Get your each day, bite-sized digest of crypto and blockchain-related information – investigating the tales flying below the radar of right now’s information.

On this version:

- Robinhood’s Crypto Income Hits Lowest In 3 Years, However It Nonetheless Helps Crypto

- US SEC Holds Calls With Spot Bitcoin ETF Hopefuls

- Merchants and Establishments Turned to OTC Market in 2023 in Search of Stability

- Arkon Power Raises $110M to Develop US Bitcoin Mining Capability, Launch AI Cloud Service in Norway

__________

Robinhood’s Crypto Income Hits Lowest In 3 Years, However It Nonetheless Helps Crypto

In Q2 2021, charges from buying and selling dogecoin (DOGE) accounted for 32% of funding platform Robinhood’s internet income. However since then, its crypto revenues have declined, dropping from $233 million throughout the surge to $23 million in Q3 2023.

“I can’t management the worth of Bitcoin or the whole volumes out there,” CEO Vlad Tenev told Fortune. “But when we’re rising market share steadily throughout bear markets, and rising it way more shortly in bull markets, I feel that’s a sign that our technique is the right one.”

Robinhood, nevertheless, has continued to increase its footprint on the earth of decentralized cash, even amid the large regulatory turbulence.

It’s launching in Europe, benefiting from a friendlier authorized atmosphere and regulators readability. It’s additionally relisting cash that the US SEC alleged had been unregistered securities and including different cryptos not accessible within the US.

“We are going to hold including for certain,” head of crypto Johann Kerbrat mentioned, referring to potential merchandise in Europe. He declined to be extra particular in regards to the additions.

Despite the fact that Robinhood appears to wish to distance itself from the memecoin mania of 2021, its plans do embrace dogecoin.

“We don’t see Dogecoin as a unfavorable asset for us,” Kerbrat mentioned. Tenev “enthused” in regards to the cryptocurrency’s standing as an “inflationary coin” and its completely different “properties,” Fortune mentioned.

Coming into the EU is a part of Robinhood’s bigger engagement with crypto through the years, throughout which its charges from crypto buying and selling vary from just some share factors of internet income to accounting for practically half.

“I feel it’s nonetheless very early innings in crypto,” Tenev mentioned.

US SEC Holds Calls With Spot Bitcoin ETF Hopefuls

US Securities and Trade Fee (SEC) staffers held separate phone convention calls with spot bitcoin (BTC) exchange-traded funds (ETF) candidates on Thursday, FOX Enterprise reported.

It’s unclear if the regulator referred to as all potential issuers. Nevertheless, per the report, it did maintain calls with BlackRock, Valkyrie, Grayscale, Ark 21Shares, and Bitwise.

It additionally referred to as the exchanges the place the candidates plan to problem their ETFs, the Nasdaq and CBOE inventory markets.

The calls mentioned the applying course of and the best way the ETFs should be structured. The SEC will take into account functions that construction an ETF that enables issuers to purchase the product utilizing money solely as a substitute of “in form” purchases utilizing bitcoin. Redemptions of the ETF have to be supplied solely in money, too.

Any point out of in-kind purchases or redemptions have to be stricken from the applying.

The regulator is nervous about potential malfeasance concerned in utilizing crypto. Additionally, it doesn’t at the moment enable broker-dealers to commerce spot bitcoin instantly prefer it does different commodities.

Per the report, the SEC requested issuers to submit amended filings by December 29.

“It’s obvious from all the following S-1 filings that the fee directed the change to money creates, seemingly as a closing hurdle earlier than passage,” CoinRoutes co-CEO David Weisberger commented. “Whereas timing shouldn’t be sure, it appears more likely to occur earlier than the following deadline on January 10.”

Merchants and Establishments Turned to OTC Market in 2023 in Search of Stability

Because of ongoing struggles confronted by centralized exchanges in 2023, in addition to the post-FTX panorama, a substantial variety of merchants and establishments turned to the over-the-counter (OTC) market seeking a extra steady and safe market construction, according to a report by the cryptocurrency knowledge supplier CCData.

In its newest report, CCData supplied insights into the construction of the digital asset OTC markets. It included knowledge collected from interviews with liquidity suppliers and supplied views on the OTC market’s efficiency and traits in a difficult atmosphere.

