Disclaimer: Cryptocurrency initiatives endorsed on this article should not the monetary recommendation of the publishing creator or publication – cryptocurrencies are extremely unstable investments with appreciable threat, at all times do your personal analysis.