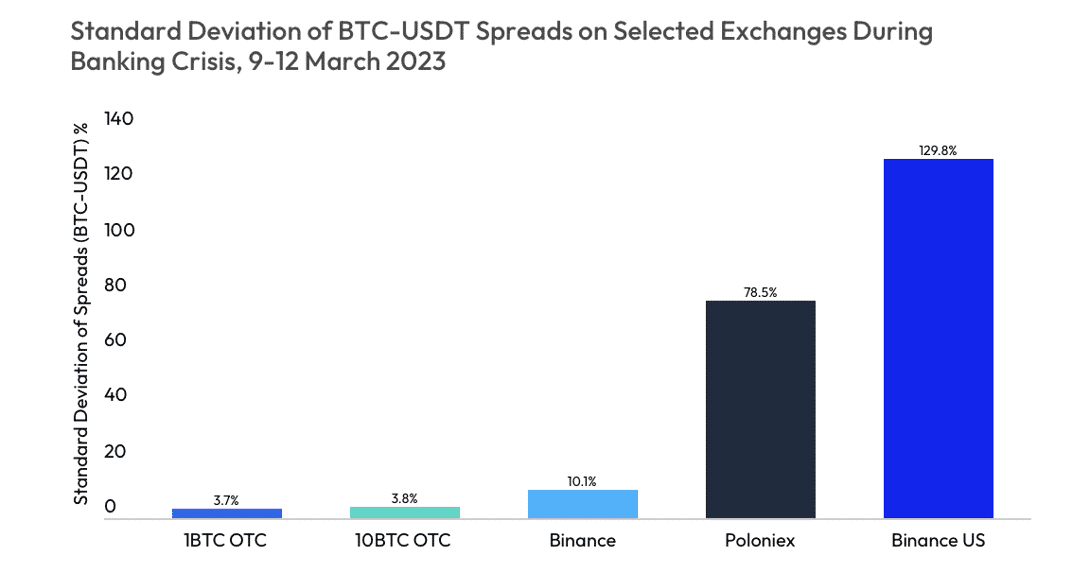

Amongst different issues, it discovered that centralized exchanges like Poloniex and Binance.US demonstrated vital variability of their spreads throughout the Silicon Valley Financial institution disaster, with commonplace deviations of 78.5% and 130%, respectively.

This excessive variability contrasts sharply with the consistency noticed in OTC markets, which confirmed virtually uniform commonplace deviations throughout completely different commerce sizes, with solely a 0.1% distinction between trades of 1 BTC and 10 BTC, it mentioned.

Arkon Power Raises $110M to Develop US Bitcoin Mining Capability, Launch AI Cloud Service in Norway

Knowledge middle infrastructure firm Arkon Energy closed a $110 million non-public funding spherical to increase its operations, the corporate’s CEO Josh Payne told TechCrunch.

The spherical was led by Bluesky Capital Administration with participation from Kestrel 0x1 and Nural Capital.

About $80 million shall be used to accumulate an extra 200-megawatt capability throughout new knowledge facilities in Ohio, North Carolina, and Texas as a part of its plan to extend the corporate’s complete megawatts by 130% by mid-2024. That is along with the 100-megawatt facility in Ohio bought in June.

“The U.S. is a pretty marketplace for us in some ways, largely due to the big home buyer demand, a mature and sturdy power trade with a number of versatile and deregulated markets, political and regulatory stability, and attractiveness to institutional buyers,” Payne mentioned. “The U.S. has an abundance of stranded, underutilized energy era belongings which might be linked to a few of the lowest-cost electrical energy sources on the earth, many that are renewable.”

The remaining $30 million shall be used to develop a man-made intelligence (AI) cloud service venture at Arkon’s knowledge middle in Norway. This may assist service generative AI and huge language mannequin coaching markets.

“Over the past yr, there was a profound market acceleration in demand for generative AI and huge studying mannequin functions,” Payne mentioned.

Arkon goals to fill a niche by offering the underlying specialised bodily infrastructure layer the AI sector depends on.

Launched in 2021, the corporate started with a 5-megawatt website in Australia. It now has over 130 megawatts and operates in different areas, just like the US and Europe.

“These websites enchantment to each bitcoin miners and AI [or] machine studying purchasers who’ve very excessive energy computing calls for,” Payne mentioned.